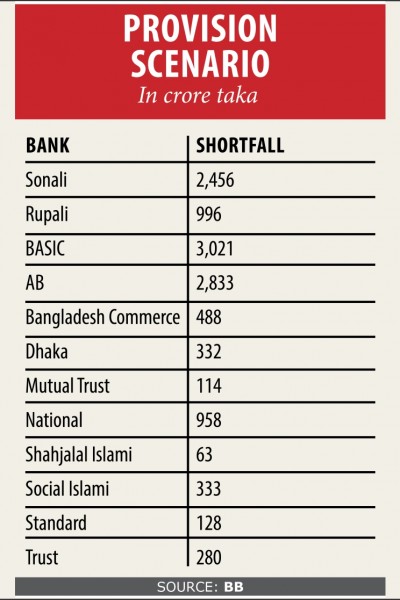

12 banks face provision deficit of Tk 12,000cr

A dozen banks faced a combined provision shortfall of Tk 12,000 crore in the third quarter of 2019 in a sign that exposed their weakness to shield depositors’ funds from financial risks.

Experts blame the central bank’s inaction for the persistent provision shortfall, saying stern actions should be taken against the errant banks following global best practices.

The banks that faced the shortfall are Sonali, Rupali, BASIC, AB, Bangladesh Commerce, Dhaka, Mutual Trust, National, Shahjalal Islami Bank, Social Islami, Standard, and Trust, according to data from the Bangladesh Bank.

Some of the lenders have been facing the shortfall for a long time as they disbursed loans flouting rules, said BB officials.

A shortfall is an amount by which a financial obligation or liability exceeds the amount of cash available. It can be temporary, arising out of a unique set of circumstances, or it can be persistent, which may indicate poor financial management practices.

Banks have to keep 0.50 percent to 5 percent provisioning against general category loans, 20 percent against classified loans of substandard category, 50 percent against classified loans of doubtful category, and 100 percent against classified loans of bad or loss category.

“Provisioning shortfall in a bank means regulatory violation. Developed and many developing countries impose financial penalty against the lenders if they breach regulations,” said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

But, the BB is yet to take any exemplary punishment against the errant banks; rather they have managed to get time from the regulator to meet the shortfall in phases over a period of three to four years, he said.

The banks even offer dividends with prior approval of the central bank, which encourages them to stay in the shortfall zone for long, said Mansur, also a former economist of the International Monetary Fund.

“They should be asked to get out of the shortfall zone within six months.” The sponsors of the errant banks should be forced to inject fresh capital into the lenders to fill up the shortfall, said Mansur, also the chairman of Brac Bank.

Provision shortfall is an indication of worsening trend of capital base in a bank, said Salehuddin Ahmed, a former governor of the central bank.

The image of the country’s banking sector will be tarnished at home and abroad if the ongoing provision shortfall continues, he said. Defaulted loans are on the rise and it will hit adversely banks’ ability further to keep required provisioning, he said.

Non-performing loans surged 24 percent to Tk 116,288 crore in September compared to that in December last year, the amount being the highest in the country’s history.

The interest of depositors will erode if banks are persistently facing provisioning shortfall, Ahmed said.

Adequate provision protects banks from financial risks deriving from unforeseen financial scams and macroeconomic instability. Confidence of savers in banks also declines if they face such a shortfall for a long time, said Ahmed, calling on the central bank to take the issue seriously in the interest of the financial sector.