Fiscal inclusion agenda gets a good start

The central bank's order to open bank or mobile phone financial service (MFS) makes up about disbursing the salaries of employees of export-oriented factories from the government's Tk 5,000 crore stimulus package gives a leg up to the digitalisation and financial inclusion agenda, authorities said.

But factory owners said the instruction given on Monday to complete starting of most accounts by April 20 might create some issues for them as well as the personnel as the ecosystem isn't ready yet for such an uphill task.

Simply half the garment sector's 40 lakh workers now get salaries through bank or MFS accounts and beginning another 20 lakh brand-new accounts in under fourteen days will be difficult, according to garment factory owners.

"This is a huge decision from the Bangladesh Bank," said Ashraful Alam, region project coordinator of US Capital Development Fund.

It will give a fillip to the country's overall financial inclusion work and help digitalise financial offerings in a stronger way.

For a while, disbursing salaries through digital means can help the staff members maintain a social distance, which is paramount to reining in the spread of the novel virus which has already kept nations reeling, explained Alam, who is also a deputy general manager of Bangladesh Bank.

"It's true that beginning 20 lakh new accounts will be a tough task and hence banking institutions, MFS operators and owners have to collaborate to that end."

The government also needs to inspire grocers to take up digital method of payments so that persons like the factory personnel can certainly pay grocery bills through their MFS accounts, he added.

However, Abul Kashem Md Shirin, managing director of Dutch-Bangla Bank (DBBL) that is clearly a leader in digitalised earnings disbursement for the garment sector, said beginning the accounts will never be a challenge at most.

"If the factory owners show workers' database with their national identification cards and images, we can certainly open the accounts."

DBBL is maintaining hundreds of thousands of salary makes up about garment factories and various other firms through business banking, agent banking and its own MFS brand Rocket.

"Immediately after the notice was issued, we obtained clarification from the central lender and the procedure seems quite easy now," Shirin stated, adding that the staff members with smartphones and access to the internet can open accounts by themselves.

The country has a total of five lakh MFS agents and regardless if one-fifth of them remain operational amid lockdown, the brand new accounts could be opened easily, he added.

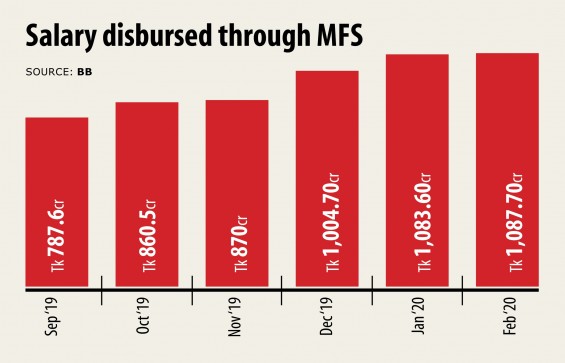

Currently salaries worth a lot more than Tk 1,000 are disbursed on a monthly basis through the MFS platform, according to BB data.

The number will double if the brand new accounts can be opened, that may also be a milestone in the country's financial inclusion efforts, Shirin said.

In the first two months of 2019, Tk 2,171 crore was disbursed as income through the MFS accounts, the amount being 32 per cent greater than a year earlier, in line with the BB.

A good garment factory owner requesting anonymity said 90 % of his employees have no MFS accounts; since all of them are now in villages, it'll be impossible to allow them to available the accounts within the stipulated period.

"Some 40 % workers in my factories have either lender or perhaps MFS accounts," explained another owner of an Ashulia-based mostly garment factory asking never to be named.

Over the past few days, the factory supervision has been attempting to open bank accounts for all 20,000 workers employed in the four units.

Some workers don't have authentic identification cards, which he said is standing up in the form of creating lender or MFS accounts.

According to the BB instruction, the personnel and employees will need to post their NIDs or perhaps birth certificates for beginning the accounts, while banks and MFS providers won't charge any fees.

The central bank also known as for taking necessary steps to create awareness and encourage more persons to open MFS accounts to support the threat of coronavirus contamination through the use of cash.

Following the government-announced general holidays, daily transactions through MFS, ATMs and banks have fallen drastically, Shirin said.

If customers are allowed to send money in one MFS operator to some other, it would benefit more people, he said, while urging the central lender to take the problem under consideration.

"We've been robbed of a lot of things as a result of the coronavirus, but the pandemic has opened a window of options on other fronts just like digitalisation in the economic sector. As a regulator, the central bank can take the lead in this article," Shirin said.

The MFS market leader bKash is also engaged in earnings disbursement in garment and other factories and has already brought lakhs of employees under its network.