Submarine Cable overstated performance in financial statements: audit

Bangladesh Submarine Cable Company Ltd (BSCCL) has overstated its earnings per share (EPS) and net asset value (NAV) without issuing stocks against the share money deposit of Tk 166 crore, according to an audit report.

A share money deposit may be the money paid in exchange for shares which have not been acquired yet.

The state-run BSCCL was audited by SF Ahmed & Co, which gave its qualified view in the report for the year that ended on June 30, 2020.

A qualified thoughts and opinions is given after the auditor finds that the data presented in the financial record is not complying with the standard accounting norms.

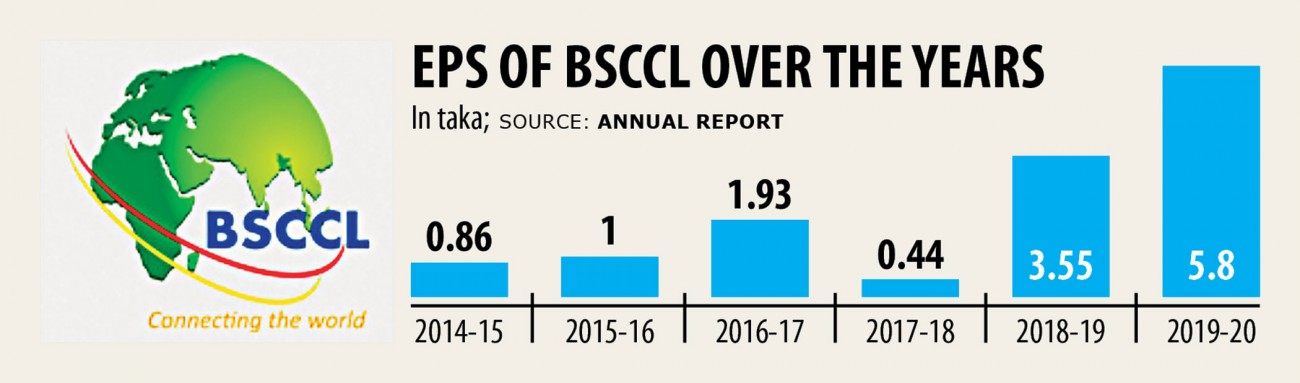

The BSCCL showed EPS of

Tk 5.80 and NAV of Tk 40.93 for the entire year and on the basis of those earnings, it announced 20 % cash dividend for investors.

"Since the company already took the amount of money from the government, the situation ought to be eventually resolved," said Ali Ahmed, a stock investor.

The business's management should use the authorities concerned to solve the issue in a way that may not heavily impact its earnings per share, he added.

If the BSCCL issues shares at face value then the number of stocks would increase greatly, reducing its EPS and dividends because of this, a merchant banker said.

The price could be set by taking into consideration the average share price for the last half a year, he added.

Between fiscal 2015-16 and 2016-17, the BSCCL received a complete of Tk 166 crore from the federal government in six different phases.

The fund was designed for implementing the regional submarine telecom project, under that your country's second submarine cable system would be established.

The amount of money was taken as equity with the condition that the said amount will be changed into equity capital in favour of the posts and telecom ministry by issuing shares.

On February 11, the Financial Reporting Council issued a notification regarding accounting and reporting on share money deposits.

According to the notification, any amount received from an investor as share capital or any other facility regarded as equity in financial statements shall be changed into share capital within half a year.

Furthermore, before day the share money deposit is changed into share capital, the amount will be looked at as potential shares.

As of June 30, 2020, the BSCCL was yet to convert the Tk 166 crore equity fund into share capital. Besides, it was not regarded as potential shares in order to calculate the NAV per share and EPS.

Because of this, as on reporting date both the NAV per share and EPS of the company were overstated, the auditor said.

As the potential share is not identified by the business's management, the worthiness overstated on net asset value per share and earnings per share cannot be quantified, it added.

The BSCCL's stocks closed at Tk 135.20 yesterday.

The BSCCL appointed ICB Capital Management on July 22 this season as issue manager, regarding the issuance of shares against equity money from the government, the auditor said.

SF Ahmed & Co. reviewed the appointment of valuer for a revaluation of the assets and liabilities of BSCCL.