Trade in secondary bond market hits an all-time high

The secondary bond marketplace in Bangladesh has boomed lately on the back of lower interest rates on bank deposits and a couple of procedures taken by the central bank.

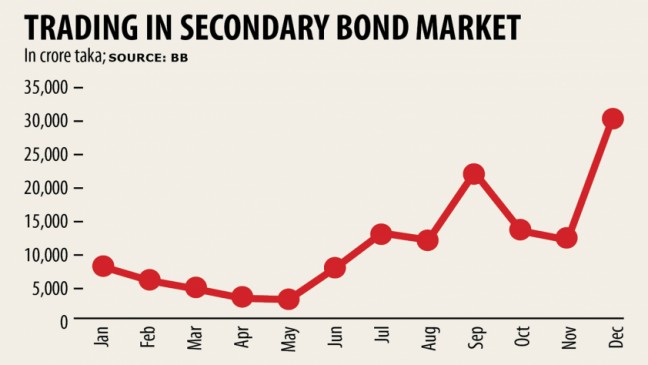

Trading in the secondary relationship market hit an all-time saturated in December as purchase rose 157 % year-on-year to Tk 29,188 crore, info from the central lender showed.

Since July, the trading of government securities has received a go in the arm as investors are receiving lower interest on deposits kept at banks than the Treasury bonds (T-bonds).

Banks now face surplus liquidity found in the wake of lower credit demand from both the private sector and the federal government, forcing them to slice the interest levels on the fixed deposit receipts.

Excess liquidity in the banking sector surged 95 % year-on-year to Tk 204,700 crore found in December.

Besides, the methods, including selecting benchmark Treasury bonds by the central bank, have made the secondary market vibrant. The benchmark bonds support loan providers fix the interest of securities.

What's the secondary bond industry?

T-bonds will be the securities issued by the government which may have maturities spanning from 2 yrs to twenty years. Bondholders earn fascination semiannually until maturity.

The government issues the securities to mobilise funds to control its deficit financing. The bonds are sold through auctions on a monthly basis at the central lender headquarters, and banking institutions are the key clients.

But, the secondary relationship market is the industry where investors can purchase and sell bonds.

The proceeds from the sale of bonds in the secondary market visit the counterparty, which could come to be an investor or a seller. In contrast, in the principal market, funds from investors goes directly to the issuer.

How come the secondary bond industry booming?

In November this past year, the central bank decided on 30 types of securities as the benchmark bonds to allow lenders to create the interest of the 269 bonds that contain been issued by the government and are now available in the market.

The central bank also asked the principal supplier banks to declare the two-way price quote (selling and buying) for all bonds. The PD banks have to announce the costs at the central bank's marketplace infrastructure module, which is certainly associated with a virtual trading program, Government Securities Order Matching (GSOM).

Individuals and corporate entities may monitor the price development through the GSOM before buying and selling securities.

The surplus liquidity in the banking sector is another reason for the higher trading in the secondary industry.

Arif Khan, managing director of IDLC Finance, said various banks and non-bank finance institutions were now embracing the secondary industry to get surplus funds.

The lower require for loans has encouraged loan providers to purchase the secondary market. Loan providers have considered the window to generate a income in the wake of business slowdown deriving from the coronavirus pandemic, he said.

Corporate entities now prefer government securities as the interest on the subject of the FDRs has nosedived as a result of lower credit demand. They also see the bond marketplace as the safest expenditure destination as the monetary health of several banks has deteriorated as a result of the business slowdown.

Banking institutions with higher credit history give you a maximum of 3-4 per cent interest rate on FDRs, whereas investors at this time earn 3 to 6 per cent in curiosity from the T-bonds, whose maturity ranges from two to 10 years.

Besides, the government has capped the investment in cost savings certificates, which provide fascination which range from 11.04 per cent to 11.76 %.

A good person cannot invest more than Tk 50 lakh in the savings instruments. Under joint titles, the expense limit is Tk 1 crore, a cap that discourages rich persons from putting in too much money in the high-interest-bearing cost savings instruments.

There is absolutely no such investment ceiling in the T-bonds, encouraging individuals and corporate entities to pour money in the tools.

The ongoing vibrancy in the secondary market might not exactly sustain when the economy makes a turnaround from the slowdown, Khan said.

Mirza Elias Uddin Ahmed, managing director of Jamuna Lender, said it had been very encouraging that trading found in the secondary bond market had got momentum, which would give a breathing space to the federal government to control its budget.

PD banking institutions have to acquire T-bills and bonds. Hence, they usually deal with liquidity shortage when borrowing by the individual sector and the government rises, Ahmed said.

But a captivating secondary bond market will resolve the challenge as the investors of the secondary industry provide you with the required fund to the federal government.

Lately, the interest on government securities has declined because of increased trading in the secondary marketplace, Ahmed said.

"This provides helped the federal government to cut its price to mobilise funds."