Remittance stays robust

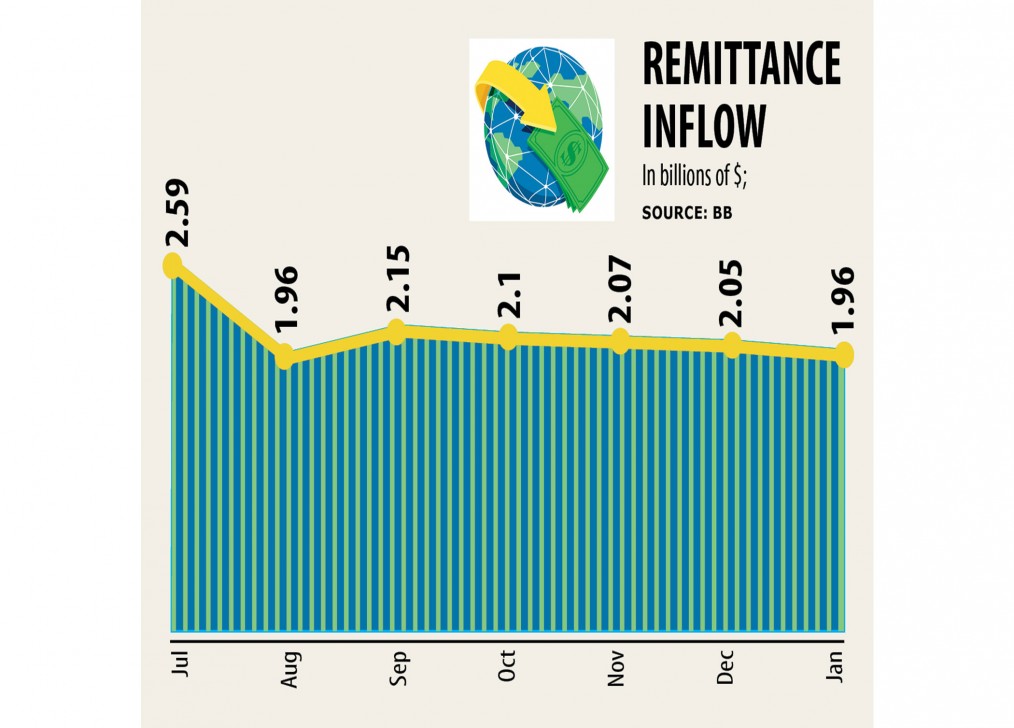

Remittance flow to Bangladesh has got maintained it is robust growth in January regardless of the persisting pandemic though it dropped below $2 billion for the first time within the last five months.

Expatriate Bangladeshis sent house $1.96 billion last month, up 19.78 % year-on-year, data from the central bank showed yesterday.

Remittance fetched a lot more than $2 billion for Bangladesh between September and December. The inflow, however, has started to slow since September.

Between July and January, the united states received $14.9 billion in remittance, up 34.95 per cent this past year, BB data showed.

"The magnificent growth of remittance has given a boost to the confidence of the federal government in managing the macro-economy in times of crisis," said Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development.

But he raised a question: why has remittance been increasing during the pandemic?

"We don't have any research to determine the reasons for the growing style of remittance through the pandemic."

Mujeri, a former chief economist of the central bank, said migrant personnel might have sent additional money to support members of the family during the crisis.

Many migrant personnel lost jobs as their host countries have imposed lockdowns to contain the deadly virus, which might have compelled the migrants to send all assets back.

The hundi system, an against the law cross-border money transfer system, has come to a halt as a result of the restriction on movement which might have taken remittance to a new high, Mujeri said.

"These are all hypothesis. The federal government should carry out research to unearth some of the known reasons for the upward craze of remittance."

The research can help find out whether the trend is momentary or can last long, he said. "The findings will assist the government in spending measures to keep the flow."

Syed Mahbubur Rahman, controlling director of Mutual Trust Bank, said it could take at least two months to understand the trend.

Although labour export has practically come to a halt, remittance has been increasing, raising an all natural question, he said.

Selim Raihan, executive director of the South Asian Network on Economic Modeling (Sanem), said that remittance had created a good mismatch from both micro and macro-economic perspectives.

Remittance features helped swell the country's forex reserve, which stood at $42.91 billion yesterday in comparison to $32.38 billion this past year.

In a report conducted between November and December, the Sanem discovered that remittance to households declined through the pandemic.