Trade deficit narrows on falling imports

Trade deficit narrowed slightly in the first two months of the fiscal year, helped by a decrease in both imports and exports in a sign that the country’s overall business is facing sluggishness.

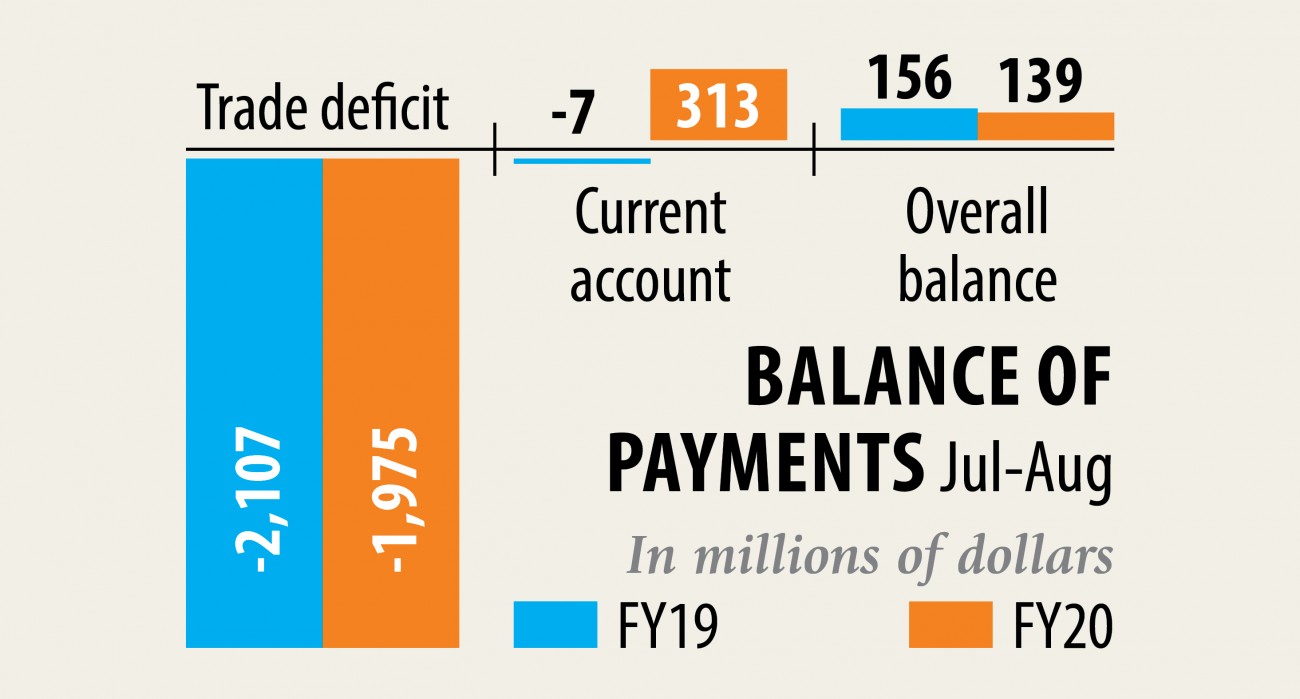

Between July and August, trade deficit, a situation when imports exceed exports, stood at $1.97 billion, down 6.24 percent year-on-year, according to data from the central bank. Imports stood at $8.62 billion, down 2.30 percent year-on-year and merchandise exports slipped 1.06 percent to $6.64 billion.

The decreasing trend of import and export is not a good indication for any economy, but Bangladesh is facing such a bad state of affairs, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

“The economy has been facing the sluggishness for the last few years. But imports went up last year as a section of people laundered money before the national elections in December,” he said.

The falling trend of export and import has depicted the actual image of the country’s macroeconomic situation, said Mansur, also the chairman of Brac Bank.

The import growth would have declined more if the import payments for petroleum products had not increased significantly.

Imports of crude petroleum rose 137 percent year-on-year to $151 million. But the import of capital machinery fell 24.42 percent year-on-year to $760 million.

All segments of the financial sector have been facing hurdles, eroding the confidence of businesspeople, said Mansur.

Fresh investment will not pick up if the government fails to restore the confidence of businesses. Against the backdrop, a quarter will try to launder money instead of making investment, he said.

“The government should give all-out efforts to perk up the economy, create fresh jobs and improve the living standard of people.”

The export earnings from the garment sector have declined in July and August, raising an alarm, said Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD). The policymakers should explore new destinations to give a boost to the RMG export, she said.

She said the country’s external sector is going through volatility. So, the government should take prompt action to ward it off.

The economist said the peers of Bangladesh have devalued their currencies against the US dollar and the central bank should consider the issue to rein the instability deriving from the external sector.

The current account balance enjoyed a surplus of $313 million during the July-August period, up from a deficit of $7 million a year ago, BB data showed.

An increased flow of remittance has played a major role in registering the robust current account, said a Bangladesh Bank official, adding that the feeble import payments has also helped to this effect.