Garment export orders rolling in once more

It seems garment manufacturers are at last breathing a sigh of relief as work orders for apparel items from international retailers are returning with the reopening of their stores in the European and American markets.

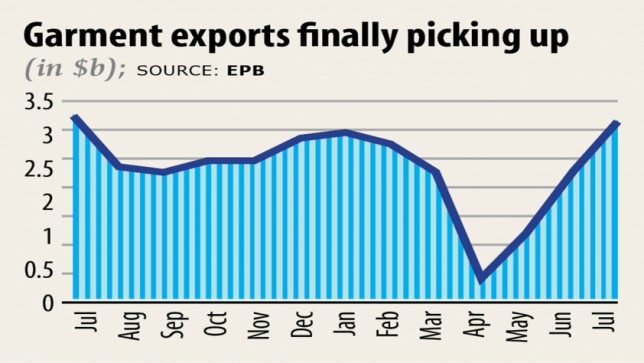

The signs of recovery for the garment sector are also evident in the export figures of July when Bangladesh earned $3.24 billion from apparel shipment though the amount is 1.98 per cent less than a year earlier.

However, garment export receipts in July are 14.18 % higher than the monthly target of $2.84 billion.

Of the full total garment shipment, knitwear exports grew 4.30 % year-on-year to $1.75 billion while woven exports fell 8.43 % to $1.49 billion, according to data from the Export Promotion Bureau.

Earnings from apparel shipment in April, May and June stood at $0.37 billion, $1.23 billion and $2.28 billion respectively.

Personal protective equipment (PPE), masks and other hospital textiles made it to the set of new export items for Bangladesh as a great number of buyers are putting work orders for these things amid the coronavirus pandemic.

If more retail stores reopen in Europe and the united states, garment exports from Bangladesh will grow further as the pandemic has failed to dampen the demand for basic apparel items, exporters said.

Sweater factories have finally put their best foot forward to meet up the deadline for the shipments of August, September and October, said Mostafa Sobhan Rubel, managing director of Dragon Sweaters.

"My factories are fully booked before end of September and my customers have also booked 60 per cent of my capacity from October towards the end of December," Rubel said, adding they have been able to totally reinstate a lot more than 90 % of the cancelled orders.

Abdullah Al Mahmud Mahin, managing director of Mahin Group, said he didn't face any work order cancellation and currently, his factory is utilising a lot more than 70 % of its capacity.

Work orders have already been rising since mid-July at his factory.

If the current state of business continues, Mahin's company's earnings this season might be 20 % significantly less than last year's, but if a coronavirus vaccine arrives by mid-September, they'll witness about a 15 per cent jump in profit.

"I am quite definitely optimistic that a large numbers of work orders should come to Bangladesh if a vaccine is available by mid-September," said Mahin, who supplies fabrics to renowned brands worldwide.

AK Azad, managing director of Ha-Meem Group, said his factories are running at more than 60 per cent capacity at present.

"My buyers have started placing work orders and slowly but surely the quantity of work orders is increasing."

Of the cancelled work orders, his buyers have previously taken back 50 % of these and promised to take another 30 %.

The remaining 20 % ought to be sold at cheaper prices to other buyers, Azad added.

"I am currently utilising 65 % of my capacity. About 80 % of might work orders remained unaffected through the pandemic while 20 per cent or less have already been reinstated," said KM Rezaul Hasanat, chairman and ceo of Viyellatex Group, another leading garment exporter.

PPE is a tiny fraction of the clothing business and it cannot even cover 10 per cent of the full total exports, he added.

"COVID-19 has affected the garment sector in a variety of ways. Initially, it broke the supply chain as we are reliant mostly on China for the majority of our raw materials," said Sheikh Mohammad Danial, managing director of Finesse Apparels.

But exports are now bouncing back, he said, adding that the queries from brands in Europe and the US have jumped.

If the existing trend in Europe continues, Bangladesh will commence to see stronger export figures from the first quarter of 2021. More clothes are being bought online, with a massive 76 per cent rise in online sales in the US, he said.

"It is the new reality that we need to prepare yourself," he added.

Work orders were slowly coming back but knitwear sector is doing better than woven products, said Azimul Islam, managing director of Alif Group.

"However the major threat may be the second wave of the coronavirus infection in the Western market. If that occurs, it'll be a bigger disaster for all of us."

His knitwear factory is running at 70 per cent capacity and the woven one at 60 %.

About 70 % of the cancelled work orders are being taken back but at a heavy discount and deferred payment terms, Islam added.

"It's too early to generate a positive remark on the inflow of new orders because so many factories are still struggling to survive because of financial hardships," said Arshad Jamal Dipu, vice-president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

New orders are coming but at a slow pace.

"We would also have to see at what prices these new orders are being placed."

It's difficult to respond since not absolutely all factories, which participated in the original survey reporting $3.18 billion cancellations, provided follow-up data.

"But we tracked suppliers to some buyers around per month ago and found that 45 per cent around $900 million worth of orders were reinstated, and right now this figure may have gone higher."

But the payment term is not pleasant, with deferred payment as high as 180-plus days, and discounts can also be common, he added.