IFC ready to lend $1b a year

The International Finance Corporation (IFC), a member of the World Bank Group, is ready to lend Bangladesh $1 billion a year to meet its long-term financing needs.

But the country could not avail the facility due to delay in approval and complex processes, a top official of the IFC said yesterday.

He said the IFC's long-term funding for the last fiscal year that ended on June 30 was $426 million, the lowest in several years.

The official made the comments on the sidelines of a workshop on “Investment Process and IFC Strategy for FY17-21” jointly organised by the IFC and Economic Relations Division (ERD) at the Pan Pacific Sonargaon hotel in Dhaka.

He said the way Bangladesh Bank fixed interest rates of foreign funds was also faulty.

The central bank follows an unwritten policy, which has set the maximum interest rate on the IFC loans at 6 percent taking into account the London interbank offered rate (LIBOR). Presently, the BB has capped the interest rate at LIBOR+3 percent but it can not be more than 6 percent.

No one has any control over the LIBOR, the benchmark rate used globally. The LIBOR rate was 2.88 percent as of September 14, 2018. It went down to as low as 0.5 percent during the global financial crisis.

“The LIBOR could go up to 4 percent on the back of growing demand. How then Bangladeshi borrowers would follow the BB's 6 percent fixed rate?” asked the IFC official, asking not to be named.

“Bangladesh needs a guideline for approval of foreign loans and its interest rate.” The IFC has a plan to provide $2.5 billion in long term financing for private sector development in Bangladesh over the next five fiscal years to 2021. Of the sum, it committed to financing $426 million in the last fiscal year.

Wendy Werner, country manager of the IFC, said the IFC aims to address key development gaps by focusing on building sustainable infrastructure, expanding financial access to improve logistics and value-added manufacturing while seeking opportunities to promote smart solutions.

She said the IFC will address the key challenges faced in the energy sector and support the development of transport, ports and trade logistics sectors.

The IFC is the largest investor in the power sector in Bangladesh, with debt and equity-financed projects expected to support 4.3 gigawatts of power generation, Werner said.

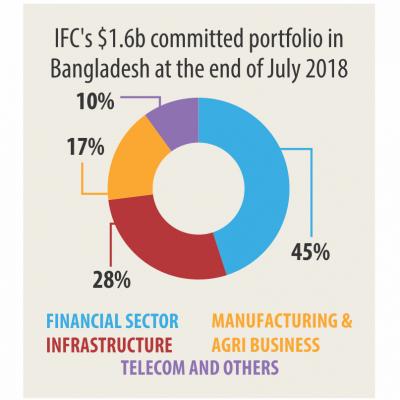

According to her, the IFC-committed portfolio in Bangladesh stood at $1.6 billion in July 2018, with 45 percent in the financial sector, 28 percent in infrastructure, 17 percent in manufacturing and agribusiness and 10 percent in the telecom, venture capital and funds sector. “Bangladesh is the ninth largest receiver of long-term funds of the IFC in the world,” she said.

The World Bank arm provides advisory support to financial market, readymade garments, public-private partnership, agribusiness, investment climate and energy efficiency.

Addressing the programme, Finance Minister AMA Muhith said the relationship with the IFC is getting more importance and Bangladesh, as a developing nation, is committed to continuing the good relationship with it.

Muhith said the government is trying to attract foreign direct investment, so funds from the IFC has become more important. The IFC is roughly providing $1 billion in funding every year, he said.

Bangladesh receives investment proposals amounting to $2 billion per year on an average, but it is not enough for the country, said Kazi M Aminul Islam, executive chairman of Bangladesh Investment Development Authority. Kazi Shofiqul Azam, secretary to the ERD, and Mahmuda Begum, additional secretary, also spoke.