Garment factories reverting to cash for wage payment: study

Garments factories are reverting to cash to pay wages and salaries to personnel just months once they embraced digital payments at the height of the coronavirus pandemic, according to a fresh study.

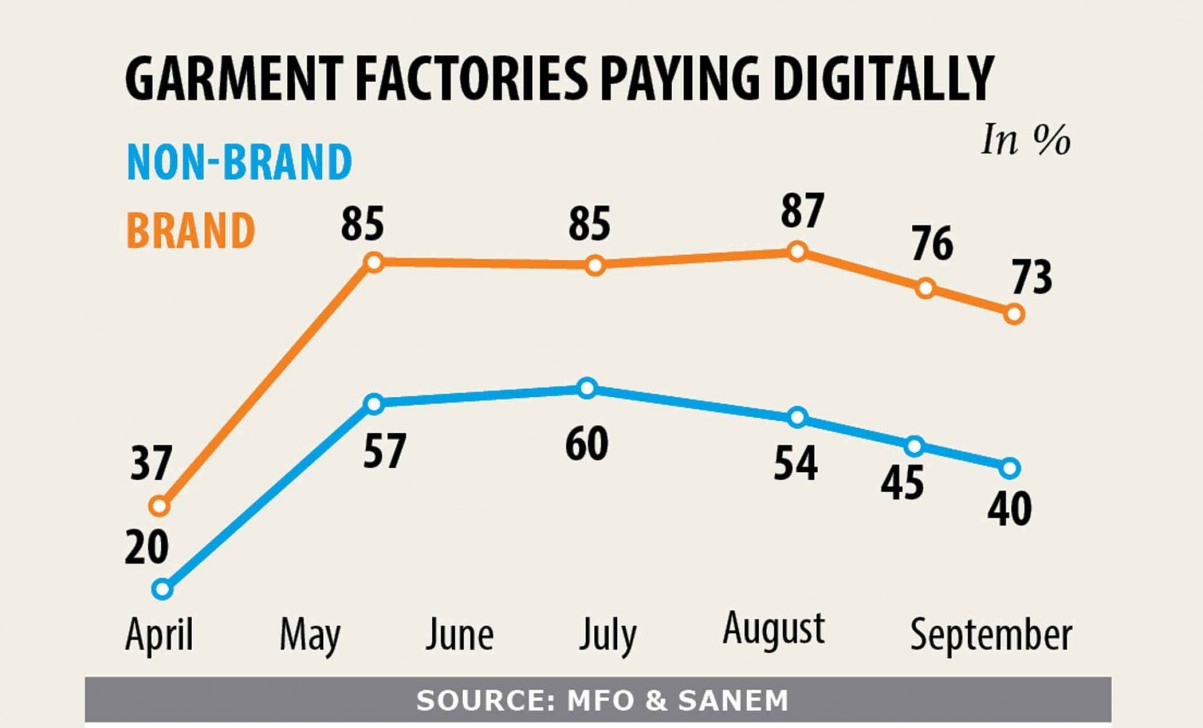

The digitalisation of wages got a leg up following the government enforced countrywide shutdown to slow the spread of the deadly pathogen in April. The upward trend in payments through electronic platforms continued until June.

Later, the ratio of digital payments began to decline despite higher advantages of digitalisation such as decreased payroll processing costs, lost worker production time, and increased security connected with digital payments, said a news release citing the study.

The Microfinance Opportunities in collaboration with the South Asian Network on Economic Modeling (Sanem) completed the analysis under a project called Garment Worker Diaries.

The project is aimed at collecting data on the working conditions, income, expenditure, and financial tool use by personnel in the global apparel and textile supply chain.

Researchers collected data on factory wage digitalisation from 1,377 workers in the main professional belts such as Chattogram, Dhaka City, Gazipur, Narayanganj and Savar from April to October.

Factories were split into two categories: Brand-facing rather than Brand-facing.

A factory is recognized as 'brand-facing' if it's on a brand's list of suppliers or is listed as a supplier to a brand on web sites of the Mapped in Bangladesh (MiB) or the Open Apparel Registry (OAR).

The MiB is a digital map of the garment industry that provides a detailed database of export-oriented factories around Bangladesh. The OAR is a source map to recognize apparel factories and their affiliations.

In the news release, the Sanem said there is a massive shift towards paying staff digitally in May, followed by a slow decline in the share of digital payments in the next months.

The firms that are listed as the supplier of brands commenced to cut digital payments from August when 76 % paid wages electronically, down from 87 % in July.

In September, 73 % of the factories paid wages digitally.

The digital payment created by the firms that aren't listed as suppliers of brands slumped to 40 % in September from 60 % in June, the news release said.

"One possible explanation was that the benefits associated with the digitalisation weren't readily apparent to the factories, particularly because they had not completely replaced cash payments with digital payments."

For instance, some employees reported to have obtained their regular salaries digitally, but Eid bonus payments in cash, the press release said.

Another reason that may have caused the factories to return to cash payments is the unwillingness of workers to get the money electronically, it added.

"Most workers are not comfortable with acquiring payments digitally as a result of the high transaction costs associated with mobile banking and insufficient knowledge about mobile financial and banking services," said the Sanem.

Sanem Executive Director Selim Raihan called the reverting to cash payments unfortunate somewhat.

"The cost for digital transactions, including through cell phones, ought to be reduced as the charge is high from the perspective of the income of garment workers."