Cotton imports tipped to come back to pre-pandemic levels by year-end

Cotton imports witnessed a slump for the very first time in over ten years last fiscal year due to a fall popular from local mills amid a beautiful drop in apparel work orders for the global coronavirus pandemic.

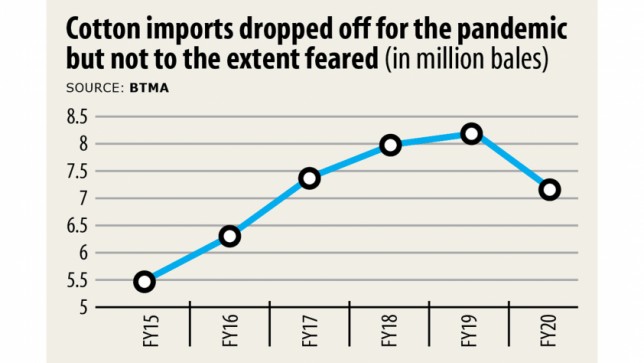

In fiscal 2019-20, Bangladesh imported 7.1 million bales of cotton, down 13.4 % from a year earlier, according to data from the Bangladesh Textile Mills Association (BTMA).

As in previous years, cotton imports were increasing up until February because of the popular for yarn and other fabrics from garment exporters.

However, imports crashed from then onwards because so many garment factories were turn off following the government declared a two-month 'general holiday' on 26 March targeted at curbing the spread of coronavirus.

Due to this fact, most spinning and weaving mills were also shuttered through the March-June period.

When the nationwide lockdown eventually found an end on May 30, most mills resumed operations with previous stocks of cotton rather than importing more regardless of the significant fall in cost for the cellulose fibre at international markets.

Cotton is currently trading at between $0.62 to $0.64 per pound in the brand new York Futures markets, down from the prior selection of $0.70 to $0.75 during pre-pandemic times.

The vast majority of Bangladesh's domestic demand for cotton is met through imports as local growers can only just supply significantly less than 3 per cent of the country's gross annual demand.

Both the import and consumption of cotton in Bangladesh had risen steadily for days gone by decade as the country's thriving garment sector has resulted in the forming of many strong backward linkage industries.

The garment sector has seen tremendous growth over time as Bangladesh's status as a least-developed country allows its apparel products to enjoy duty-free usage of many developing and developed nations.

"Since last month, the consumption of cotton started growing as garment factories resumed production after around three months," said Khorshed Alam, managing director of Little Group, a respected cotton importer and consumer.

Typically, Alam imports almost 33,000 bales of cotton every year. One bale equals 480 pounds.

Millers used their previous stocks of cotton after reopening their factories following the lockdown.

Besides, many importers delayed releasing cotton shipment from the port amid the coronavirus outbreak.

Textile millers also faced other issues, such as for example having to preserve unsold stocks of yarn and other fabrics.

However, the prior inventory of such materials has emptied significantly as a result of return of demand from garment manufacturers.

"So now, we will start importing cotton again," Alam added.

The pandemic may be the sole reason behind the declining trend of cotton imports, said Razeeb Haider, managing director of Outpace Spinning Mills.

"I am quite definitely hopeful that cotton imports will rise again soon as the demand for yarn and other fabrics has been increasing gradually," he added.

Most garment factories in Bangladesh are actually running at 75 % of their total production capacity which indicates that work orders are coming back.

The demand for various fabric materials could go even higher after September if the international retailers continue steadily to source their products from Bangladesh at the existing pace, he added.

Echoing the sentiments of Alam and Haider, BTMA President Mohammad Ali Khokon said that more than 50 per cent of the twelve-monthly sales target for fabrics had been met by July.

"I am hoping sales recover by a lot more than 75 % by September and fully by the year-end."

By January next year, sales should go back to its previous growth rate, Khokon added.

Of the $8 billion invested in the principal textile sector, Tk 20,000 crore was already lost to the coronavirus fallout, according to varied millers.

About 11,000 micro, small, medium and large spinning, printing, dyeing and weaving mills were not able to create any goods in March and April for concern with coronavirus contagion.

Because of this, the millers missed two mega sales events, Pahela Baishakh and Eid-ul-Fitr.

Currently, there are about 450 spinning mills in the united states while total investment in the sector stands at Tk 40,000 crore. Besides, Tk 30,000 crore has been committed to the weaving and dyeing sectors.