Credit growth unlikely to rise

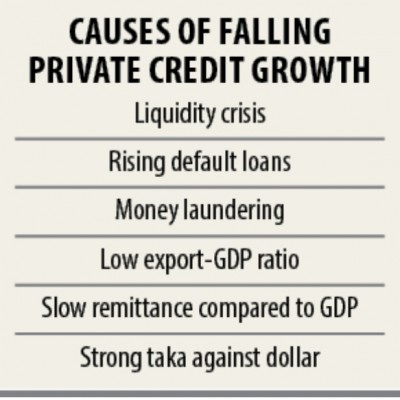

Private sector credit growth, which fell to a six-year low of 11.3 percent last fiscal year, is unlikely to rise in the coming months owing to a liquidity crisis, rising bad loans and the growing incidents of money laundering, analysts said.

Besides, businesspeople are also facing barriers to taking up investment plans or expanding existing units because of a lack of electricity supply, bureaucratic red-tape and corruption, they said.

This means both demand and supply sides are going through a crisis, bringing the private sector credit growth to 11.29 percent in 2018-19 against the target of 16.50 percent.

The lower credit growth will persist in the current fiscal year as well unless the problems are addressed, they said.

Under these circumstances, the central bank will unveil its monetary policy statement (MPS) tomorrow for the first half of the fiscal year.

It may aim to keep the private sector credit growth target at 15 percent to 15.50 percent to pull off 8.20 percent GDP growth and contain inflation at 5.5 percent.

“The situation of the private sector credit growth will not improve too much in the near future,” said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh, a platform of the managing directors of private banks.

“Some banks have adopted a cautious approach to disburse term loans because of the liquidity pressure.”

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said credit growth target is not a matter of concern.

“The central bank will not be able to achieve lower or higher credit growth if the ongoing liquidity crisis continues.”

As of April, the excess liquidity stood at Tk 66,760 crore, down 12.60 percent from December last year and 8.23 percent a year earlier, according to data from the central bank.

Deposits have dried up in the banking sector in the wake of growing default loans, money laundering and mobilisation of lower-than-expected funds from export earnings and remittances, Mansur said.

Default loans soared to Tk 110,874 crore as of March. Exports grew 10.55 percent year-on-year to $40.53 billion in the immediate past fiscal year, while remittance hit an all-time high of $16.40 billion.

But the exports and remittances have not grown much in terms of GDP in recent years, according to Mansur.

In recent years, some vested quarters have laundered money abroad, he said.

Ensuring corporate governance in banks is highly important to achieve the MPS goals as they are the main players to implement the policy, he said. Imports shrank alarmingly last fiscal year as businesspeople faced unavailability of funds from banks, he said.

“The central bank should immediately depreciate the local currency against the US dollar with a view to perking up the deposit base in banks.”

“The measure will help the country strengthen its net foreign assets (NFAs), which will give space to the central bank to pump the local currency into the market.”

Mansur also said the government borrowing from the banking system is on the rise and it will create an inflationary pressure if the volume of the NFAs does not widen.

Besides, an unnecessary import demand may escalate if the central bank supplies excess local currency than the lower volume of NFAs, he said.

“This will also create a balance of payment crisis,” said Mansur, also a former economist of International Monetary Fund.

Many banks have recently been forced to mobilise deposit at 10-10.5 percent interest rate to run operations, said M Kamal Hossain, managing director of Southeast Bank.

Banks will have to set 15-16 percent interest rate on lending to make their business viable, he said.

He said some banks think that lending can’t be the main option for profits, prompting them to give special attention on recovering default loans and making profit from commission and service charges.

Businesses are also reluctant to make investment because of the liquidity crisis, said Shafiqul Alam, managing director of Jamuna Bank.

A large number of businesspeople is going through a confidence crisis because of the haphazard situation on the country’s socioeconomic front, said AB Mirza Azizul Islam, a former adviser to a caretaker government.

Businesses face difficulties in getting power connections for new industrial units. Although there is no wide-scale political unrest in the country, the transportation system frequently witnesses setback at district level as workers or other communities block roads to fulfil their demands, he said.

“Bangladesh’s ranking in the World Bank’s Ease of Doing Business Index will have to improve in order to boost the confidence of businesspeople,” said Asif Ibrahim, founder chairman of the Business Initiative Leading Development, a private sector initiative working to improve the business climate.

“We need to ensure that the investment climate is conducive for attracting investment,” he said.