Govt-backed loans for state enterprises rise to Tk 60,653cr

Taxpayer-assured loans for Biman Bangladesh Airlines more than doubled to Tk 10,279 crore as the state-run carrier got credits to buy new Boeing aircraft.

The guaranteed amount stood at Tk 4,937 crore last fiscal year.

The carrier received guarantees from the federal government for the loans from JP Morgan, US Exim Lender, Sonali Lender and HSBC.

The most recent credit guarantee includes Tk 2,654 crore that Biman took from state-run Sonali Lender in December this past year to get Boeing 787-9 aircraft and spare engines.

It took another Tk 977 crore for the purchase of the 3rd Boeing 787-8 in July this past year, according to a document of the financing ministry.

The airline borrowed Tk 1,000 crore in working capital loans from state-run Sonali Bank beneath the stimulus packages unveiled by the government to tackle the impact of the coronavirus pandemic.

Altogether, the publicly-guaranteed loans at Biman account for a sixth of the credit supported by the taxpayers in today's fiscal year.

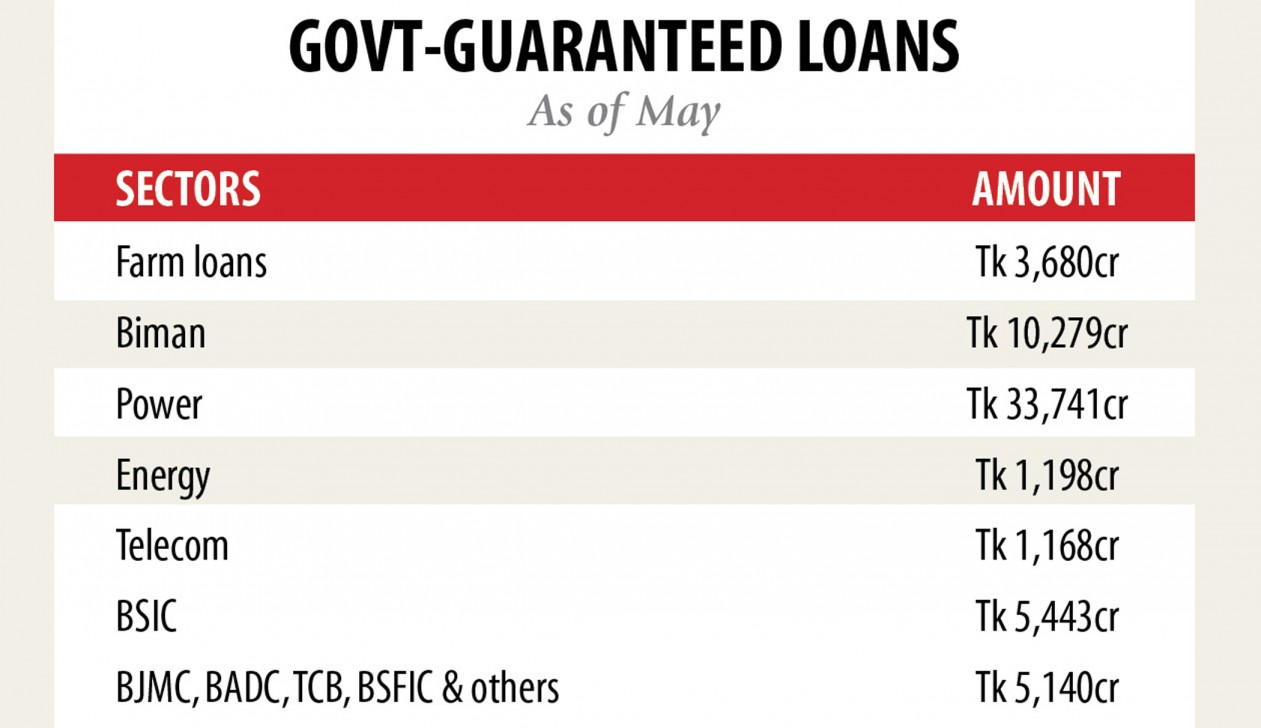

The government's guarantee and counter guarantee for the loans at state-owned enterprises (SoEs) stood at Tk 60,653 crore by May, which is 2.16 per cent of the projected GDP of fiscal year 2019-20 and would take into account 10.68 per cent of the government expenditure in 2020-21, according to the mid-term macroeconomic insurance plan statement.

The total amount is about 5 per cent greater than Tk 57,825 crore within the last fiscal year.

The government must supply the guarantee to the SoEs to greatly help them borrow funds to perform and expand operations because they can't secure loans by themselves due to their weak financial conditions, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

The federal government gives guarantees and counter guarantees for loans taken by the SoEs in the priority sectors such as power, energy and agriculture. If the SoEs fail to honour repayment, the federal government bears the responsibility.

Of the indirect debt, 58.61 % are in the energy and energy sector, 16.98 per cent at Biman and 6.07 % in the agriculture sector.

The power sector makes up about 55.63 per cent, or Tk 33,741 crore of the full total taxpayer-guaranteed debt. It was Tk 33,777 crore in FY19.

The guarantee covered Tk 2,458 crore secured by Ashuganj Vitality Station for a 450-megawatt power project and another Tk 1,188 crore for a 225MW power project.

Bangladesh Power Development Table (BPDB) borrowed Tk 1,596 crore from Japan Lender for International Cooperation for Bibiyana-3 gas-based power plant and Tk 1,587 crore under a syndication for 300MW power project on Shahjibazar.

Northwest Power Generation Firm Ltd took two loans, respectively Tk 1,358 crore and Tk 1,487 crore for the next and third products of the 225MW combined cycle vitality plant in Sirajganj.

Bangladesh-India Friendship Power Company borrowed Tk 3,902 crore from Exim Lender of India for the coal-based vitality plant in Rampal.

Bangladesh-China UTILITY COMPANY Ltd secured Tk 12,447 crore from Exim Lender of China for the Payra 1,320MW thermal power plant.

The guarantee for the energy sector may rise within the next fiscal year as a number of projects are being implemented.

The government in addition has provided guarantee for loans handed out by Bangladesh Krishi Bank and Rajshahi Krishi Unnayan Lender of Tk 3,680 crore, up from Tk 3,143 crore a year ago.

The guarantee in the energy sector was given as state-run Bangladesh Petroleum Corporation imported crude and refined oil worth Tk 1,198 crore, down from Tk 3,381 crore in FY19.

The total guarantee also included Tk 1,168 crore for the Bangabandhu satellite project.

The federal government has formulated an insurance plan to keep an eye on the indirect debt in order that they don't turn into immediate debts for the united states, the finance ministry's policy statement said.

It really is hoped that the sovereign guarantee and counter guarantee rules would help the government keep the indirect debt at a tolerable level.

Public debt in Bangladesh was $105 billion in FY2019, around 34.9 per cent of GDP, and the external public and publicly guaranteed (PPG) debt ratio was 14.5 % of GDP.

Both are low, said the Asian Development Lender recently.

The additional external debts of $2.9 billion, as the federal government projected to tackle the effects of the coronavirus pandemic, increase both external PPG debt-GDP ratio and community debt-GDP ratio by 0.9 per cent in FY2020.

"Bangladesh remains at low threat of debts distress," the ADB said.

As a result of coronavirus pandemic, Bangladesh's public debt-to-GDP ratio, which has thus far experienced a healthy job, is defined to exceed the responsible threshold of 40 per cent.

In the coming years, Bangladesh's public debt-to-GDP ratio would swell to about 41 per cent owing to increased borrowing to guard equally lives and livelihoods, the International Monetary Fund said lately.

"Even so, credit debt should remain sustainable," said Ragnar Gudmundsson, resident representative for Bangladesh of the IMF, on the crisis lender's website, recently.