Rising imports leave little room to use reserves for dev projects

The government's intend to use foreign exchange reserves to bankroll infrastructure projects may face difficulty in today's fiscal year as rising imports will keep little leeway for making such lending.

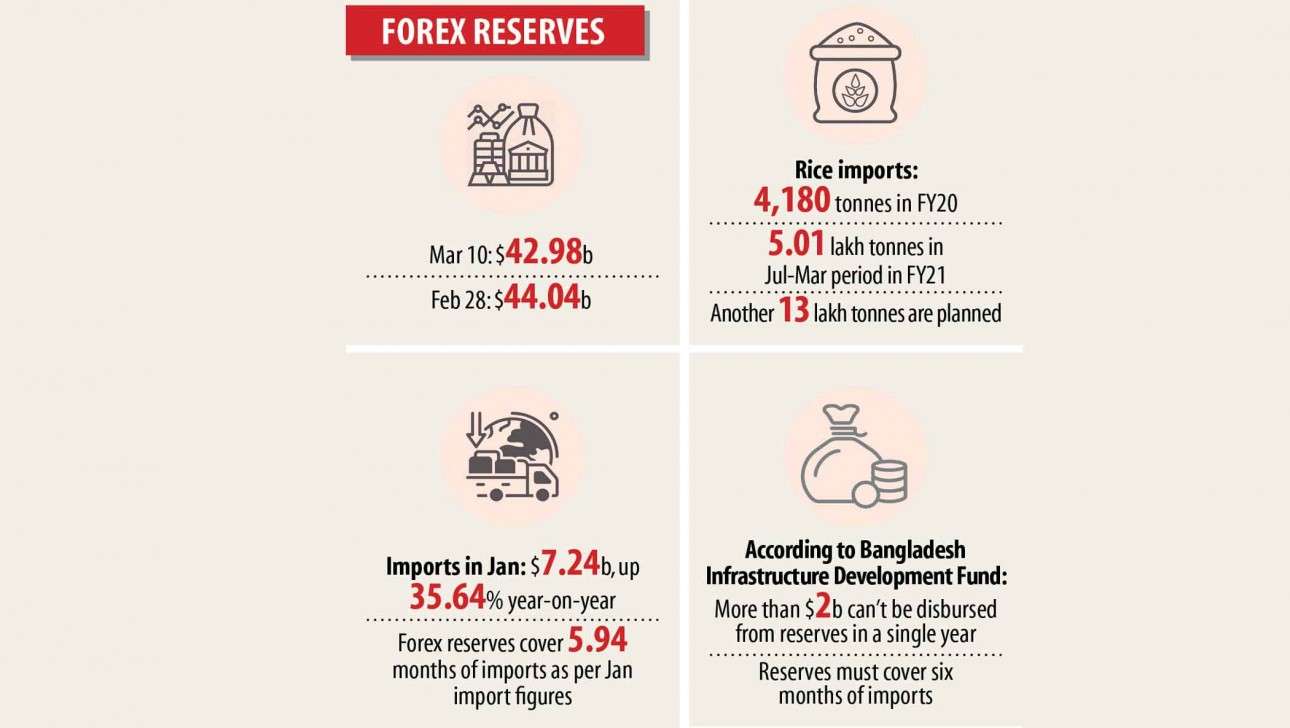

If the regular monthly import expenditure of January is taken into account, Bangladesh now has forex reserves that may cover import expenditures for 5.94 months, below the comfortable level of six months.

The reserves, aided by robust remittance and lower imports, stood at $44.04 billion on February 28 before decreasing to $42.98 billion on March 10, in line with the latest info of the Bangladesh Bank.

Import payments were $7.23 billion in January, up 35.64 % year-on-year.

The entire import declined by 0.23 % from July to January. It, even so, has been rising since January as a result of the recovery of the market from the pandemic-induced slowdown.

On March 15, the government, for the first time, took a proceed to lend funds from the forex reserves for a production project. It sanctioned a loan of 524.56 million Uk pounds, or Tk 5,417 crore, from the reserves for the dredging of a channel for Payra Slot, a seaport in Kalapara, Patuakhali.

The federal government has formed the Bangladesh Infrastructure Development Fund (BIDF) to lend money from the reserves.

According to finance ministry records, two conditions must be met before lending by the fund happen to be: the annual expense target out of the fund will be only $2 billion, and the lending has to be carried out after keeping the reserves intended for at least half a year of import expenses.

Import expenditure may climb in the foreseeable future as the overall economy is making a turnaround.

In line with the letter of credit (LC) settlement info of the BB, the import of consumer goods rose 12.48 % from July to December. The LC starting such things increased 4.58 per cent.

The LC opening to buy raw materials from international market segments was up 1.71 % during the half a year. The LC settlement for capital machinery declined.

The import of food grains has gone up since January.

A total of 5 lakh tonnes of rice were imported from July to March 15. It was 4,180 tonnes in the complete fiscal year of 2019-20.

The government imported 1.42 lakh tonnes of rice out of 5 lakh tonnes that entered the united states so far in today's fiscal year. And almost all of the imports occurred within the last two . 5 months.

The government in addition has initiated the procedure to import another 13 lakh tonnes of rice to keep carefully the supply smooth and avoid price volatility.

Due to plan of investing in a massive quantity of food grains from exterior options, the import would get momentum found in the coming months.

The uptick in imports came after global economical prospects improved markedly in recent weeks, on the trunk of ongoing mass vaccination against the deadly coronavirus around the world.

"Execution of the policy decision to work with forex reserves exceeding half a year equivalent to imports for infrastructure expenditure depends on how the Bangladesh Lender assesses the month to month import requirements in the years ahead and how actual reserves evolve," explained Zahid Hussain, a past lead economist of the World Bank's Dhaka business office.

Import payments have already been relatively low found in days gone by couple of years due to weak household demand. International commodity rates were either stable or declining, based on certain commodities. The pandemic possessed exacerbated these pre-existing developments.

"A sharp pick-up in import payments to more than $7.2 billion in January is an effective reminder that this can not be taken for granted," Hussain said.

International commodity prices have risen, and domestic demand is normally poised to recuperate with the global vaccination and developing virus fatigue.

Advanced economies will be projected to recuperate strongly in the second half of 2021 since their vaccination fees approach herd immunity. International commodity prices may thus rise additional or continue to be at the existing elevated levels, according to Hussain.

If imports remained at about $7 billion per month, there would hardly be any unwanted reserves left because it had recently been varying between $42 billion and $43 billion, he said.

Remittance growth offers slowed, and exports are actually struggling to come back to pre-pandemic amounts, said the economist, adding that global recovery might boost both, but there is absolutely no certainty about how much and when.

Adequacy of reserves is a significant self confidence anchor for foreign investors and creditors. It permits the Bangladesh Lender to smoothen exchange fee volatility, which is crucial for macroeconomic stability.

"We wish the Bangladesh Lender will err privately of caution in identifying the adequacy of reserves."

Self-reliance in managing exterior stability risk is even more important than self-reliance in financing infrastructure, said the economist.