Trade deficit narrows in Jul-Oct

Trade deficit narrowed slightly in the first four months in the current fiscal year on the back of rising export earnings against moderate import payments.

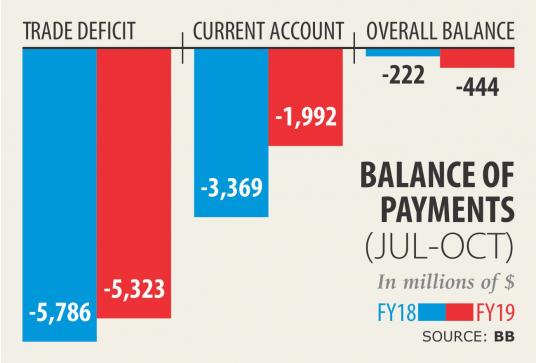

The country's trade gap fell 8 percent year-on-year to $5.32 billion between July and October, according to data from the central bank.

Experts welcomed the downward trend of the major component of the balance of payments as it would give respite to the local currency from the ongoing exchange rate pressure.

The reduced trade deficit will help the foreign exchange reserve stabilise from its current sliding trend, they said.

The experts, however, said the narrowing of the trade deficit might not be sustainable in the months to come because of several challenges prevailing in the financial sector.

Export earnings stood at $13.40 billion in July-October, up 18 percent from a year earlier. Imports rose 9.28 percent to $18.73 billion.

The export growth between October and November picked up remarkably, squeezing the trade deficit, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

“This is a positive turnaround. If the trend continues, the foreign exchange reserve will get a great relief from the ongoing pressure, mainly stemming from the high import payment,” he said.

He, however, said the national election scheduled for December 30 might have discouraged businesses to import capital machinery and other major goods.

“Businesses think that an unstable situation may be created centring the polls which will be harmful for their enterprises,” said Mansur, also a former economist of International Monetary Fund.

The ongoing labour unrest in the garment sector will hurt the export earnings from the sector, he said, adding that the authorities should address the issue properly.

AB Mirza Azizul Islam, a former finance adviser to a caretaker government, said although the deficit in the current account declined significantly, it was still beyond the expected limit.

The current account deficit should be contained further to cool down the foreign exchange rate pressure on the taka, he said.

Between July and October, the current account deficit stood at nearly $2 billion in contrast to $3.36 billion during the same period a year ago.

Yesterday, the interbank exchange rate was Tk 83.90 per US dollar, up from Tk 82.60 a year ago, according to the central bank.