Govt may revisit decision: Kamal

The government will revisit your choice of bringing down interest rates on postal savings, considering its effect on small and marginal savers, Finance Minister AHM Mustafa Kamal said yesterday.

"We gives it another thought. But we are in need of time for that, and if we can not do it now, we can do it within the next budget," he said replying to questions from journalists after a gathering at the secretariat.

The disclosure came amid outcry from various quarters as the federal government slashed interest rates on ordinary and fixed deposit accounts of about 50 lakh savers mostly from the low-income bracket.

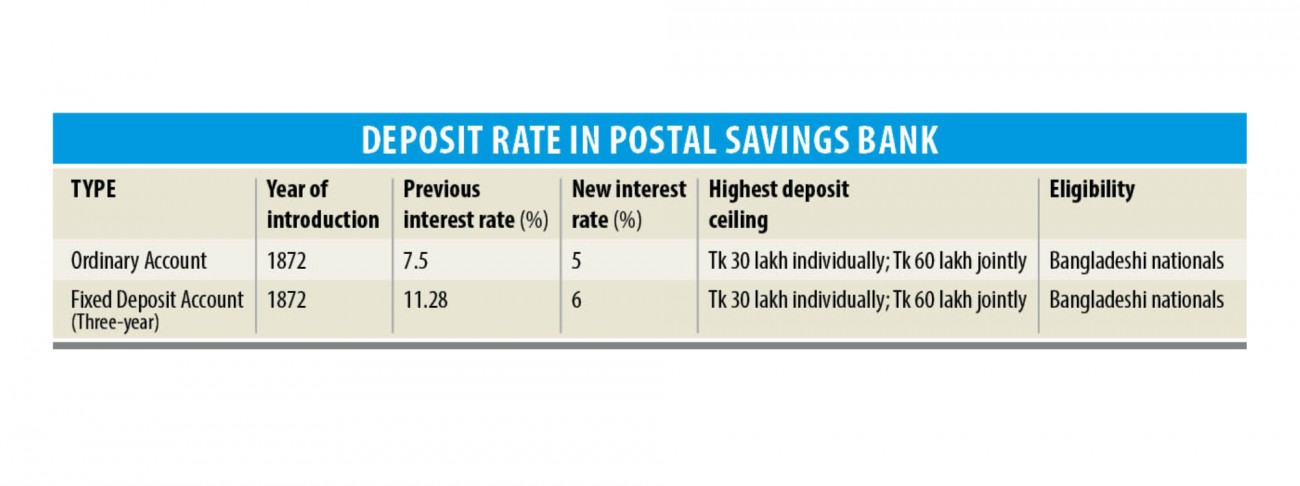

The finance ministry on February 13 reduced interest on postal fixed deposits of three-year tenure by almost half -- from 11.28 per cent to 6 per cent -- to conform to a government move of decreasing bank interest for lending and deposit.

Most banks lowered interest levels on fixed deposit schemes right from the start of this month based on the government decision targeted at spurring private investment.

However, interest rates on savings certificates issued by the Department of National Savings have already been kept unchanged at a lot more than 11 percent.

Kamal said the rates of interest on deposit schemes in post offices were slashed with regard to 'uniformity'.

"We have to make a trade-off. Our definitive goal is to lessen all rates of interest to single digits, and by doing this, we need to look at every related component," he said.

The federal government had introduced savings instruments to aid the marginalised persons and pensioners, he said. "But we discovered that the scope was grossly misused."

Once savings instruments were displayed as security deposits for taking part in tenders and people even had bought savings tools of Tk 20 crore with the objective, he said.

"Who'll pay the interest of the savings certificates?" the minister said, adding that there is no control in the sector in the past.

The government has taken the problem of investment in savings instruments under some rules to ensure transparency, he said.

"We had a need to know who were buying these and how much these were buying."

Once the rules were tightened, deposits in post offices began to go up sharply, the minister said, adding that the federal government initially didn't want to lower interest rates on these deposits.

"But later we found that all of the savers were switching to create offices," he said.

"Who'll deposit in banks for 6 percent interest if indeed they get interest of 11-12 percent in the areas?"

Fixed deposits in post offices stood at Tk 15,500 crore in fiscal 2018-19. Deposits jumped 66 % year-on-year to nearly Tk 11,700 crore in the first half of the fiscal year, according to Bangladesh Post Office data.

"We can do whatever possible for the indegent. But before doing so, we need to know who they are really," Kamal said, adding that the federal government will consider exempting tax for the marginalised people.