Bangladesh can borrow more from abroad

The country has scope to bankroll its infrastructure projects through external borrowing as it has a very low debt to gross domestic product ratio, said International Monetary Fund recently.

“Bangladesh has a low risk of external debt distress and a low overall risk of debt distress,” the lender said in its latest debt service analysis on Bangladesh.

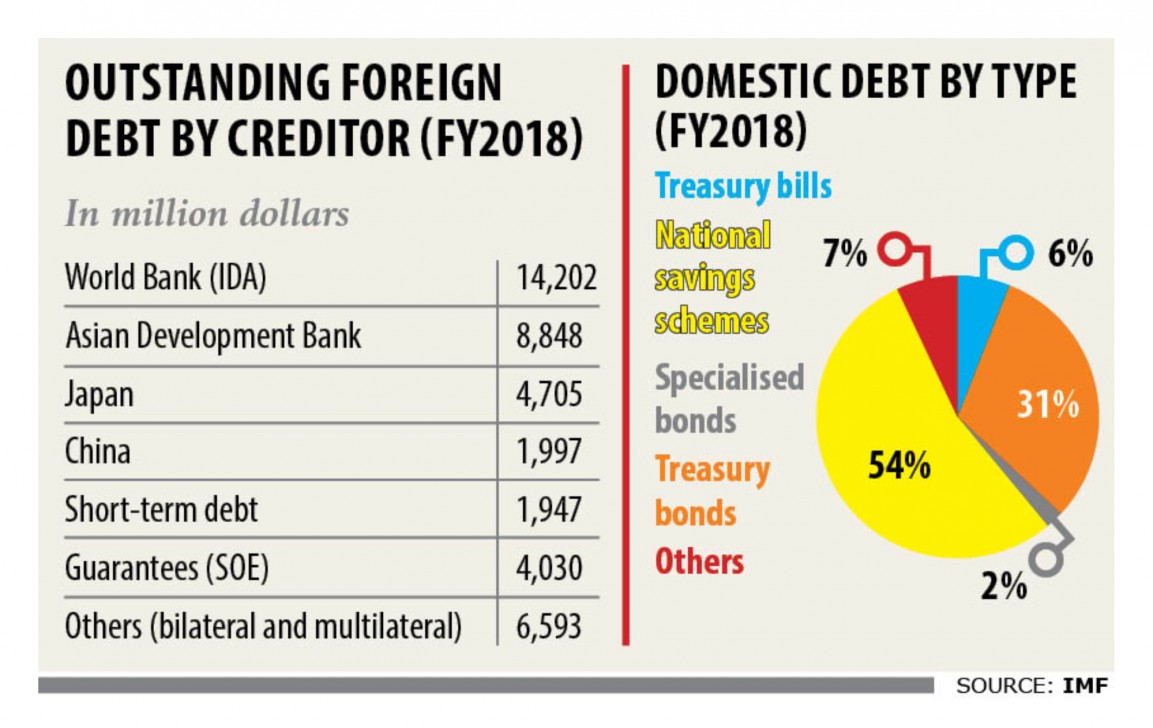

In fiscal 2017-18, public debt in Bangladesh stood at $91 billion, which is about 34 percent of the GDP.

The majority of public debt is domestic and denominated in local currency.

In fiscal 2017-18, domestic debt was 56 percent of the total public and publicly guaranteed debt (PPG) stock.

More than one half of outstanding domestic debt is composed of national savings certificates (NSCs) and around a third is treasury bonds, the lender said its latest staff report.

The IMF arrived at the assessment without the use of judgement as all external debt indicators are below their thresholds and overall public debt is below its indicative threshold.

External debt stood at $40 billion in fiscal 2017-18 and is predominantly owed to multilateral and bilateral creditors, which account for 62 percent and 23 percent respectively of the outstanding debt.

As infrastructure needs in Bangladesh remain, external debt will likely be the primary avenue to finance large infrastructure projects. Favourable debt dynamics help support the sustainability of the investment effort.

“The authorities should continue to seek concessional financing to the extent possible,” the IMF said.

External debt-to-GDP ratios are on a declining trend, moving from 15 percent of GDP in fiscal 2017-18 to about 13 percent in fiscal 2028-29.

The IMF welcomed the government’s work on revising the medium-term debt management strategy (MTDS). The last MTDS was prepared in 2014, but the recent rapid increases in NSC issuance reduced its relevance.

A new MTDS should consider the implications of possible reduction in concessional financing with the forthcoming graduation from least-developed country (LDC) status and increased need for issuance of market-based government securities as a result of ongoing NSC reforms. The most extreme shock to the external PPG debt-to-GDP ratio is the non-debt flows shock or a shock to remittances, which would increase the current account deficit.

Given the still competitive garment sector, the present value of debt-to-exports and debt service-to exports ratios are well below their thresholds, with the most extreme shock being to exports.

The debt service-to-revenue ratio is on a declining trend and below its threshold, with the most extreme shock a one-time depreciation given the currency mismatch.

“Overall, public debt indicators suggest a low overall risk of debt distress.”

The present value of the total public debt-to-GDP is well below its indicative threshold and the largest shock to the indicator is a natural disaster.

Indicators in percent of revenues are on a slightly increasing trend.

This further highlights the importance of increasing the revenue-to-GDP ratio, which is assumed to be roughly constant in the projection period.

“Increasing the revenue-to-GDP ratio will be critical in providing non-debt financing to growth-enhancing infrastructure projects.”

The government is cautious in contracting external debt and views the low risk of debt distress as an important indicator, signalling confidence in the economy, the report said.

“They are proud of being good borrowers and remain committed to doing so through servicing their debts on time.”

They recognise that infrastructure gaps remain and that large infrastructure projects are likely to be financed in part with external debt.

“They [the government] are also aware that they will face less concessional terms as they proceed toward upper middle income status. In the authorities’ view, these risks are fully contained so far.”

The Washington-based multilateral lender advised the government to bring reforms to NSCs as a large portion of the government’s borrowing is coming from savings instruments.

The NSCs stifle the development of a domestic bond market as they provide a yield of about 11 percent, whereas the government bonds of similar maturities provide a yield of 5 to 6 percent.

The cap on the amount of NSCs a person can hold has been difficult to enforce, the report said.

To bolster enforcement of the cap, the authorities have rolled out an online database to keep track of NSC purchasers and plan to use the database to help downsize the amount of new NSCs issued.

However, there are no plans to reform the interest rates of NSCs, the report said.