Seven banks in 'red zone'

The central bank is concerned about seven banks, including three state-run lenders, for their deteriorating financial health stemming largely from rising default loans and declining capital and profits.

These lenders belong to the “red zone” in the Bangladesh Bank's Bank Heath Index (BHI) report.

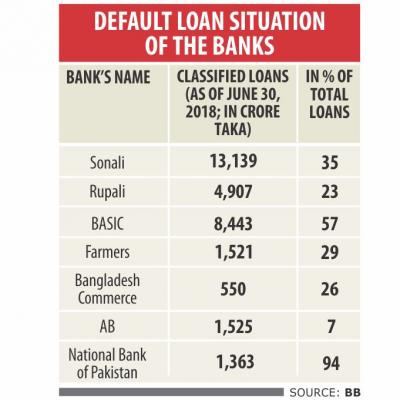

The banks are: state-run Sonali, Rupali and BASIC, private commercial banks Farmers, Bangladesh Commerce and AB as well as foreign lender National Bank of Pakistan.

In the second week this month, the Financial Stability Department (FSD), a wing of the central bank, recommended the BB's policy and inspection departments take special supervisory and regulatory measures to improve the financial health of the lenders.

Since 2015, the central bank has been preparing the half-yearly BHI report on the basis of six financial indicators: asset quality, capital adequacy ratio, efficiency, profitability, liquidity and lending ratio against capital.

Banks that perform well in line with the indicators are placed in the 'green' category, while lenders with worst performance belong to the red zone. The yellow zone consists of banks that stay between the red and the green zones.

Among the seven lenders, Sonali, BASIC, Bangladesh Commerce, Farmers and Rupali have failed to meet the minimum capital requirement in the recent quarters.

Default loans at the seven banks also continued to go up as they had disbursed a huge amount of loans in violation of credit norms in the past.

The central bank also unearthed a number of financial scandals at most of the banks in recent years. Because of the irregularities, they have entered the red zone, a BB official told The Daily Star.

The latest BHI report, prepared on the basis of the financial health as of December last year, showed that 32 banks stayed in the yellow zone and 14 banks in green zone.

The FSD also advised the departments concerned at the central bank to take special measures to supervise six other lenders in the yellow zone as their financial health worsened significantly in recent times. The banks are Agrani, Janata, Prime, Islami, Shahjalal Islami and First Security Islami.

Bangladesh Krishi Bank, Rajshahi Krishi Unnayan Bank and ICB Islamic Bank are not included in the BHI report as their financial health is “too bad”, the BB official said. Shimanto Bank was also excluded as it received licence in 2016.