More IPOs needed

There are 61 merchant banks in the country but they were able to collectively bring in only 14 companies in the capital market last year, widening the gap between demand and supply of stocks.

This meant it took an average 4.35 merchant banks to introduce one single IPO (initial public offering) in the stockmarket.

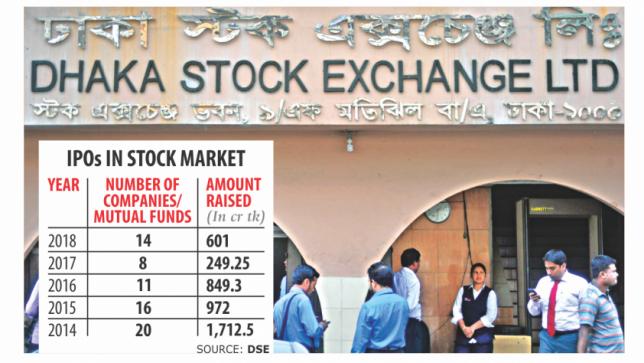

The 14 companies raised Tk 601 crore in total by offloading shares to the public and institutions, up 141 percent from that the previous year when eight companies raised Tk 249 crore.

“We are disappointed with merchant banks' work,” said a senior official of the Bangladesh Securities and Exchange Commission (BSEC).

He said the BSEC had allowed many merchant banks to operate in order to increase the supply of stocks through the IPOs of shares of different companies.

“But merchant banks are not focused on IPOs,” he said, adding that some merchant banks submit IPO documents only to fulfill conditions to retain licence.

According to the BSEC rules, a merchant bank has to submit at least one IPO proposal to the regulator every two years.

Listing of new companies, however, grew year-on-year in 2018 but the number is still lower compared to previous years because of lower-than-expected performance of merchant banks.

Merchant banks are responsible for bringing in new companies in the stockmarket, but most of them failed to introduce any firm last year.

Merchant bankers, however, blame the slow approval on the part of the regulator and comparatively small amount of fees they get in return of helping a company get listed on the market for the lower number of new companies.

“IPO procedure is very lengthy, so issue managers can't afford the operational cost of their IPO department if they fail to bring in many companies a year,” said Khairul Bashar Abu Taher Mohammed, secretary general of Bangladesh Merchant Bankers Association. “So, some issue managers are reluctant to bring in IPOs. The lengthy process, apart from many other reasons, also makes many companies reluctant to go public.”

Bashar, also the chief executive officer of MTB Capital, a leading merchant bank, said policy support was needed to attract new companies to the market. “Then the activities of merchant banks will be a lot easier.”

Saifur Rahman, spokesperson of the BSEC, says the regulator gives approvals as early as possible. “But issue managers submit incomplete documents. So, it takes time.”

Bashar admitted that it was true that issue managers sometimes submit incomplete documents and this was largely because of a dearth of skilled workforce dealing with IPOs.