Budget execution rate falls

The government's countrywide budget implementation rate fell significantly within the last one decade mainly due to too little efficiency, accountability and capacity and a rise in corruption.

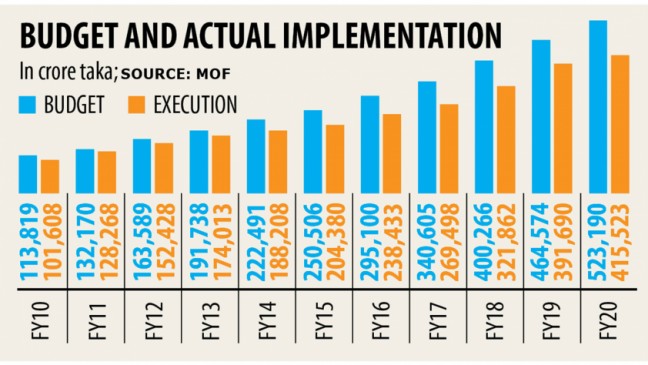

For fiscal 2019-20, the government passed a national budget of Tk 523,190 crore but towards the end of the year real implementation was Tk 415,523 crore.

That means Tk 107,667 crore has been kept unimplemented.

Over the last 10 years, the budget implementation fee has typically been on a downward curve, falling to 79.4 % in 2019-20 from 84.3 % in the last year.

Just five years back, the implementation rate was more than 80 per cent yearly and the highest through the decade was 97 % in fiscal 2011.

The government should give attention to the implementation rate because lower implementation ultimately deprives persons of quality services, said Hossain Zillur Rahman, former adviser to a caretaker government.

Salaries and great things about government officials have already been increased by around 50 % in the last couple of years with hopes that it'll ensure higher efficiency and reduce corruption, he said.

However, a lack of performance and rise of corruption among these civil servants happen to be causing the spending plan implementation rate to drop, he said.

"This is a big concern today," said Rahman, as well executive chairman of the Power and Participation Research Center (PPRC).

The country's leaders should take proper initiatives to improve their efficiency, capacity and reduce corruption in budget implementation, to ensure that people get bigger advantages from the government's plans and quality services.

Ministries failing on the execution the most ought to be questioned, because without strong accountability the problem will not progress, he added.

The info shows the financial implementation rate, but will not include the standard of the implementation, which is much lower, said Mustafa K Mujeri, executive director of the Institute for Inclusive Financing and Development (InM).

"There are many reasons for the lower implementation rate but the primary reason is low potential," he said.

"The primary problem is that our economy is growing, requirements are rising. However, execution capacity is certainly in a downward development," he added.

"If we cannot improve the ability, the implementation level would fall at an increased extent in the coming years," said Mujeri, who is also a former director general of the Bangladesh Institute of Development Studies (BIDS).

In that situation, if the government tries to improve the budget artificially after that quality of the general public services will fall further, he said.

"So, our development voyage would be impacted," he warned.

Keeping these in account, he recommends taking proper measures quickly and urgently.

The growing gap between target and implementation of public expenditure can be related to both poor programming and weak implementation capacity, said Towfiqul Islam Khan, senior research fellow of the Centre for Policy Dialogue (CPD).

Over the years, the finance ministry followed a "business as usual" approach in preparing budgetary allocations without considering ground realities, he said.

It may also come to be true that the shortfall found in revenue collection recently has restrained the federal government regarding spending, he said.

"Even this 12 months, we are able to recall that in this fiscal year, in a matter of one month of approving the spending plan found in the national parliament, the Financing Division advised that only 70 % of the budgetary allocation from authorities fund against ADP assignments could possibly be spent," he said.

"Indeed, through the years, the announced fiscal framework of the national budget has misplaced its credibility," he explained.

"For Bangladesh, consumer expenditure-GDP ratio should be around 20-22 %. Unfortunately, we are unable to go beyond 15 %," Khan added.