State firms call for guidelines in how to set the value for share money deposit

Listed businesses have called upon the regulators to introduce guidelines how to set the share value that the companies have to issue against share money deposit.

Share money deposit is the money paid in exchange for shares that contain not been acquired yet.

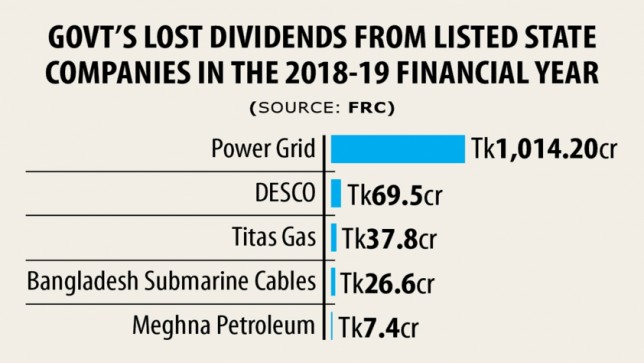

The Financial Reporting Council (FRC) recently detected that in fiscal 2018-19 alone, the federal government missed out on at least Tk 1,155.5 crore in dividend against Tk 6,652.6 crore the firms showed in their "share money deposit" accounts as the government's investment.

Based on the results, the watchdog for financial reporting and auditing practices possesses asked the companies to concern the shares within half a year.

Until fiscal 2018-19, the government invested Tk 6,652.6 crore in Bangladesh Submarine Cable connection Company (BSCCL), Titas Gas, Vitality Grid Organization, Meghna Petroleum, Rupali Lender and Dhaka Electric Supply Company and the total amount was shown as show money deposits in the companies' financial reports.

The companies' share cash deposits amounted to Tk 4,775.5 crore in fiscal 2017-18 and Tk 3,815.8 crore in fiscal 2016-17 respectively.

"The main issue is when the federal government had provided the money it didn't specify anything as to when the share ought to be issued and what would be the share benefit," said a top official of the BSCCL preferring anonymity.

Last week, the business sought a guideline from the FRC on how to set the share value that would be issued to the federal government against the share money deposit.

The government didn't mention anything about the share issue price: whether it might be issued at face value or market value or based on something else.

So, there should have been a guideline, the state said.

"Now, if we consider the money as capital according to the FRC order then our revenue per talk about would fall, which would impression the overall investors. So, we must take approval from their website first," he added.

If the firms issue the shares at face value, then your number of shares would increase heavily and it'll lessen their earnings per share and thus affect dividends, explained Md Moniruzzaman, managing director of IDLC Investments, a merchant bank.

The price could possibly be set by taking into consideration the average share price of the previous half a year, which was seen sometimes before, he added.

"We do valuation predicated on a company's cashflow and earnings per show, gives a clear photo of a company's fiscal strength," said Khairul Bashar Abu Taher Mohammed, ceo of MTB Capital, another merchant lender.

It also ought to be taken into profile the way the earnings of a good company are in comparison to its equity or perhaps possessions, he said, adding that it offers a concept of how proficiently the assets are actually used.

If the shares are issued at deal with value, it could be a big blow for the overall investors, Mohammed said.

"We are carrying out analysis on what would be the valuation process for show issuance," stated Sayeed Ahmed, executive director of the FRC.

It might be predicated on net asset worth and the preceding year's share prices weighed against the earnings per share.

"Alternatively, companies can issue choice shares. Then your number of shares would not rise and the wages per share would not be damaged," Ahmed added.

Those shares are distributed to favored persons by not issuing latest ordinary shares and the holders of preference shares get the dividend at a set rate before any dividend is paid to various other classes of shareholders.

IDLC's Moniruzzaman said if the firms issue preference shares at higher yield prices then your companies' payment obligation can rise, so again the overall investors will suffer.

So, the yield fee might be fixed taking into consideration the dividend yield, he added.

The dividend yield is a ratio that shows just how much a company pays out in dividends every year in accordance with its stock price.

There are 19 government-owned companies listed with the bourses and almost all of them have share money deposits, based on the Dhaka STOCK MARKET data. Included in this, BSCCL sought 14 a few months to complete the share issuance.

The business has been facing an audit claim of Tk 8.6 crore from Foreign Aided Assignments Audit Directorate, which needs to be settled first to get the actual amount of share money deposit.

"The matter might take four a few months to be settled," the BSCCL official said.

Alternatively, it'll need to take approval from stock investors and the federal government about the show issuance and setting show value.

Apart from these, an audited financial report, possessions valuation, details memorandum to take approval from the currency markets regulator and some other regulatory actions ought to be completed to concern the shares.

All the formalities will need 14 months, based on the official of the BSCCL, which has already appointed ICB Capital Control as its issue supervisor.

The FRC ordered the stated companies to count the share cash deposit as potential share capital and count the wages per share of the business based on the brand new capital until its share issuance.

Before taking approval from the stock investors, if the wages per share are counted taking into consideration the share money deposit as potential share capital then your currency markets will be impacted, the BSCCL said.

"We want to concern shares to the government but there was no directive in regards to what would be the issue value," said a high official of another stated state-run company, asking never to be named.

The shares were not issued due mainly to too little efforts from the government's side, he added.