Farmers deprived of low-interest loans

Farmers continue to face interest rate as high as 25 percent for agriculture loans as many banks prefer to disburse them through non-government organisations that keep a cut for themselves.

In the process, the central bank's intent to extend low-interest loans to farmers gets defeated.

Considering agriculture as a priority sector, the central bank usually sets the interest rate on farm loans at 2-3 percent rate less than the major credit products of lenders.

If the loans are disbursed through bank branches, farmers can get them at 9 percent interest rate.

But when disbursed through NGOs and microfinance institutions, the rate goes up to 20-25 percent as they take the funds from banks first at 9 percent interest and then give them out to farmers.

Banks turn to NGOs and microfinance institutions for farm loan disbursement to lessen their supervisory- and recovery-related costs.

The central bank earlier instructed lenders to distribute at least 30 percent of their annual farm loan disbursement target through their respective branches, but a number of banks disregarded the rule.

At least 26 banks disbursed more than 70 percent of their farm loans last year through NGOs, but the central bank has not taken any punitive measures against them. In fiscal 2016-17, the number was 22.

“Banks' dependency on NGO channel is on rise as the central bank has been overlooking the issue,” said a BB official.

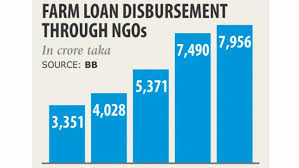

Farm loan disbursement through the NGO channel increased 6.23 percent last fiscal year to Tk 7,956 crore. Every lender has to disburse at least 2.50 percent of their total loans in a year to farms in line with the central bank's agriculture credit policy.

Banks have been achieving the disbursement quota in recent years but by outsourcing it to NGOs.

In fiscal 2017-18, farm loan disbursement stood at Tk 21,394 crore, 37.19 percent of which was given out through the NGO channel.