Remittance hits $2b mark for third straight month

Bangladesh has once more gone past the $2-billion mark found in remittance income as migrant workers continued to send house a massive amount for the 3rd straight month.

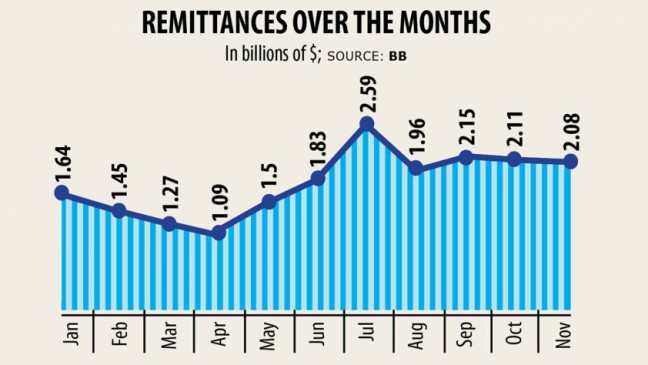

In November, migrant employees remitted $2.07 billion, up 34 per cent year-on-year, showed Bangladesh Bank info.

However, last month's physique is slightly lower when compared to previous month when the inflow stood at $2.11 billion.

The Bangladeshi diaspora continues to choose the formal channel in sending their money as a result of global hundi cartel turning ineffective amidst the coronavirus pandemic, said experts.

The increasing trend in remittance has given an enormous respite to the federal government in regards to to managing its external sector from the ongoing economical hardship.

Gurus hope that the development would be maintained found in the approaching months given the global economic scenario and the initiatives taken by the government.

The country's workforce export has almost come to a halt since April due to the pandemic, which forced both Bangladesh and the destinations, where its employees are based, to impose lockdowns and restrictions on motion to keep carefully the deadly flu away.

Between January and March this season, a complete of 181,218 Bangladeshi citizens went abroad, according to data from the Bureau of Manpower, Employment and Teaching (BMET).

No data is on the BMET web page for April onwards.

On average, the country sends the workforce abroad in the number of 7 to 8 lakh persons per year. Last year up to 700,159 workers visited different countries to manage job.

The stagnation of hundi, an against the law cross-boundary financial transaction, has pushed the country's remittance up, said Zahid Hussain, a former lead economist at the World Bank's Dhaka office.

The act of sending personnel to foreign nations has almost come to an end because of the ongoing business slowdown, he said.

"The economic transaction for the export procedure for workers is generally settled through hundi," he said.

Furthermore, money laundering through imports has been nearly taken to an end lately, he said.

A vested quarter usually dodges taxes by way of under-invoicing while settling imports, Hussain said.

This is echoed by Ahsan H Mansur, executive director of the Insurance plan Analysis Institute of Bangladesh.

A great number of migrant workers will not get back to the hundi system following the pandemic as they today feel secure and comfortable by way of using the formal channel.

Diversion to formal channels for problems in carrying funds under travelling restrictions amid the pandemic and latest flood damages helped Bangladesh bring remittance move back again to the positive in 2020, according to a recently available World Bank statement.

In addition, the widespread utilization of digital technologies now inspire migrant workers in sending money through formal channels as well, said Mansur, also a former high official of International Monetary Fund.

The platform of cellular financial service (MFS) is little by little turning into among the pivotal centres for transferring money from foreign nations, he said.

"Along with the migrant staff, some expatriate Bangladeshis, who go businesses abroad, could also have transferred cash to the country within their portfolio expenditure," he said

A portfolio investment can be an ownership of a inventory, bond, or other monetary assets with the expectation that it'll earn a return or grow in value as time passes, or both.

It entails passive or perhaps hands-off ownership of property as opposed to direct purchase, which would involve an active management role.

"Many countries on North America and Europe have already entered in to the deadlock of a zero per cent interest rate. A country generally will need several years to remove such a predicament," Mansur said.

This has also created a deflation in the countries in both continents.

Given the activities of countries that had before faced deflation, an economy requires at least 3 to 4 years for the moribund situation to fade away.

Therefore the Bangladeshi diasporas now send funds as the interest on deposit products offered by local lenders is a lot greater than those in the countries they are actually based in.

Mansur went on to express the hope that the upward trajectory of remittance can continue for in least five to six months.

The two % cash incentive introduced by the federal government last year in addition has encouraged the expatriate Bangladeshis to send additional money through the formal channel, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

Between July and November, remittance hit $10.90 billion, up from 41.32 % year-on-year.

This has had a great impact on the country's forex reserve.

The reserve stood at $41.18 billion by November 25 in contrast to $31.72 billion twelve months earlier.