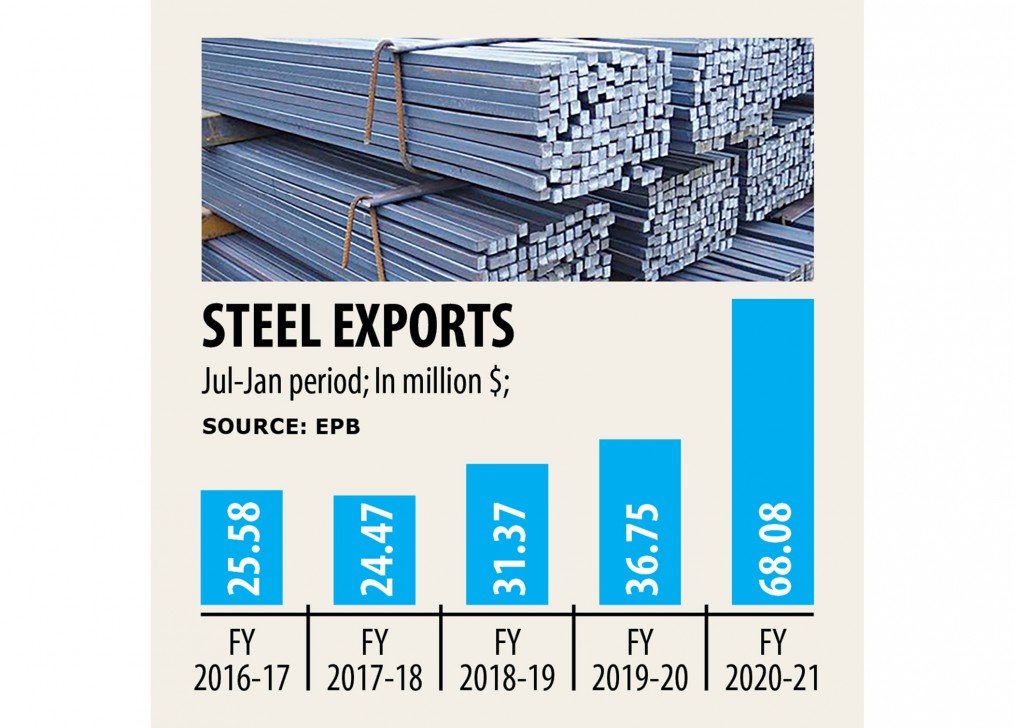

Steel exports jump 83pc

Bangladesh's steel export, mainly semi-finished casting goods, leaped 82.91 % year-on-year during the July-January amount of the ongoing fiscal, interestingly coinciding with the ongoing pandemic-induced economical slowdown.

Of the export, $10 million worth of goods visited China.

Bangladesh's steel mills generally import scrap steel to create the intermediate casting goods which want further processing to end up being turned into finished goods.

The industry handles ferrous waste and scrap, re-melted ingots and products made from such metal of most shapes and sizes such as for example angles, rods, plates and pipes.

The export destinations are predominantly the United Arab Emirates, India, Malaysia, Japan, Thailand, Pakistan and Myanmar.

"The export increased because of a leading metal maker exporting around 45,000 tonnes of billet during the pandemic which showed a major jump in metal export," said Manwar Hossain, president of Bangladesh Steel Mills Owners Association.

The leading steel manufacturers tried to generate cash rather than making a gain selling at less than the production cost as the situation was not favourable during that time, he said.

According to him, this sort of strategies in steel export are good for building images however, not commercially viable.

Tapan Sengupta, deputy managing director of Bangladesh Steel Re-Rolling Mills, said Bangladesh's steel mills export by-products that they themselves cannot use including air pollution control dust and elements of scrapped ships such as for example propellers.

He said the ferrous waste materials and scrap were exported to India, China, Taiwan etc.

As for finished items, he said Bangladesh had attained top quality of international standard however, not export volumes according to expectations. Though some had been exported to north east India, the total amount is quite insignificant, he said.

Shahriar Jahan Rahat, deputy managing director of Kabir Metal Re-Rolling Mills Group, said there is zero scope of exporting done steel as the millers were capable of only catering to native demand.

He said the sector was dependent on importing the raw materials.

Rahat said Bangladesh's annual intake had risen by 15 % to 20 % between 2017 and 2019 whereas earlier it had been increasing by some 10 per cent.

He believes the demand would persist for some time in Bangladesh.

Rod consumption reached about 6 million tonnes found in 2019 as the sector comes with an installed total annual production capacity around 110 million tonnes.

There are about 40 active manufacturers with a combined potential to produce nine million tonnes of steel a year. Of them, Abul Khair Metal, GPH Metal, BSRM and KSRM fulfill over fifty percent of the total annual demand of eight million tonnes.