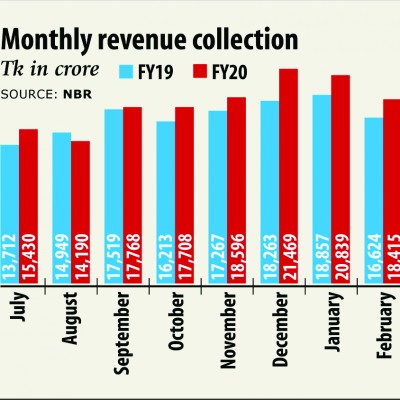

State coffer was topping up nicely before outbreak

crore in the first eight months of the fiscal year aided by healthy tax generation however the shortfall against the government target has kept widening.

Between your months of July this past year and February this season, the National Board of Revenue (NBR) had aimed to create Tk 189,823 crore in taxes.

Tax collection rose 14.54 per cent year-on-year to Tk 44,624 crore through the period, provisional data from the NBR showed.

Value-added tax (VAT), which is paid by consumers, went up 7.83 % to Tk 56,953 crore. The indirect tax may be the biggest source of earnings for the NBR.

Import tariff edged up 2.90 % to Tk 42,837 crore.

However in all three areas, the NBR has didn't hit the targets set for the time.

Collections from income tax was 22.77 % short, import tariff 28.88 % and VAT 20.69 %.

The NBR has been tasked with mobilising Tk 325,600 crore this fiscal year, up 45 % from fiscal 2018-19's actual collections.

Amid the sluggish collection, the government had already started thinking about trimming the mark by Tk 20,000 crore. That was prior to the coronavirus outbreak.

Now, due to looming COVID-19 threats, which includes ground the economy to a halt, the NBR may need to shave the mark by a bigger amount, said a tax official.

"The coronavirus hasn't impacted income generation by February. The effect will be clear from March onwards," he said.

In Bangladesh, the first confirmed cases came on March 8.

Revenue shortfall in fiscal 2018-19 was Tk 87,402 crore. If the ongoing trend continues, total revenue shortfall this season may reach Tk 100,000 crore, in line with the Centre for Policy Dialogue (CPD).

As a way to slow the spread of the virus, the federal government has recently locked down the united states, shutting offices and educational institutions and limiting the movement of transport and folks.

Most businesses attended to a standstill and export and import activities have already been hit hard.

Uncertainty in the global economy and consequent repercussions for the Bangladesh economy may create added pressure on revenue mobilisation during the remainder of the fiscal year and beyond.

Downturn in trade, particularly that of import values may bring about considerably lower collection of earnings from customs duty, VAT and supplementary duty (SD) at the import stage.

In view of the added uncertainty and increased medical expenditure in the event of an enormous outbreak and job loss and low income, particularly in the informal sector, households could also spend less, the CPD said in a paper on March 21.

And an extended epidemic may result in a slump in business activities, which, subsequently, could trigger lower assortment of VAT, SD and income (both corporate and personal) tax at the local stage, it said. Total revenue-GDP ratio in fiscal 2018-19 was merely 9.9 % and the tax-GDP ratio only 8.9 per cent, which is amongst the cheapest in the world.