Variety taskforce to monitor delivery of stimulus packages

A multi-stakeholder taskforce ought to be formed to monitor the delivery of the Tk 101,117 crore stimulus packages to avoid misuse and leakage, a think-tank and a specialist said yesterday.

The taskforce must have representatives from the ministries, the central bank, commercial banks, trade bodies, civil society, non-government organisations and academia, the Center for Plan Dialogue (CPD) said.

The thought of the think-tank was backed by Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

"A monitoring committee should be place up to check out who is getting how much. It should be ensured that excessive loans are not directed at anybody or any group which will undermine the recovery effort," Mansur said.

Bangladesh Bank has separate teams to monitor the implementation of the stimulus packages, said Lila Rashid, an over-all manager of the central bank.

They spoke at a virtual dialogue on "Giving an answer to COVID-19: A Rapid Assessment of Stimulus Packages and Relief Measures" organised by the CPD.

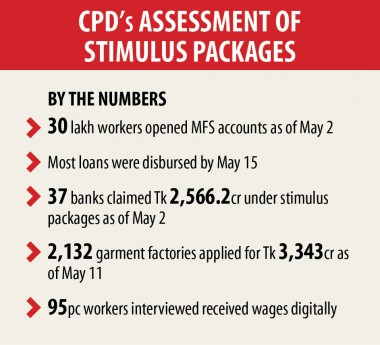

The CPD completed a rapid assessment of various government initiatives that contain been announced to stimulate the economical activities and offer relief for the marginalised parts of the society.

In a paper, it said insufficient fiscal space has compelled the federal government to provide mostly liquidity support rather than fiscal stimulus to mitigate the adverse impacts of Covid-19.

In general, the type and design of the liquidity support plans have three key characteristics.

Firstly the best amount of liquidity support is offered to minimal vulnerable and second of all the most stringent requirements and regulations are applicable to the virtually all vulnerable.

The 3rd is that several loopholes have been left wide open to supply ample room for unscrupulous individuals and businesses to exploit humanitarian aid for private gain.

The banking sector features been tasked with the tremendous responsibility of supporting businesses and people during the pandemic because they would channel a lot more than Tk 82,000 crore of the stimulus packages, said Fahmida Khatun, executive director of the CPD, during a presentation.

The truth is that the banking sector of Bangladesh is unprepared to provide the Covid-19 related liquidity support packages. Almost all of the main problems in the banking sector continue steadily to persist through the pandemic and are apprehended to obtain additional acute, the CPD explained.

"Urgent steps are had a need to rescue the banking sector from the quicksand of poor governance, because if it sinks underground it'll most likely have the complete economy along with it," the think-tank said.

The CPD said the core objectives of the stimulus packages would hardly be achieved through the Tk 5,000 crore emergency support for the export-oriented industries.

The impact when it comes to stimulating financial revitalisation of the RMG sector is rather limited. Raising private consumption through personnel' wages could not be ensured because of irregularities in wage repayment while regardless of the credit support, staff' employment cannot be ensured.

Rather, there happen to be incidences of unemployment found in the RMG sector, the think-tank said.

"Found in this backdrop, the government must rethink about the stimulus package so as to ensure its effectiveness."

The CPD said the stimulus package for SMEs is a crucial monetary policy instrument. Even so, the instruments in its current web form will hardly obtain the objectives.

The government must think about additional measures to make sure that SMEs are actually in a position to draw benefits from the stimulus package, it said.

Given the existing allocation, coordination, monitoring and infrastructural management of the existing social back-up programmes, this would be arduous to attain the maximum number of beneficiaries amid this crisis.

Besides, the social safety system of the country suffers from the condition of targeting, leakages and beneficiary collection which came in the fore at this critical moment.

Because of these ongoing flaws in today's system like the distribution mechanisms and corruption on the listing method and its own delivery system, more attention in the coming times will be needed from the authorities and policymakers, the think-tank said.

In this context, attention will be required to focus on preparing a central database of the beneficiaries for all back-up programmes and boosting and enforcing the coordination and collaboration both equally at the neighborhood and central level.

Enormous demand for loans within a time will make it difficult to exercise homework and undertake the inspection of borrowers to examine repayment capacity.

This could wrap up with disbursement of adequate loans to possible future defaulters, said Khondaker Golam Moazzem, research director of the CPD, throughout a presentation.

About 3.3 per cent of the personnel surveyed reported that they had been let go from their factories, the CPD findings showed.

Unless the business enterprise situation improves, incidences of both laying off and retrenchment of personnel will increase additional in the arriving months, the CPD stated.

"In other words, fiscal stimulus didn't help stop laying from factory workers. Without any improvement in the business situation, workers will be retrenched in the arriving months."

The government must rethink about the stimulus package in order to ensure its effectiveness in achieving the explained objectives, it said.

More than 80 % of the stimulus plans will be channeled through the bank operating system, said Syed Mahbubur Rahman, managing director of Mutual Trust Lender.

Banks have been around in a vulnerable problem going back few years and so are lagging behind when it comes to international standards. Aside from a few banking institutions, all loan providers are in a hard situation, he said.

The implementation of the stimulus packages exposed the banking sector to vulnerability in ways, he said.

There are 14 to 15 % NPL in SMEs, hence banks are apprehensive somewhat to lend to the entrepreneurs in the segment, Rahman said.

"The stimulus packages have helped the garment sector keep wide open the factories within the last 8 weeks," said Md Fazlul Hoque, managing director of Plummy Fashions.

He's hopeful that the sector would go back to the pre-coronavirus level within the next five to half a year. Even there may be the opportunity that Bangladesh's garment sector can perform better than before as orders could possibly be shifted from China.

The important challenge facing the garment sector is always to survive within the next half a year, said the entrepreneur. "If the factories are up and running, no shuttered factories would receive orders regardless if there can be any opportunity. We remain getting 30 to 40 per cent of the orders because the factories are open."

BB's Lila Rashid said the industries ministry has a monitoring workforce comprising federal government and private representatives that is doing work for the last 8 weeks on the stimulus plans earmarked for the SMEs.

A good decision has been taken up to create district level committees beneath the national committee and the district-level committees would be associated with the central bank, she said.

"We have also started working to think of a credit rating guarantee scheme. The procedure began this past year and it was thought that it could run on a restricted scale. We are considering to provide full-fledged support to the SME sector."