IMF projects 7.6pc GDP growth this fiscal year

The International Monetary Fund (IMF) has projected Bangladesh’s economic growth to be 7.6 percent this fiscal year, which is 0.6 percentage points lower than the government’s projection of 8.2 percent.

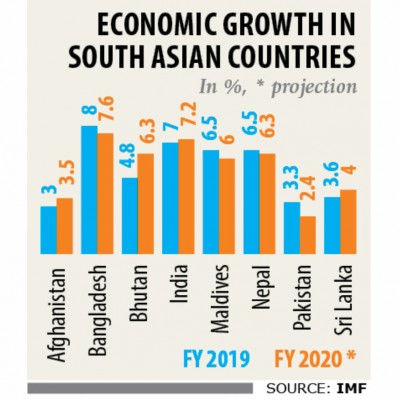

Yet, the growth rate projected for Bangladesh is the highest in the South Asia region, according to the IMF’s South Asian Update, which was released last week.

“Despite the positive near-term outlook, maintaining the past growth performance will become more challenging in future and will require further increase in investment and upgrading the policymaking practices and institutions,” the IMF said.

India will have the second highest growth in the region at 7.2 percent, followed by Bhutan and Nepal at 6.3 percent and Sri Lanka at 4 percent. Pakistan will have the lowest economic growth in the region at 2.4 percent.

IMF also upgraded Bangladesh’s growth estimate for last fiscal year. Earlier in April, the Washington-based multilateral lender had projected Bangladesh’s economic growth to be 7.3 percent in fiscal 2018-19.

But now IMF estimates Bangladesh will log in 8 percent growth in the fiscal year that ended on June 30. The Bangladesh Bureau of Statistic’s provisional estimate say the GDP growth was 8.13 percent.

Domestic revenue collection needs to increase to provide fiscal space for growth-enhancing public investment and social spending.

The launch of the new VAT law in July 2019 is welcome but further efforts will be needed to simplify the VAT rate structure, broaden the tax base by reducing tax exemptions and strengthen tax administration, IMF said.

Reflecting tight expenditure control, fiscal 2018-19’s budget deficit is expected to remain within 5 percent of GDP and the public debt-GDP ratio broadly stable, according to IMF.

Private sector credit growth has been decelerating since 2017, reflecting the Bangladesh Bank’s January 2018 decision to reduce the loan-deposit ratio to 83.5 percent, and the adverse impact of the large issuance of the National Savings Certificates (NSC) on banks’ deposits.

With the government’s bank borrowing picking up in recent months, liquidity in the banking sector has been tightening and the lending and deposit rates gradually increasing.

Non-market budget borrowing continues to increase, and the recent measures to control the issuance of the national savings certificates should support the development of a government bond market and the implementation of a sound debt management strategy.

Despite robust economic growth, default loans remain high, particularly in state-owned commercial banks.

Financial sector regulation and supervision will need to be further strengthened to improve the health of the banking sector and the role of the state-owned banks needs to be reassessed. However, providing alternative sources of long-term investment financing, improving the business environment and developing a well-functioning domestic capital market are medium-term priorities.

Regarding the Rohingya issue, the IMF said although the economic impact so far is limited, the Rohingya refugee surge could have implications for economic policies.

Thus far, there has been little progress with repatriating more than 700,000 Rohingya refugees.

While a large share of the immediate relief needs has been met with support from the international community, the support could decline over time. Thus, if the situation persists, assisting the refugees and integrating them into the local community could have a sizeable impact on the budget.