Wheat import declines

Wheat imports declined 2 % or perhaps 72,000 tonnes found in the first half a year of fiscal 2020-21 compared to the corresponding weeks of the prior year as rates rose amid a good shortage of supply found in the international market.

This is due to the ongoing coronavirus pandemic, during which large countries increased their stocks of wheat, leading to price volatility in the international market, according to importers.

The price of wheat has truly gone up by $50 to $60 per tonne in the last three months.

Besides, Russia, among the world's top wheat exporters, recently announced imposing export duty of €50 per tonne from next March.

An identical announcement could result from another key wheat exporter, Ukraine, they added.

The importers also said other exporting countries were imposing similar export tasks to discourage shipments and ensure enough source for themselves amid the coronavirus pandemic.

The country's gross annual demand for wheat stands at around 77 lakh tonnes, 85 % which is met through imports, according to data from the National Board of Revenue (NBR) and Department of Agricultural Extension (DAE).

The DAE estimates show that year about 13 lakh tonnes of wheat will be produced on 3.5 lakh hectares of land although it was 12.45 lakh tonnes from 3.29 lakh hectares of land in 2019-20.

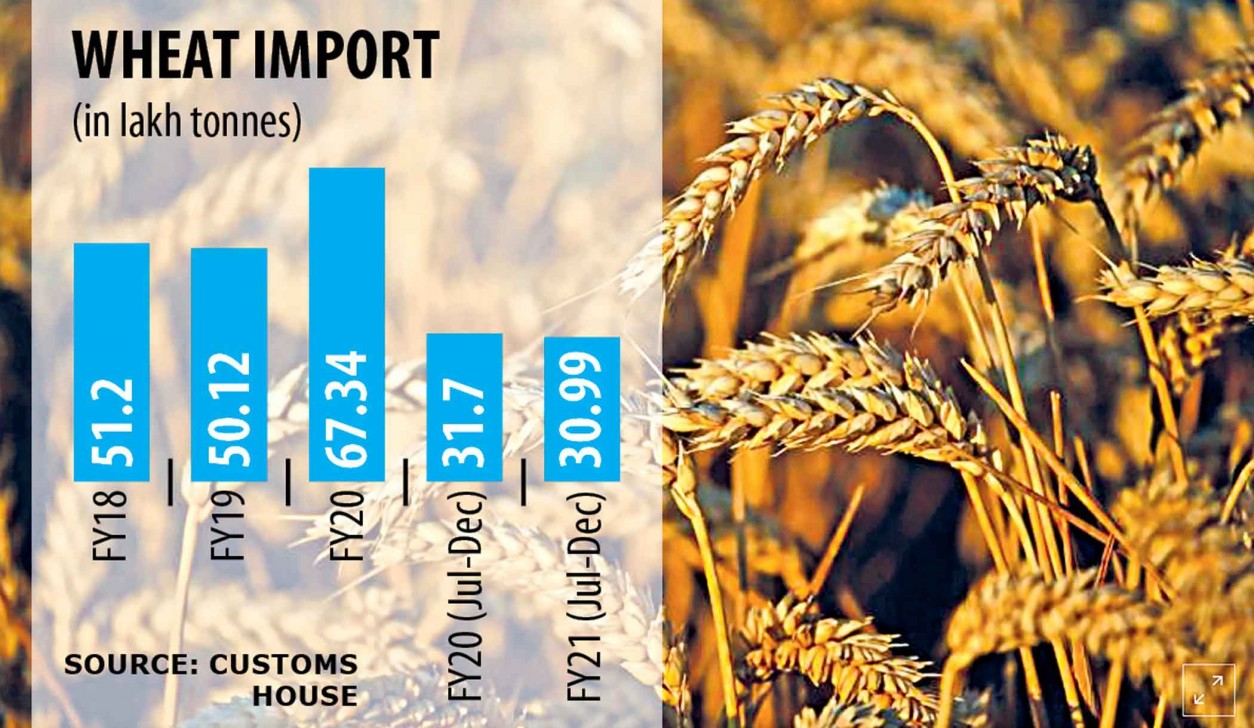

According to sources in Chattogram Customs, some 30.99 lakh tonnes of wheat worth Tk 6,731.18 crore was bought in the first half a year of fiscal 2020-21. It had been just 31.70 lakh tonnes in the same amount of fiscal 2019-20, the NBR data shows.

Wheat was imported in an average value of Tk 235 per tonne in the last financial calendar year but the current average price is Tk 256 per tonne.

Being an necessary commodity, wheat bears not any import tariff. Wheat involves Bangladesh from 16 countries, incorporating Russia, Canada, Ukraine, India, the US, Cyprus, Italy, Australia, Argentina, Estonia and Belgium.

Relating to importers, the acquire of wheat and wheat products has grown at a rate of 10-15 % almost every year in the last decade because of increased require in the domestic industry.

Nasir Uddin Chowdhury, director of TK Group, told The Daily Superstar that wheat production found in almost all countries worldwide has declined because of the ongoing pandemic.

"We imported slowly as a result of selling price hike in international market segments. Prices are becoming more unstable daily," he said.

The require for wheat is always within an upward trend because of changing food habits and the increased require and export of baked goods.

"So, there is much less opportunity to reduce imports," Chowdhury added.

Abul Bashar, chairman of BSM Group, among the country's top wheat importers, told The Daily Superstar that the country's gross annual demand for bakery products has been raising for a price of 10-15 % for the last decade.

At present, the way to obtain baked goods to the overseas markets is going to be low while prices have become unstable because of the upsurge in wheat stocks in a number of large countries, including China.

Previous Thursday, wheat from Russia and Canada was traded at $330 per tonne while it was $320 per tonne in Ukraine and $315 per tonne on the Indian market.

The cost of wheat had already risen globally even prior to the €50 export tariff was announced by Russia, Bashar said.

Wheat Production

IndexMundi, a information and statistics data portal, ranks Bangladesh seventh among wheat importers. Egypt topped the list with 1.30 crore tonnes over the last fiscal followed by Indonesia with an gross annual 1 crore tonnes.

According to an USA Section of Agriculture (USDA) article published on November 8 this year, Bangladesh has place the annual meals grain production target to get wheat by 13 lakh metric tonnes for fiscal 2020- 21.

If realised, the harvest would be a 4.2 percent rise over the 2019-20 harvest.

In consumption, Bangladesh comes 20th while China takes top rated spot with an annual 1.3 crore tonnes.

In production, Bangladesh located 31st in the last economic year and again, China heads the first choice plank with 1.37 crore tonnes.