Trade deficit narrows in falling imports

The trade deficit shrank heavily in the first half of the ongoing fiscal year due to dwindling imports amid the financial slowdown, in a sign of depressed require and consumption.

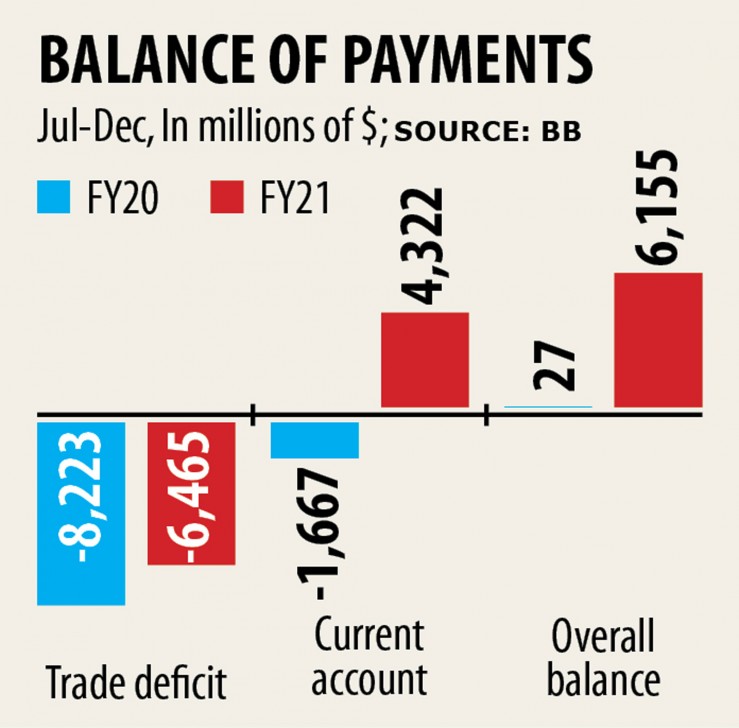

Between July and December, the trade deficit, which occurs when imports outweigh exports, stood at $6.46 billion, down 21.37 % year-on-year, data from the central bank showed.

Through the period, imports declined 6.8 % from a year earlier to $25.22 billion, eclipsing a 0.44 % fall in exports to $18.76 billion.

"Although a declining trade deficit is apparently good for an economy, such a trend will put an adverse impact on the GDP growth," said Mustafizur Rahman, a good distinguished fellow of the Center for Policy Dialogue.

The economic meltdown due to the coronavirus pandemic has adversely damaged the domestic demand, bringing down import payments.

The dropping import of capital machinery and professional raw materials indicated that purchase in the individual sector is feeble.

Capital machinery import stood at $ 1.5 billion in the first half of 2020-21, down 29.17 % from a year ago. This implies businesses are reluctant to set up new plant life or expand their existing types.

Import of intermediate things, including industrial raw materials, dipped 8.8 % to $15.33 billion, in a sign of lower production compared to the pre-pandemic period.

The consistent lower import growth as well highlighted the issue the exporters in the united states are facing as a result of the crisis. In Bangladesh, exporters are usually among the major importers as they produce products for external markets.

The decline in imports has already established an adverse impact on the private sector credit growth, which stood at 8.37 per cent in December against the central bank target of 11.5 %.

"The increase in private expenditure will be key to more rapidly growth and the rebound of the market. Proper implementation of the stimulus plans is also essential," Rahman said.

Current account balance, among the major indicators of the total amount of payments (BoP), stood in $4.32 billion in the July-December period in contrast to a deficit of $1.66 billion a year ago.

The current account includes all of the transactions (apart from those in financial items) that involve monetary values and occur between resident and non-resident entities.

The lower imports and a rise in remittances possess widened the current account.

Between July and December, expatriate Bangladeshis delivered home remittances really worth $12.94 billion, up 37.60 % year-on-year.

The large balance in the current account has contributed to the ballooning of the foreign exchange reserve, which stood at $43.17 billion towards the end of December.

But the current balance will be meaningless if the market does not try to make a turnaround, according to industry experts.

The entire balance was $6.15 billion in the first half a year of the fiscal year in comparison to $27 million a year earlier.

The stronger current balance and the loans from multilateral lenders helped raise the overall balance of the BoP.