RMG exports soar 36pc

Garment export to non-traditional markets grew by 36.21 percent year-on-year to $2.90 billion in the current fiscal year's first six months because of a government stimulus package and duty-free market access.

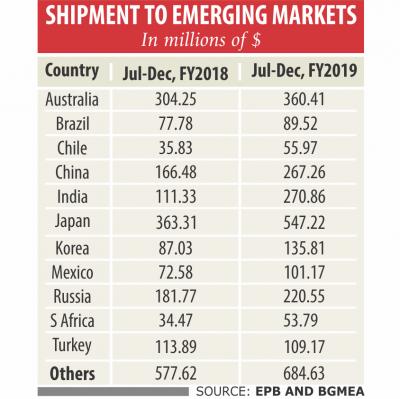

The receipt from the garment shipment in the same period last fiscal was $2.13 billion, according to data from Export Promotion Bureau and the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

Apart from the traditional US, European Union and Canadian markets, all others are considered non-traditional or emerging markets for Bangladesh. Of those, 11 are performing stronger than others.

Australia, Brazil, Chile, China, India, Japan, South Korea, Mexico, Russia, South Africa and Turkey are the 11 stronger markets.

Garment export to non-traditional markets has been growing since 2010-11 when the government announced a 5 percent cash incentive as a stimulus package to offset fallouts of financial recessions that affected the global economy in 2007 and 2008.

Since 2010-11, apparel shipments to new destinations have been growing rapidly. Exports to those destinations varied from $200 million to $500 million before the stimulus package was announced, said Siddiqur Rahman, president of BGMEA.

In the first year, the government provided a 5 percent cash incentive for emerging markets but later gradually reduced it to 2 percent. However, the amount was raised again to 4 percent in July last year, Rahman said.

The stimulus package has encouraged the exporters to start exploring new markets, he said, adding that most of the new markets have duty-free access facility for Bangladeshi exporters.

For instance, among Asian nations, Japan is the only country where Bangladesh exported $1 billion worth garment items availing the duty privilege.

Japan extends duty-free trade privilege to the garments imported from least developed countries to reduce over-dependence on China.

Similarly, China, the largest apparel supplier worldwide, has also been turning into a major export destination for Bangladesh.

The Chinese government also allowed duty-free access to over 5,000 Bangladeshi products, most of which are garment items.

India, Brazil, Mexico and Chile are also turning into major export destinations for Bangladesh.

Moreover, inspections by the Accord and Alliance prompted factory owners to remediate their units to strengthen workplace safety, which brightened the country's image as well as that of the sector, he said.

As a result, international retailers and brands have been coming here with handfuls of work orders, he said.

Rahman also added that a lot of work orders were shifting from China to Bangladesh as buyers were accepting the South Asian country as an alternative to China.

Work orders are also shifting to Bangladesh due to the ongoing tariff war between the US and China, he said.

Last fiscal year, Bangladesh exported garment items worth $30.61 billion, registering an 8.76 percent year-on-year growth whereas in the first six months the export from this sector grew by 15.65 percent year-on-year to reach $17.08 billion, he said.

“So, it is evident from the shipment trend that the work order for domestic garment units will continue to rise. It is expected that the positive trend will continue for many years for the country,” Rahman said.