There is a nervous tension at HeidelbergCement headquarters

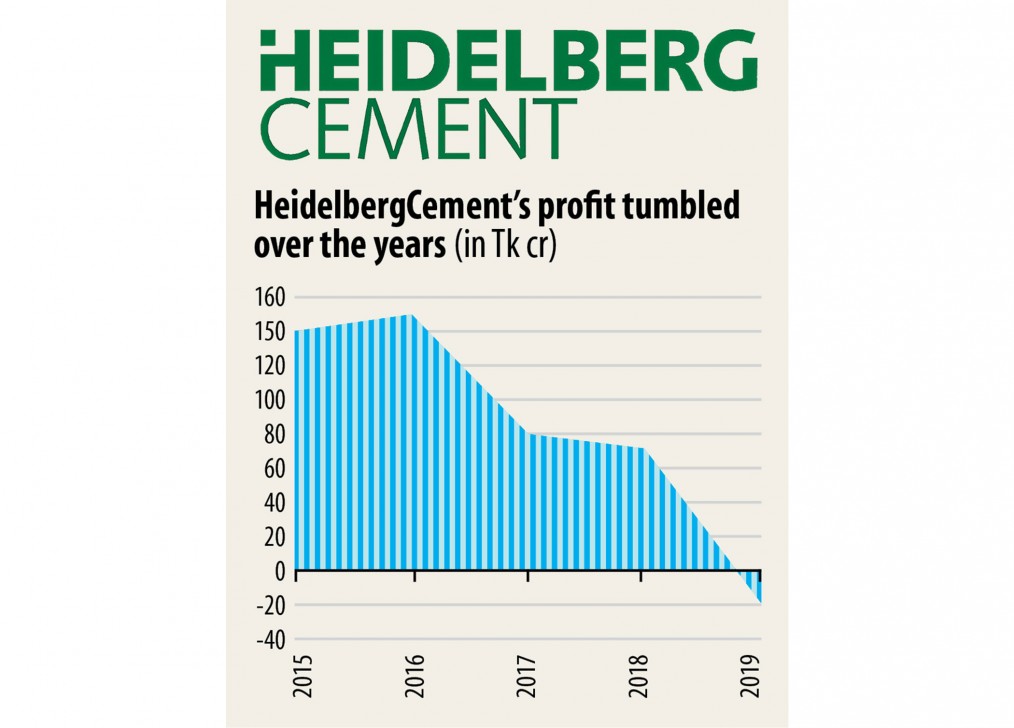

HeidelbergCement Bangladesh, the German cement maker, has been incurring losses because the second quarter of 2019 due to fierce competition available in the market, higher prices of clinker, the imposition of advance tax and higher interest cost.

The situation was aggravated further amid a plunge in sales as a result of two-and-a-half-month-long countrywide general shutdown starting from 26 March to flatten the spread on coronavirus. The shutdown screeched construction works to a halt across the country.

The listed cement manufacturer incurred a lack of Tk 14.4 crore in the first half of the year, as opposed to a profit of Tk 15.2 crore a year earlier.

However, the cement maker that markets two brands namely Scan and Ruby made a profit in the first quarter of 2020.

The company's profits and sales declined because of the purchase price hike of recycleables in the international market, low income and the imposition of minimum tax on import of raw materials, according to its Chairman Kevin Gerard Gluskie. The federal government imposed a 5 % advance tax on the import value of recycleables in fiscal 2019-20.

"Furthermore, the prevailing market competition forced us to adapt our prices significantly," Gluskie said in the company's annual report.

Though the advance income tax has been reduced to 3 % at the start of 2020, many cement producers blame their losses on the tax.

Earnings per share of MI Cement, another local listed cement manufacturer, was Tk 1.6 in the negative between July 2019 and March 2020, that was Tk 1.1 in the same period a year earlier.

Consolidated EPS of HeidelbergCement was Tk 2.5 in the negative in the January-June period. A year earlier, it had been Tk 2.7.

As HeidelbergCement Bangladesh, that was listed in 1989, didn't provide any dividend to its shareholders last year due to losses, the business was downgraded to Z category shares in the Dhaka and Chattogram stock exchanges. Along using its depressing performance, the business's stock prices plunged 58 % to Tk 150 within the last two years.

HeidelbergCement, which operates in a lot more than 50 countries, is facing the same problem that other multinational businesses face in Bangladesh: unfair competition, said an official of the company asking not to be named to speak candidly on the matter.

"Like local companies we can not adopt unfair methods to win government projects. Local firms, oftentimes, evade tax and VAT but we have to comply fully with regulations and can't compromise on quality," he said, adding that Bangladesh's corruption culture isn't well suited for many multinational companies.

HeidelbergCement's sales dropped 38 per cent to Tk 176.6 crore in the next quarter of the entire year.

Another top official of the cement maker said it had to borrow plenty of money to get Emirates Cement and Emirates Power however the company's sales didn't rise compared to that extent.

"So, it really is struggling to make profits," he said.

HeidelbergCement acquired 100 % ownership of the companies from UltraTech Cement Middle East Investments Ltd, a UAE-based company, in December 2019 at a price of Tk 182.5 crore.

Emirates Cement Bangladesh made sales of Tk 35.9 crore in the first half of the entire year.

HeidelbergCement Bangladesh's net interest cost was Tk 9 crore in the first half a year of the year while its interest income was Tk 4 crore a year earlier.

"The complete cement industry is not in a good condition because of higher production capacity than demand," the official added.

Bangladesh can produce a lot more than 60 million tonnes of cement a year against the demand for approximately 35 million tonnes, according to industry insiders.

The cement producers were raising their production capacity seeing the burgeoning financial growth of the united states, the state said, adding that whenever the GDP of a country accelerates, cement companies see huge potential.

The twelve-monthly per capita cement consumption in Bangladesh is continuing to grow from 45 kilograms to 200 kilograms within the last two decades, as the country's gross domestic product growth stayed around 7 per cent in the last couple of years.