Steel makers feel the pinch of a subdued private sector

All but among the listed rod makers' profits dropped in the first half of the current financial year on the trunk of lower sales volume and higher deferred tax expense.

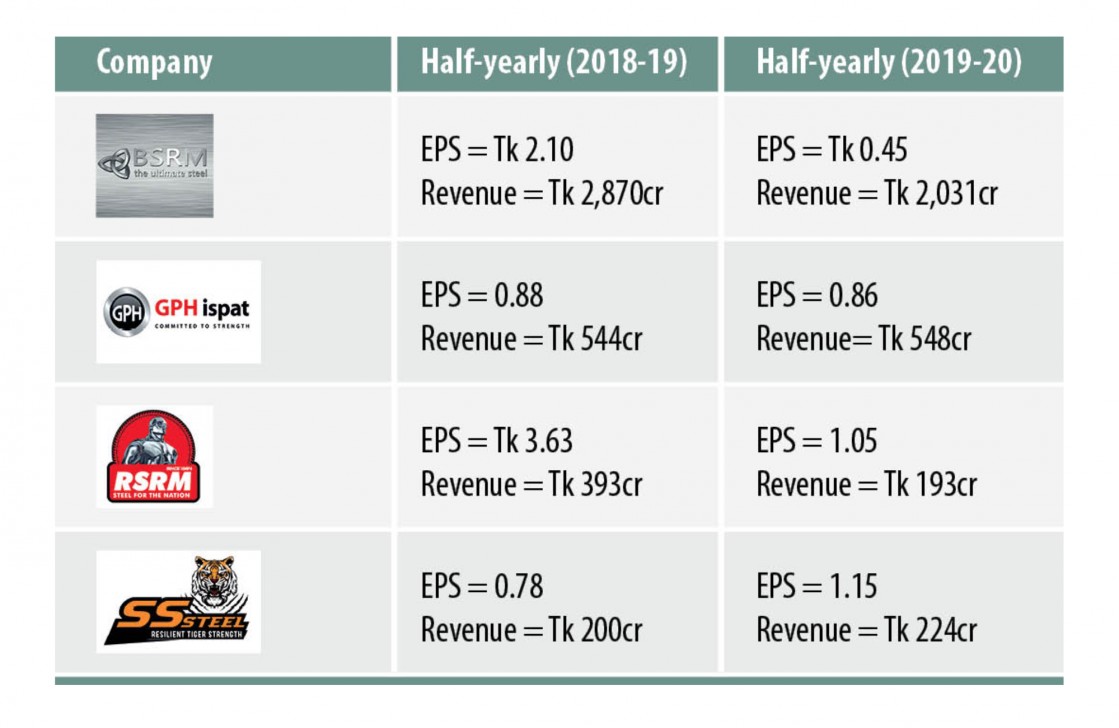

Only SS Steel logged in higher profits, while BSRM Steels, Ratanpur Steel Re-rolling Mills and GPH Ispat saw their profits contract at that time.

"Construction activities of the private sector was 'abnormally' slow in the first half of the financial year," said RSRM Director Marzanur Rahman.

The demand for rod fell although supply remains the same, which finally resulted in lower sales volume and shorter profit percentage. The rod maker supplies to both government and the private sector.

Shekhar Ranjan Kar, company secretary of BSRM Steels, echoed the same about the shrinking profitability: lower sales volume.

BSRM's profits for the months of July and December last year crashed a staggering 78.71 % year-on-year to Tk 16.8 crore.

But Kar, also the general manager of finance & accounts of the steel maker, also blamed the higher deferred tax burden.

The steel company made a provision for deferred tax expenses of Tk 11.48 crore for the first half of the financial year 2019-20. A year earlier, it was Tk 1.73 crore.

At least Tk 500 per tonne must be provided now as minimum tax when steel is imported.

"When we sell we have to pay 3 % tax, which involves about Tk 2,000 per tonne. This can be a minimum tax. Whether we make profit or loss these taxes are mandatory."

The value-added tax of Tk 1,100 per tonne should be paid too.

"Such a high tax regime ate into our profits and it will continue to fall," Kar added.

The Chattogram-based rod maker also made a provision of current tax of Tk 27.47 crore as a minimum tax this year, which isn't comparable with the previous year as tax provisioning for the previous year was calculated on net profit.

RSRM also said there is an impact from advanced trading tax, which is newly imposed, and a rise in import duty.

Industry insiders said the gas price hike has also impacted rod makers' business: about Tk 1,500 must be paid extra for each tonne of rod now.

The energy regulator increased gas prices for manufacturers by about 17.5 % from July 1, 2019.

The impact was slightly less for newly listed SS Steel, whose earnings rose in the first half.

SS Steel mostly sells to the federal government, so its earnings remains strong, according to analysts.

However, within the last quarter SS Steel's earnings was flat.

Between the months of October and December of this past year, the steelmaker's earnings per share was Tk 0.46, which was Tk 0.43 a year earlier.

Big companies' sales are diversified, said Javed Opgenhaffen, chairman of SS Steel.

In the coming years, rod makers will face a challenge because capacity of their production rose however the demand has not.

"So, demand must increase to overcome the task," Opgenhaffen added.

Because the rod makers' raw materials result from China, the impact of coronavirus will be felt deeply in the times ahead, Rahman of RSRM said.