Garment makers embracing artificial fibres

Import of man-made fibre (MMF) as well as investment in its organization is increasing found in Bangladesh because of higher demand for polyester and viscose-made garment items worldwide.

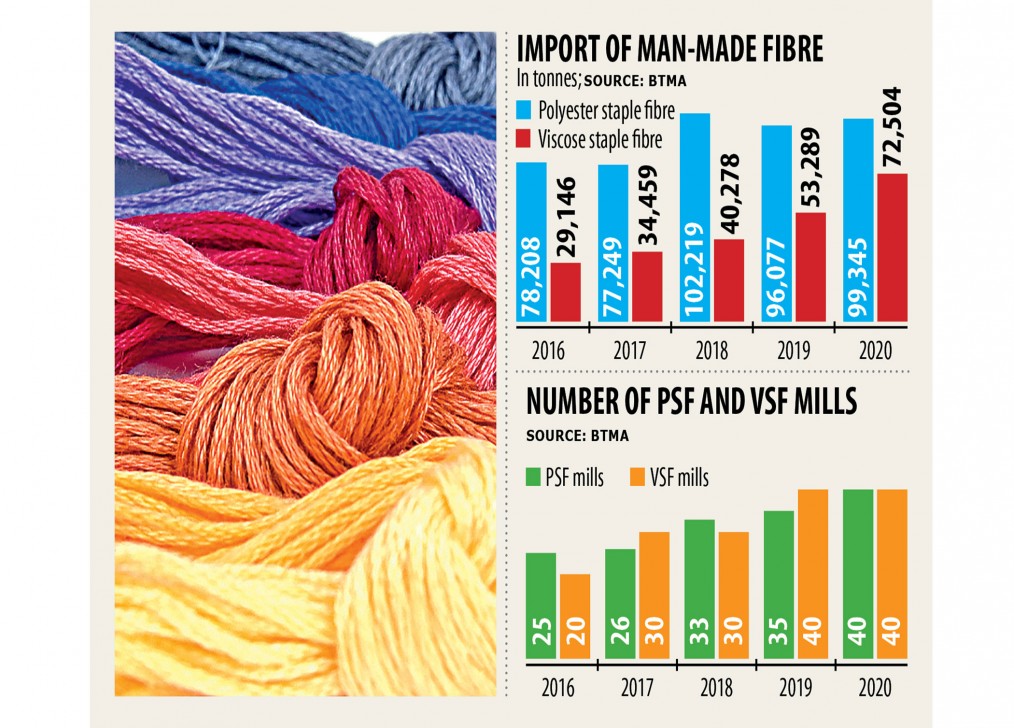

Local spinners imported 99,345 tonnes of polyester staple fibre (PSF) on 2020, up 3.4 % from 96,077 tonnes this past year even through the coronavirus pandemic, regarding to data from the Bangladesh Textile Mills Association (BTMA).

Presently, 40 spinning mills import PSF fibre to make yarns to create high-end garments, such as for example sportswear.

The import of viscose staple fibre (VSF) rose last year as well as spinners earned 72,504 tonnes of VSF, an increase of 36 per cent year-on-year.

The import of MMF has been on the rise over the last few years as a result of the surge popular of fabrics created from the fibre instead of cotton.

Since MMF is employed as an alternative for cotton fibre, each of the imported MMF is employed by local millers.

The demand for everyday wear experienced the roof for the longer stay of men and women indoor worldwide as a result of Covid-19.

People are shopping for more MMF-based apparels because they are durable, recyclable and re-useable. MMF as well meets the standards for sustainable clothing in comparison to cotton-based fibre. In addition, because of lifestyle changes, consumers are looking for goods that are simple to health care for. MMF increases that comfort, spinners say.

Nearly 30 % away of $8 billion investment in the principal textile sector in Bangladesh took place in the MMF segment, up from 20 % three years ago, spinners said.

"The expense in MMF is growing as people are choosing the fabric as a substitute to cotton fibre," said Md Khorshed Alam, chairman of Minor Star Spinning.

The use of MMF increased due to higher production of value-added garment items, he said.

The concentration in cotton with regards to garment items produced and exported increased from 68.67 % in fiscal 2008-09 to 74.14 % in 2018-19, regarding to a report of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

The global trade of cotton-based apparel stands at around 35 per cent. It shrank by 0.5 % annually between 2007 and 2017.

The share of MMF-based garments in the global apparel trade is around 45 per cent, and it grew at 5 % compound gross annual growth rate through the decade.

In 2017, the global trade of MMF-based apparel was $150 billion. Bangladesh had a 5 % share in the segment, in comparison to 10 % of Vietnam.

Industry persons say Bangladesh features clear potential found in the global marketplace of MMF-based clothing.

"The potential is quite high as we are receiving a lot of do the job orders of MMF-based apparels. We must capture this global market," explained Syed Shafqat Ahmed, managing director of Saiham Knit.

Currently, more than 120 spinning mills out of a complete of 500 possess the production facility for PSF and VSF, said Monsoor Ahmed, secretary of the BTMA.

Member factories of the BTMA are expanding the production center of PSF and VSF each year as being the demand is increasing worldwide, he said.

Since setting up another spinning mill focused on PSF and VSF yarn creation is expensive, most producers get yarn from MMF in the same mill with separate lines.

It costs Tk 80 crore to Tk 120 crore to set up a medium-sized MMF spinning mill in Bangladesh, Alam said.

Out of 2,052,000 tonnes fibre import of Bangladesh in 2018, the show of cotton was 93.57 %, which highlighted the country's reliance on the natural fibre.

"While we can't ignore the value of the cotton-based marketplace, the MMF-based clothing marketplace bears strategic significance so far as our item diversification and higher-value-addition-led development strategy can be involved," explained BGMEA President Rubana Huq.

BTMA President Mohammad Ali Khokon said the import of MMF would have to be duty-free of charge like cotton as the demand of yarn was increasing.

The imposition of 5 % VAT on the sales of yarn is a discouraging factor for the sector, he said.

The price of MMF has increased because various mills were shut in China and India during the peak of Covid-19 last year.

90 days ago, PSF was sold between $0.70 and 0.72 per kilogram. It gone up to $1.30 to $1.40.

VSF was priced between $1.15 per kg and $1.18 per kg 90 days ago. The prices now vary between $2.50 and $2.54.