Tk 2,000 for filing in returns online next fiscal year

The government will probably offer Tk 2,000 to individual taxpayers next fiscal year to lure them to file returns online, since it looks to accelerate the shift from the manual filing of twelve-monthly tax statement, according to finance ministry officials.

Bangladesh aims to become digital economy by 2021 and over the past decade, it has made strides in many areas. Yet, its advancement in digitisation in the financial sector and tax administration is lagging.

Regarding revenue administration, nearly all customs documents can be processed online, as the businesses can submit VAT returns online. However, taxpayers are yet to deposit VAT to convey coffer electronically.

For income tax, among the successful ventures of the tax department has been the issuance of Taxpayers Identification Numbers (TINs) online.

And in September 2011, the federal government launched a project with a $25 million loan from the Asian Development Bank to ensure online filing of tax returns, digitise land records management system in selected districts, and improve the usage of tax and land information in specialised information and service centres.

As part of the project, the tax administration in November 2016 introduced e-filing.

However the response from taxpayers has been abysmal.

The Manila-based multilateral lender said 44,000 taxpayers submitted online taxation statements in 2017, which is approximately 3 % of the total taxation statements filed in fiscal 2016-17, showed the NBR data.

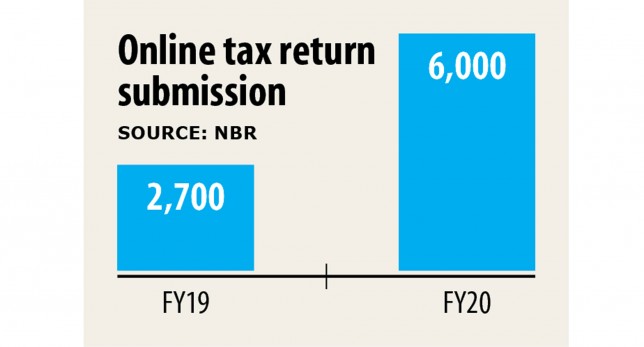

But e-filing of returns dropped off in the next years. For example, the tax authority received just 2,700 returns online in fiscal 2018-19.

This fiscal year, the number of online filers were about 6,000, which is significantly less than 1 per cent of the returns submitted.

The cumbersome procedure for e-filing of taxation statements has been blamed for the dismal response up to now. To file returns online, taxpayers have to physically collect user ID and password from the field offices.

However the finance ministry officials are hoping that the rebate might convince individual taxpayers to take the trouble of making that visit to the field office to accumulate the log-in credentials.

The move to inspire e-filing comes at a time when it's believed that digitalisation of the tax administration offers significant prospect of developing countries to improve their revenues.

"Evidence from even the lowest capacity countries (e.g. Liberia) suggests investments in digital capability in tax administration can be a game-changer," said the Organisation for Economic Cooperation and Development in a report styled 'Tax and Fiscal Policy in Response to the Coronavirus Crisis'.

Besides, the pandemic, which has left people to remain put at home for weeks at a time to flatten the curve on coronavirus, has magnified the necessity for digitisation of the tax system, as the countrywide general shutdown since March 26 meant many cannot file in tax paperwork promptly.

Were a digitalised system in place, taxpayers might have had the opportunity to accomplish the heed from their homes.