SS Steel to enter ceramics market

SS Metal yesterday announced that it could spend about Tk 200 crore to buy a 75 % stake found in Southeast Union Ceramic Sectors in order to expand its product bottom in the building sector.

"Ceramic is a building related merchandise and since we already provide steel, investing in a stake found in the ceramic tiles maker will strengthen our foothold," said Javed Opgenhaffen, chairman of SS Steel.

Southeast Union Ceramic offers its products under the brand of SEUCL and FONDI.

SS Steel, that was listed with the country's bourses back in 2019, saw its share price to go up 3.84 % to Tk 22.80 yesterday.

On the outskirts of Dhaka in Tongi, the company manufactures mild metal (MS) deformed bars of various grades comprising MS billets and ingots. In addition, it creates MS billets from scrap.

In August last year, SS Metal announced that it could invest roughly Tk 160 crore in Saleh Metal, a maker of MS rods.

Of the quantity, Tk 24.75 crore would be equity investment for a 99 % stake.

"We curently have a consumer base so catering to ceramic needs will be possible for us," Opgenhaffen said.

Besides, the demand for ceramic goods in construction is on the rise, especially found in the rural areas, he added.

In line with the Bangladesh Ceramic Producers and Exporters Association (BCMEA), the marketplace for ceramic products was valued at about Tk 35,000 crore in 2019.

The industry's production capacity is continuing to grow by about 200 % within the last 11 years and Bangladesh currently retains 0.14 per cent of the global industry for ceramic products.

Local suppliers focus on around 80 per cent of the domestic demand.

"You could ask why we chose Southeast Union Ceramic, however the answer is that the business is go by Chinese control who are audio and efficient found in the sector," the SS Metal chairman said.

Southeast Union Ceramic has huge probable in the market because it uses state-of-the-artwork technology at its factory, that is a China-Bangladesh venture company situated in Bagerhat, Khulna.

The business's historical profitability, asset valuation and potential will be looked at within an extra general conference (EGM) of SS Steel, where the company will seek approval from its shareholders to complete the purchase.

Southeast Union Ceramic includes a production capacity of around 9.6 crore square toes of tiles yearly, according to data posted on the Dhaka Stock Exchange website yesterday.

However, SS Steel isn't by itself in its foray in to the ceramic market as greater than a dozen other companies are preparing to do the same.

For example, Meghna Group of Industries (MGI) is investing Tk 400 crore to create a ceramics factory at the Meghna Economic Zone in Narayanganj.

Of the 68 ceramic manufacturers presently operating in Bangladesh, 20 produce tableware, 32 get tiles and the rest of the 16 manufacture sanitary ware.

Up to now, around Tk 9,000 crore has been committed to the sector which employs about five lakh staff, including two lakh women.

A lot more than 25 crore bits of tableware, 20 crore square metres of tiles and 83 lakh bits of sanitaryware were stated in Bangladesh in fiscal 2017-18, BCMEA data displays.

"After the shareholders approve our proposal, we will financing the Tk 200 crore cost from the lender and provider fund," Opgenhaffen said.

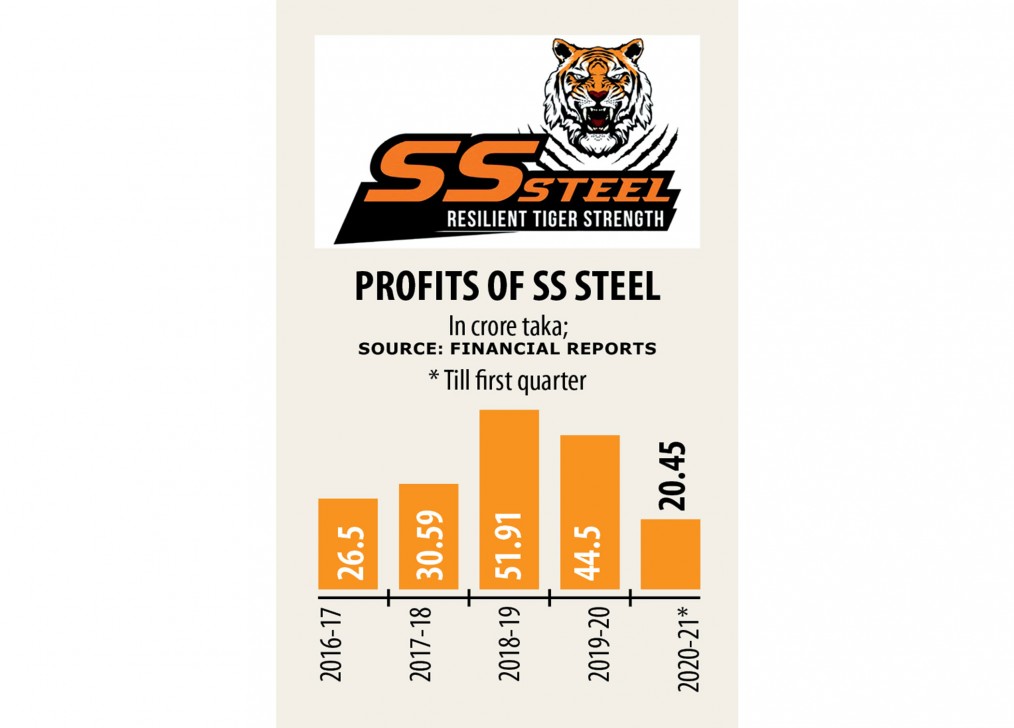

SS Metal has retained income and share funds deposit of Tk 118 crore and Tk 40.30 crore respectively, regarding to its first quarterly financial report of fiscal 2020-21.

When it comes to their takeover of Saleh Steel, the chairman said that SS Steel has already completed the acquisition.

Established in 1995, Saleh Metal can produce about 84,000 tonnes of MS rods and coils each year.

The brand new investment alone is likely to increase SS Steel's turnover by about Tk 500 crore a year.

Regarding the business's current organization situation, its chairman stated their organization has been relatively secure so far because of the government's ongoing infrastructure jobs.

"However, the cost of raw materials provides risen while container handling is normally tight therefore the transit period has increased, which includes had a bad effect on us," he added.

The company's profits dropped 3.68 % to Tk 18.56 crore in the July-September amount of 2020-21 regarding to its quarterly financial report.