What the finance minister should watch out for

The government has taken a firm decision to enforce the ceiling on lending interest rate from April 1, 2020. The 9 percent maximum lending rate will apply across the board to all types of lending except those provided through credit cards.

The finance minister also announced that government funds will be deposited at the highest interest rate of 6 percent. Although no ceiling has been mentioned for deposit interest rates for private funds, presumably these rates will also come down significantly once the ceiling on the lending rate is enforced.

The decision of the government has been hailed by the business community, while reservations have been expressed by many others, including economists and financial experts from banks and non-bank financial institutions (NBFIs). Those who are in favour of this decision expect higher private sector investment as a result of decline in the interest rate. The apprehensions, on the other hand, relate to possible decline in savings, diversion of savings from bank deposits to real estate, differential adverse impact on the profitability of the financial institutions, reduced supply of credit, and marginalisation of small and new borrowers.

IMPACT ON SAVINGS

Generally speaking, a lower real rate of deposit rate discourages savings and encourages consumption. The push towards higher consumption gets a further fillip when there is a simultaneous pull factor in the form of lower interest rate on consumption loan, as envisaged in the proposed administered interest rate regime to be effective from April 1.

Currently, Bangladesh economy is growing at a respectable rate. The main policy concern now is how to accelerate investment to achieve higher growth targets. A lack of effective demand does not appear to be holding back the economy, rather one must be cautious against possible overheating of the economy given the rising trend in the level of inflation. So, stimulating aggregate demand is not a policy priority at this stage.

The implication that follows from here is that the finance minister will be better off managing the macro-economy if he keeps consumption loan outside the lending interest rate ceiling. There is high administrative cost involved in credit card service, and loans against credit cards are also less secured. These are probably the reasons why credit card loans have been kept outside the lending interest rate ceiling. The same logic applies in the case of consumption loan too and this should be dealt with in the same manner.

IMPACT ON DEPOSITS

Once the size of intended savings is decided by a person, where it is parked depends on alternative rates of return. If the rate of interest earned against deposits in financial institutions is fixed at a low level, it will surely have a displacement effect on this type of deposits.

What are the options that a saver has in Bangladesh? Until recently, the high rate of interest in savings certificates made it the first choice of long-term savers. However, streamlining the process of savings certificates purchase has drastically reduced rampant use of this instrument. The deplorable state of the capital market is also a big disincentive for savers to shift safe savings in financial institutions to risky investment in the capital market.

The next best option for the savers is to invest in real estate. Recent government policies allowing subsidised home loans for government officers and public university teachers, and lowering of registration fees for real estate property have already contributed towards enhancing demand in this sector. If there is a reinforcement of the process through lowering the rate of interest for home loans, the low deposit rate will push savings out of financial institutions and real estate prices are likely to experience sharp rise.

Once again, for the sake of macroeconomic stability the finance minister will be better advised to keep home loans outside of the lending interest rate ceiling at least initially.

DIFFERENTIAL IMPACT ON FINANCIAL INSTITUTIONS

The displacement of deposits due to low interest rate from the financial institutions is unlikely to take place in an even manner. The worst affected, in this case, is likely to be the non-bank financial institutions (NBFIs). The NBFIs’ basic modus operandi is to attract deposits offering higher interest rates than the banks and then lending these to niche markets at higher interest rate. If NBFIs are required to apply the same lending rate as the banks, it will be a recipe for their downsising, as they will be unable to attract deposits at the corresponding low deposit rate.

The same logic applies when it comes to competition between public and private banks for deposits. The finance minister seems to be aware of this and he mentioned that for government deposits the private banks will be allowed to offer slightly higher interest rates. But government deposits account for only a small proportion of the total deposits in the banking sector and so the case for differentiated deposit rate is even stronger in the case private deposits in private banks. The finance minister mentioned that 50 percent of government deposits will be allocated among the private banks in proportion to the size of their paid-up capital. Given that private banks have highly varying CAMEL ratings, it is not clear how the allocation scheme will reconcile unwillingness of public institutions to keep their deposits in private banks with poor CAMEL ratings. Clearly, working out a fair and acceptable allocation scheme for government deposits among highly differentiated private banks is going to be an administrative nightmare. Moreover, if private banks are allowed to offer higher deposit rates for government funds, why would there be a need for allocating this fund? Instead of such centrally managed allocation scheme, allowing private banks and NBFIs to offer higher deposit rates within a range for all deposits may be the short-term workable solution to the problem. But, if differentiated deposit rates are allowed, differentiated lending rates will become a logical corollary. In that case, what we shall end up with is interest rate ceiling with a band.

Impact on credit growth to the private sector

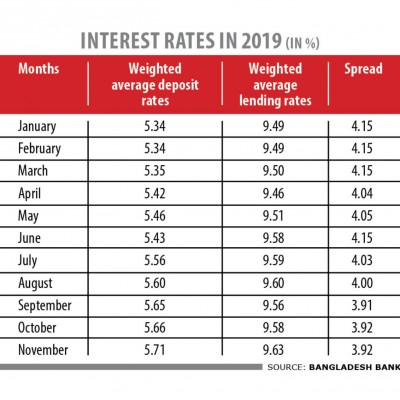

For the last two years, growth of credit to the private sector has been showing a monotonically downward trend. The announcement of lower deposit rate of interest tended to divert deposits from private to public banks creating a serious liquidity crunch for the private banks and further restricting their ability to lend, and most private banks stopped short of implementing the single digit interest rate although the public banks more or less complied. However, the liquidity situation has since improved due to lowering of CRR, streamlining of savings certificates purchase process, and relaxation of compliance requirement regarding AD ratio (again back to 85). But still the downward trend in credit growth persisted for the private banks.

The single digit interest rate implemented by the public banks allured away many borrowers from private to public banks. Second, in anticipation of future imposition of 9 percent lending rate ceiling, private banks shifted to a more cautious lending policy. This trend is continuing and after April 1 banks are likely to become much more selective in granting credit to the private sector, which may affect credit growth.

As basic economics teaches us, when price ceiling is set below the market clearing price, supply shrinks and excess demand shows up. In the face of this excess demand, supply needs to be rationed among potential takers using some criteria. In the context of Bangladesh’s financial market, the most likely scenario is one where SME and retail lending involving relatively higher administrative and supervisory cost are unfavourably placed in this selection process. As such SMEs, particularly the new borrowers, will tend to receive relatively lower amount of credit.

Clearly, some rescue plans for this weaker segment of the borrowers in the credit market in this administered lending rate regime will have to be devised by the Bangladesh Bank.

Thus, it appears that the finance minister needs to be careful while implementing the capping of interest rate with the aim of boosting private sector credit and overall investment scenario of the country without hampering the macroeconomic stability.

The author is senior research fellow of the Bangladesh Institute of Development Studies.