Bank Company Act to be amended to nab defaulters: minister

The government will amend the bank company act to recover the bulging default loans, said Finance Minister AHM Mustafa Kamal.

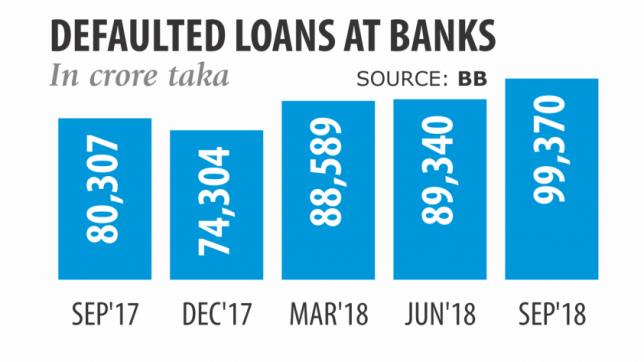

At the end of September, banks' non-performing loans almost grazed Tk 1 lakh crore -- the largest yet in Bangladesh's 48-year history -- raising criticisms that the government has failed to run the financial sector effectively in the past 10 years.

The huge amount of non-performing loans will come down if the laws are implemented properly, Kamal told reporters after a meeting with the Banking Division officials at his secretariat office yesterday.

“It could not be brought down due to weaknesses in some provisions of the laws. Amendment to the provisions will be brought soon.”

He expressed hope that the prime minister, the law ministry and the parliament will give their nods to the changes. “Our clear-cut statement is that whoever borrows money from a public or private bank has to repay on time with interest.”

At present, if a borrower becomes a defaulter he/she goes to the High Court to thwart the bank's recovery efforts.

“Everybody can go to the High Court -- that is their citizen's right.”

But Kamal will look to prevent defaulters from hiding behind court orders.

A committee will also be formed to recover the written-off loans. The working group will examine why the loans are not being realised.

“The committee will also try to identify whether government officials had any role behind the default loans not being recovered yet. We will not be harsh against anybody if we can recover the loans.”

Asked if a bank commission would be formed, as suggested by his predecessor AMA Muhith, Kamal said: “We already know the problems, so there is no need to form one at the moment.”

NO FOREIGN LOAN AGAINST COUNTRY'S INTEREST

Kamal in another programme yesterday asked officials of Economic Relations Division (ERD) to be cautious about conditions tagged with foreign loans so that those do not go against the country's interests.

He held a meeting with the ERD which is the key department in negotiating foreign credit from bilateral and multilateral development partners.

“You will have to negotiate with different development partners with a tough stance so that the interest of Bangladesh is upheld,” Kamal told the officials, according to a statement of the ERD.

It should be ensured that conditions of loan agreements are kept in favour of Bangladesh, he said.

The finance minister told the ERD to project Bangladesh's ability to repay foreign loans before the world community as it would make it easy to avail loans for infrastructure sector in the future.

He said, “Bangladesh has not delayed by even an hour the payment of an instalment of any loan till date.”

Bangladesh's external debt-GDP ratio is only 13.2 percent while the risk-free ratio is 40 percent. Bangladesh is among the few countries with the lowest debt-GDP ratio.

Kamal said when selecting projects, emphasis must be laid on availing loans for small ones which were related to uplifting quality of life, alongside infrastructure loans.