Towards a more conducive tax program: reform strategies and priorities

The Covid-19 pandemic has laid bare around the globe the necessity to strengthen domestic income mobilisation systems of countries, particularly in producing nations. Given the crucial of harnessing assets to combat the extremely deleterious ramifications of the pandemic on countrywide economies, the revenue system in a region like Bangladesh, whose swift improvement towards attaining developed region position has received an unexpected shock, does come in for some examination.

Major economic shocks are affecting global markets, culminating in lower or perhaps negative growth, higher unemployment, surge in poverty, and severe fiscal pressure for countries around the world. The International Monetary Fund (IMF) projects the global market will contract by 4.4 % in 2020 while emerging and growing Asia will grow at around negative 1.7 %.

Bangladesh too, having displayed a robust average growth of more than 7 per cent during the last decade, might witness a lower expansion. There is, of lessons, a rebound since June with positive tendencies in exports, remittances, and large parts of the domestic market but several challenges continue steadily to persist, including uncertainties in middle-east job market segments, displacement of tiny enterprises, and lack of livelihoods or drop in income for millions.

While the current scenario is encouraging, the loss of the past almost a year will not be simple to recoup. For the export and abroad workers sectors, the condition of the many customer and sponsor countries will be important determinants within their performance going forward.

In the immediate aftermath of the Covid-19, the federal government of Bangladesh was quick and bold in announcing a massive $11 billion financial stimulus programme, equivalent to more than 3 % of the country's GDP; as well as direct fund transfers and meals help to the neediest.

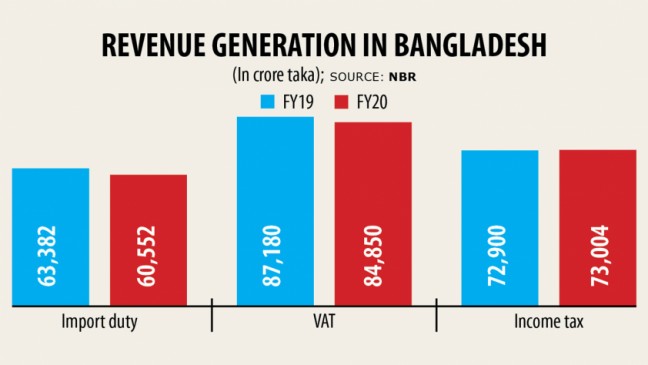

A lot more than three-fourths of the total stimulus comes from bank credits, however the fiscal expense is significant - around 1 % of GDP. It really is unarguable that although through earlier prudent fiscal administration, the government has created significant headroom to manoeuvre possibly in these troubled waters, earnings technology will be strained.

Managing the health and financial crisis and necessary prudent measures to protected medium-term recovery require significant fiscal means. Allocation of bigger resources in the health sector, absorbing fascination losses or subsidies in the banking sector, delivering direct assistance to the indegent, forbearance in tax and various other regulatory compliance, tailored insurance policy and financing support will place a significant fiscal burden of the condition.

Bangladesh's unprepossessing tax-GDP ratio, which hovers around the 10 % and below the tag, is not a wholesome sign for the quantity of revenue would have to be generated to keep the financial scenario as stable due to in the last several years. The fundamental dialogue needs to start now about how effectively to work at increasing this ratio while lowering the financial and regulatory burden of compliance on great taxpayers.

Securing these information in a fiscally sustainable approach, and how to take care of them wisely are fundamental policy questions for the federal government to address. Notably, the necessity to strengthen the state's potential to accumulate tax revenue to make sure a sustainable debt-GDP location while funding essential open public services such as health and social protection will demand careful but immediate effective consideration accompanied by prompt action.

This may seem like an inauspicious time to contemplate significant reforms; however, in addition to probably focusing the thoughts of policy-makers, large shocks may also provide prospects to positively address political and bureaucratic resistance to significant change, consequently opening new reform options.

In addition to giving an answer to the crises to mitigate its effect on the people of Bangladesh, this may be an opportunity to re-engineer processes to eliminate the discretionary application of regulations and rules, in addition to making them a lot more technology-drive, which will create a large measure of transparency and accountability.

One critical rationale for Bangladesh policy-makers at this moment that warrants an instant and effective tax reform program is to help make the country's organization environment considerably more conducive and supportive of the country's 'Developed Nation' eyesight. The regulatory and institutional environment features many weaknesses which happen to be reflected in global indicators and indices. Significantly, both domestic and overseas shareholders rank the taxation system and administration as one of the significant roadblocks towards increasing non-public investment in Bangladesh.