Stock turnover falls on liquidity crisis

The stock market ended the week in the negative territory amid fears of a liquidity crisis in the banking sector, analysts said yesterday.

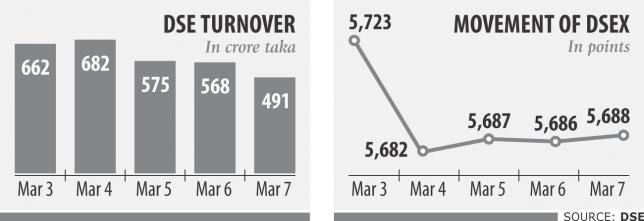

Turnover, one of the important indicators, fell 25.77 percent to an average of Tk 491.57 crore a day last week. Moreover, turnover went below the Tk 500 crore level after two and a half months.

The turnover was more than double, Tk 1,024.61 crore, as recorded on January 30 by Dhaka Stock Exchange. Analysts blamed the fall in turnover on the downward adjustment of banks' advance-deposit ratio (ADR) by this month as per an order of the central bank.

Last year, Bangladesh Bank ordered banks to bring down the ADR to 83.5 percent from 85 percent, meaning that banks with a higher ratio are in pressure for deposits, which ultimately pushes up interest rate.

“Fears over a liquidity crisis in banks are a major cause for the fall of the market,” said Mohammed Rahmat Pasha, managing director of UCB Capital Management.

Some banks ordered their subsidiaries to return some funds, if possible, as the banking sector underwent some pressure on the liquidity issue, said Pasha.

Moreover, the interest rate of the banking sector rose 1.5 to 2 percentage points, which is why the stock market was affected.

Pasha expects the stock market to get better in the coming weeks as the timeframe for maintaining the ADR was eased.

“A more positive side is that foreign investors are buying continuously,” he added. A top official of a leading merchant bank, requesting not to be named, said many institutional investors were inactive and adopted a wait-and-see approach last week.

General investors were also disappointed as the index did not gain as per their expectations after the national election, he added. DSEX, the benchmark index, soared to 5,950 points but could not cross the 6,000 mark after the polls. The index fell to 5,688.45 yesterday.

“The recent fall in stocks and turnover dampened their confidence further.”

A top official of another stockbroker said institutional investors' participation was very low last week. Most of the turnover came from general investors but they were also suffering from a lack of confidence, he said asking not to be named.