Banks post hefty operating profits despite challenges

Private banks reported hefty operating profit in the just concluded year, helped by the much higher interest rate on lending than that on deposits.

The banks gave emphasis on mobilising funds by opening non-interest bearing capital and savings accounts, which cut down costs and pushed up profits, said top bankers.

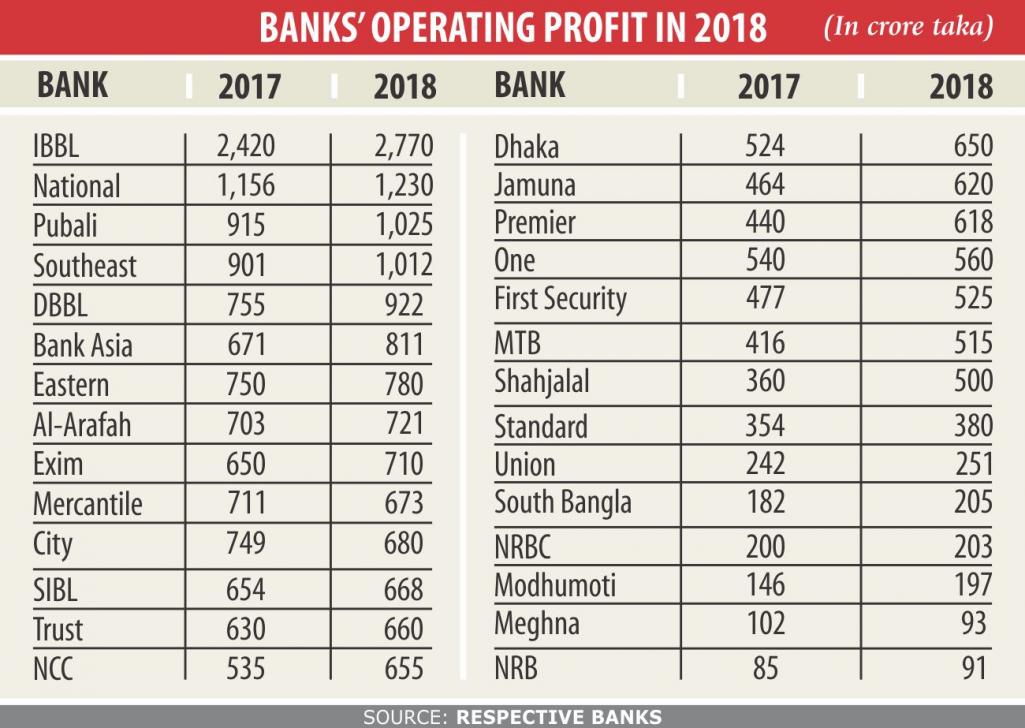

The Daily Star obtained data of 28 banks' operating profits: 25 posted growth in the range of 1.5 percent to 40 percent.

For instance, Premier Bank logged in about Tk 618 crore as operating profits for 2018, up 40 percent year-on-year.

The export sector was the main driving force behind Premier's profits, said M Reazul Karim, managing director of the bank.

“We mobilised funds by opening non-bearable account throughout last year. This led to decrease in the cost of funds and an increase in profits simultaneously,” he added.

Among the banks, Islami Bank Bangladesh registered the highest profit of Tk 2,770 crore in 2018, up 14.46 percent year-on-year.

Southeast Bank is in a buoyant mood as its operating profit touched four digits for the first time in its history: its profits stood at Tk 1,012 crore last year, up from Tk 901 crore a year earlier.

Southeast Bank had made an all-out effort to recover default loans, which helped it post a good profit, said M Kamal Hossain, its managing director.

The bank also gave a higher commission to remitters in order to encourage the expatriate Bangladeshis to send their money through it. “We enjoyed adequate US dollar stock when the money market faced a shortage, which ramped up our profits.”

The interest rate spread, which is the interest rate different between lending and deposits, remained high in the banking sector. “This has also contributed to the banks' high profits,” he added.

No bank followed the lending and deposit rates of 9 percent and 6 percent respectively in line with the instruction from the Bangladesh Association of Banks (BAB), a forum of the directors of the private banks.

The majority of the banks set higher lending rates -- going against their own policy. But, they strictly followed the 6 percent interest rate on deposits.

Soaring profits in the banking sector is not unexpected considering a private sector credit growth of 15 percent in recent months, said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh, a platform of private banks' managing directors.

But, there is no reason to feel complacent as only the net profit will give the true scenario of the banks' financial health, he said.

The figures delivered by the banks are highly provisional as the operating profit is a profit from business operations before deduction of provisioning against loans and corporate taxes. Dhaka Bank's operating profit surged 24 percent year-on-year to Tk 650 crore last year.

A good number of banks had failed to offer cash dividend to their stakeholders in 2017 because of their high volume of default loans, said Faruq Mainuddin Ahmed, managing director of Trust Bank.

Against the backdrop, the banks went to the central bank and managed a deferral support to keep provisioning against their non-performing loans in phases, he said.

The support has finally helped the banks to ensure profit last year, Ahmed said.

Mercantile Bank's operating profit, however, came down to Tk 673 crore in 2018, down from Tk 711 crore a year earlier.

Kazi Masihur Rahman, managing director of Mercantile Bank, said his bank converted a good amount of funds from its operating profits of 2017 to general reserve.

“For this reason, our operating profits were lower last year compared to the previous year,” he added.