Budget execution faces roadblocks

Bangladesh's exterior sector came under strain in January following the outbreak of coronavirus disease in China, the country's largest trading partner, slowed global trade, as a result impacting the economy somewhat.

The outbreak converted into a full-blown health crisis in Bangladesh and all of those other world in March after the World Health Organisation labelled it a pandemic.

This prompted the federal government to impose a countrywide lockdown to limit the spread of the deadly virus, delivering the economy to a screeching halt.

The lockdown was eased in June, and the economy is reported to be on a recovery path although a full revival is still a long way away. Due to this fact, the spending plan implementation throughout 2020 offers been under challenge.

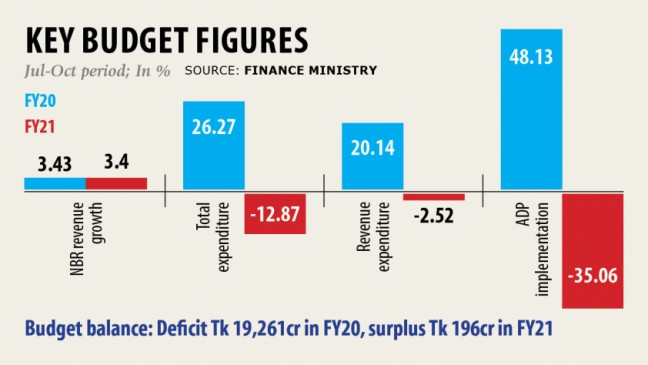

Official data showed that the earnings accumulated by the National Plank of Earnings (NBR) rose 3.4 % in the July-October period against 3.43 % a year ago.

The revenue made by the tax administration is an essential indicator of the budget implementation as it accounts for about 85 per cent of most revenues earned by the united states in a year and allows the government to implement its plans.

The decline in the non-NBR tax collection widened to 18.95 % during the four-month period compared to 2.39 % last year.

In the same way, total expenditure dropped 12.87 per cent in July to October, that was 26.27 % in the positive territory in 2019, due to the government cannot spend much.

The implementation of income budget was down 2.52 per cent although it was 20.14 % in the great during July to October within the last fiscal year, finance ministry info showed.

The pandemic also dealt a major blow to the implementation of the twelve-monthly production programme (ADP). It plunged 35.06 % in the four months, whereas it possessed risen 48.13 % through the same period last year.

The budget balance was in surplus of Tk 196 crore from July to October compared to an enormous deficit of Tk 19,261 crore, year-on-year.

Total government spending fell 12.87 per cent in the first four months of the fiscal year as the advancement expenditure declined 34.57 per cent on the back of slow execution of the production projects as a result of Covid-19 pandemic, the finance ministry said in a report.

Zaid Bakht, an economist, stated the implementation of the price range and the ADP faced adversaries for most of the entire year. The execution of the mega projects possessed witnessed significant slowdown as overseas consultants and engineers returned to their homes as a result of the coronavirus pandemic.

"The impact of the financial slowdown is petering away. Nonetheless it remains to be observed how the second wave of coronavirus attacks plays out."

Bakht, likewise the chairman of state-owned Agrani Bank, said the government's borrowing did not go up as it could not spend much. "The spending is usually picking right up now."

The revenue situation hasn't improved much as the global trade scenario and the monetary activities in the home have remained subdued. It is expected to visit a similar style in the coming a few months as well.

"Overall, the government's funding possesses been facing a good situation," said Bakht.

"But, if the public borrowing goes up, you won't create much trouble for the federal government as banks are flooded with excess liquidity."

The surplus liquidity in the banking sector stood at Tk 160,979 crore by August, up 105 % year-on-year.

Bank borrowing more than halved to Tk 14,008 crore in July to October found in FY21 from Tk 33,510 crore this past year, finance ministry data showed.