BB plans uniform method to calculate cost of funds

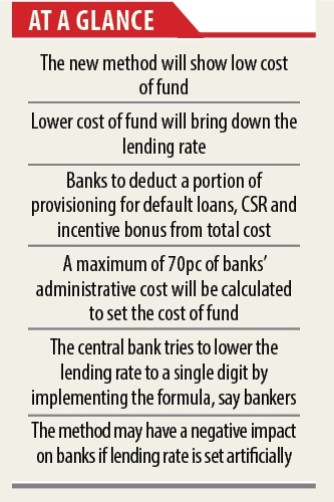

The central bank is set to come up with a new formula for calculating the cost of funds for banks with a view to bringing down the interest rate on lending, much to the trepidation of bankers.

The cost of funds is the interest rate paid by lenders for the funds they use in their business.

The move comes as banks now calculate their cost of fund following different methods, raising questions of transparency.

In a bid to bring uniformity the Bangladesh Bank has now decided to come up with a blanket formula that all banks must use to calculate their cost of funds.

Bankers said that the forthcoming method will help the central bank to keep the interest rate on lending at 9 percent -- a move that will have a negative impact on lenders.

“The new formula will show a lower cost of fund,” said the managing director of a bank wishing not to be named.

He fears that the central bank may stipulate a lower spread between the cost of funds and the interest rate charged to borrowers in order to bring down the interest rate on lending to single digits.

To make profit, banks keep the spread at at least 5 percent, he said.

The spread between the cost of funds and the interest rate charged to borrowers represents one of the main sources of profit for many financial institutions.

The cost of funds is one of the most important input costs for a lender since a lower cost will end up generating better returns when the funds are used for short-term and long-term loans to borrowers.

“Lenders will be forced to decrease their interest rate on lending when the new central bank guidelines will be implemented,” said a central bank official.

According to the draft guidelines, banks have to include their interest expense on deposits, borrowings, subordinate bonds and administrative and other expenses to calculate their total cost.

A portion of provisioning against default loans will not be calculated to determine the default loans.

Lenders will also be allowed to include a maximum of 70 percent of their administrative expenses -- such as salary payment to their employees -- when they will calculate their total cost.

Besides, expenditures related to the corporate social responsibility and performance and incentive bonus payment for their employees will not be included with the total cost.

Banks are now calculating 100 percent administrative cost, provisioning for default loans, CSR expenditure and performance and incentive bonus to determine their total cost.

For this reason, the total cost of banks will decrease when the new method will be effective.

“This will have a positive impact on the interest rate on lending,” the BB official said.

For the determination of total fund, lenders will have to calculate daily outstanding amounts of deposits, borrowings, shareholders’ equity, general provisions and mobilisation of funds through issuance of the sub-ordinated bonds.

The country’s banking sector is now following the global best practices to determine their cost of fund, said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh, a platform of the private banks’ managing directors. Asked whether the upcoming formula will arrest the lending rate, he said there is no scope to make a comment to this end as the guidelines are yet to be circulated.