Govt to inject another Tk 1,500cr

State banks can keep on expecting to be coddled despite their continued financial irregularities and irresponsible lending practices, with the government looking to inject Tk 1,500 crore in the upcoming fiscal year to help the lenders meet their capital shortfall.

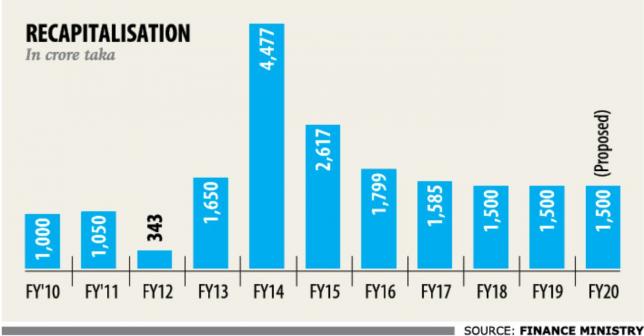

In the last 17 years, the government has injected a total Tk 20,584 crore of the taxpayers’ money into the state-run banks -- without any tangible improvement in their governance and lending practices to show for.

“This should be stopped,” said Khandker Ibrahim Khaled, a former deputy governor of the central bank.

The aim of the state-run commercial banks is to provide funds to the government from their profits and the government will spend the money for welfare activities, he said.

But these banks are being given money to meet their capital shortfall, which defeats the purpose of their existence, he added.

Unconditional recapitalisation has not helped address the root cause of the problem, said Zahid Hussain, lead economist of the World Bank’s Dhaka office.

State-owned banks are at the heart of the default loan problem dogging Bangladesh’s banking sector: at the end of 2018, they accounted for 52 percent of the total default loans in the industry.

“They remain severely under-capitalised despite capital injections every year over the past years,” he added.

As of 2018, state banks Sonali, Janata, Agrani and BASIC have total capital shortfall of Tk 15,452 crore.

Some Tk 1,500 crore has also been set aside in the current fiscal year’s budget and within a couple of weeks the money will be disbursed, according to finance ministry officials.

Curiously, the budgetary allocation for recapitalisation of the banks has been on the rise since fiscal 2006-07, with the government putting in as much as Tk 5,000 crore in a single year.

“Clearly, recapitalisation alone can’t solve the fundamental problem of poor governance and management in these banks,” Hussain said.

Recapitalisation should be linked with restructuring programmes aimed at addressing default loans and transforming the banks into development finance institutions with well-defined mandates and sound corporate governance framework.

“Better lending discipline and asset-quality control can be achieved only through governance changes,” he said, adding that balance sheets and capital inadequacy are symptoms of deeper governance problem for state-owned banks.

Meanwhile, finance ministry officials said a portion of the allocation were for Bangladesh Krishi Bank and Rajshahi Krishi Unnayan Bank (RAKUB), both of which lend at the instruction of the government and have to waive loans of farmers sometimes.