BB policy sparks flurry of loan write-offs

Loan write-offs almost quadrupled in the first quarter of the year on the back of the central bank’s easing of rules, in a sobering reminder of the banking sector’s deteriorating financial health.

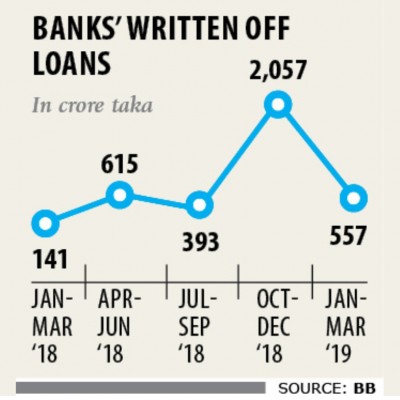

Between January and March, Tk 557.30 crore was written-off, in contrast to Tk 141.26 crore a year earlier, according to data from Bangladesh Bank.

Earlier in February, the central bank revised its policy to allow banks to write-off default loans that have been languishing in the bad category for three years, down from five years previously.

Furthermore, lenders do not have to file any case with the money loan court to write off delinquent loans worth Tk 2 lakh, up from Tk 50,000 previously.

Banks usually write off a maximum amount of default loans in the last quarter of the year with a view to cleaning up their balance sheets.

Between October and December last year, banks wrote off Tk 2,057 crore.

“But the write-offs in the first quarter were uncharacteristically high,” said a central bank official, adding that it might continue for the rest of the year for the BB’s policy relaxation.

Khondkar Ibrahim Khaled, a former deputy governor of the central bank, echoed the same.

“The write-off policy is exercised by almost all banks across the globe, but the trend is excessively high in Bangladesh. This is not good for the banks’ health.”

He went on to blame the high write-offs on the surge in default loans -- in the absence of corporate governance.

At the end of March, default loans in banks stood at Tk 110,874 crore, up 25.15 percent year-on-year.

Of the banks that took the facility to clean up their balance sheets, Dutch-Bangla Bank topped the chart, writing off Tk 290.55 crore. It was followed by Jamuna Bank, which wrote off Tk 191 crore.

With the latest round, a total of Tk 53,258 crore has been written-off since the facility was introduced in January 2003 by the central bank to show lower amounts of default loans in banks’ balance sheets.

Of the amount, 76 percent has remained outstanding to date, meaning banks’ efforts to recover the loans did not yield much.

As of March, the state-owned banks have written off Tk 23,187 crore and private banks Tk 28,342 crore.

The two state-run specialised banks, Bangladesh Krishi Bank and Rajshahi Krishi Unnayan Bank, have written off Tk 555 crore and foreign banks Tk 1,174 crore.

As per the Bangladesh Bank norms, loans are written off after making 100 percent provisioning. Banks though are obligated to continue with their recovery efforts.

Lenders opt for write-offs when all avenues for recovering the default loans have been exhausted, Khaled said.

Loan write-offs have gradually been rising in recent years and the trend reflects the ongoing crisis in the banking sector.

“Written-off loans are like uncollectible loans -- the recovery of such loans is highly difficult.”

Subsequently, he urged banks to check corruption such that vested quarters cannot take loans banking on the unethical process.