Widening revenue shortfall raises alarm

Revenue collection deficit from target widened further in November despite the pace of overall collection growth last month compared with October, according to provisional data of the National Board of Revenue (NBR).

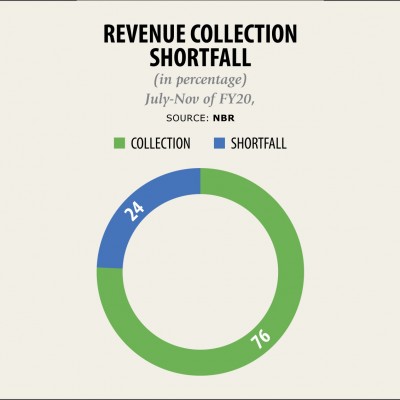

The tax collector logged nearly Tk 83,700 crore in July-November of the current fiscal year, trailing the target by Tk 27,000 crore.

Until October, the NBR was Tk 20,000 crore behind its target -- a situation that has already forced the government to depend more on bank borrowing, raising concerns of a credit crunch and slowdown in implementation of development projects.

Overall, tax receipt growth slowed by 5 percent year-on-year in July-November of fiscal 2019-20 from Tk 79,700 crore in the same period a year ago.

The NBR’s collection had grown 7 percent in July-November of 2018-19.

“Good thing is that overall collection increased last month compared with the collection in October. Both VAT and income tax receipts grew,” said a senior official of the NBR seeking to remain unnamed.

Yet, Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said the 5 percent revenue collection growth was not good enough to meet the country’s huge demand for resources and for financing the budgetary plans.

He said the trend of collection shows that the government was on track to a record fiscal deficit and its subsequent bank financing.

“The pace of implementation of projects will be slow. The overall budget deficit will increase and government’s borrowing from banks will be all time high. This will seriously affect private sector credit flow, which is already down to single digit growth,” he said.

As of November 21, the government borrowed 90 percent of its annual target of Tk 47,364 set for this fiscal year.

During July-November of fiscal 2019-20, income tax collection grew 13 percent faster year-on-year to Tk 24,800 crore.

Collection of VAT, the biggest source of revenue, soared 4 percent year-on-year to Tk 32,800 crore.

Import tariff collection remained flat at Tk 26,000 crore on suffering a fall of imports.

“Clearly this is a fallout of half-cooked implementation of VAT and SD Act. At the same time, apparently the economy is also not bringing enough dividend in terms of revenue mobilisation,” said Towfiqul Islam Khan, senior research fellow of the Centre for Policy Dialogue.

Mansur said revenue collection growth had always been below the targets in the past and it has slowed to a single digit since last fiscal year.

“This is a reflection of a rapidly slowing economy,” he said, adding, “This is also a reflection of lack of reform and badly managed reform effort for VAT.”

“The name of the VAT law has been kept unchanged. But the way the contents of the original VAT Act of 2012 has been changed due to pressures from the political and commercial interest groups…,” said Mansur.

“Furthermore, the government’s failure to implement the types of administrative reforms and automation efforts envisaged under the original implementation plan essentially implies that the new VAT law cannot deliver anytime in the near future unless things are rectified in major ways.”

Towfiq said the NBR should come up with a plan on ways to minimise the shortfall.

“Lack of revenue mobilisation is putting macroeconomic stability at risk. The government must immediately work on revision of the budget from both income and expenditure sides,” he said.

Mansur said the economic slowdown and its proper management would be the most important challenge for the new year of 2020.

“The three challenges are extremely sluggish revenue collection, particularly in the area of VAT, … long running serious problems plaguing the banking sector and reluctance of the policymakers to allow market-based exchange rate determination for Bangladesh taka to provide an immediate boost to export growth.”