Ring Shine crash lands

Abdullah Hujaifah, a retail investor, was terribly excited when his name was drawn from the lottery for Ring Shine Textiles’ initial public offering (IPO).

This was the second time he managed IPO shares. The last time he got them, he made a killing, so he was expecting it would be the same this time.

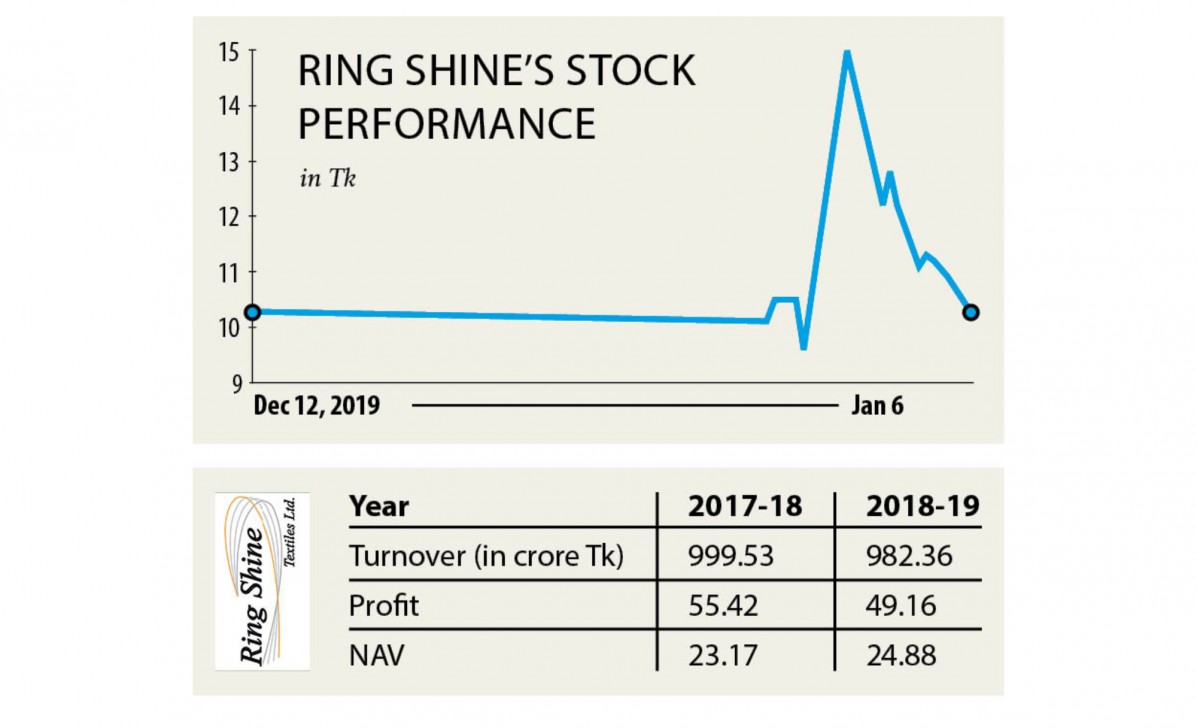

But his hopes were dashed soon. Ring Shine’s stock price started sliding soon after it made its debut on the Dhaka and Chattogram bourses on December 12.

Yesterday, its shares were trading at Tk 9.60 yesterday -- Tk 0.40 less than its face value, according to data from the Dhaka Stock Exchange (DSE).

The episode raises questions about the aptitude of the issue manager, who was in charge of designing the IPO.

A merchant banker blamed the stunning crash on the mismatch of demand and supply.

“This was expected,” he said, adding that Ring Shine floated a large volume of shares, which failed to drum up excitement among stock investors.

The textile manufacturer raised Tk 150 crore by issuing 15 crore shares.

Furthermore, it provided 15 percent stock dividend, which further expanded its share supply, according to Hujaifah.

It is rather unusual for a stock’s price to crash this soon after getting listed. “I can’t remember seeing anything of this nature in at least 15 years,” the merchant banker said.

Plus, the textile manufacturer’s company performance is nothing to write home about.

Ring Shine’s profits dropped 11.29 percent year-on-year to Tk 49.16 crore in the 2018-19 financial year, according to the company’s annual report. Its turnover also fell 17.17 percent year-on-year to Tk 982.36 crore during the same period.

The textile manufacturer’s net asset value was Tk 24.88 as on June 30 last year.

“As a result, many investors got rid of their stocks,” Hujaifah said.

However, AFC Capital, the issue manager, remains defiant.

“The company’s fundamentals are good enough, so it will give good returns to shareholders,” said Mahbub Hossain Mazumdar, chief executive officer of AFC Capital.

Mazumdar believes that the drop in stock price fall is not related to the company’s performance.

“The episode will further weaken investor confidence in the market, as it demonstrates that the quality of IPOs nowadays are sub-par,” said Abu Ahmed, a stock market analyst.

Subsequently, he urged caution when going for IPO shares.

Hujaifah, who works in a travel agency, too is thinking along this line.

“I won’t put my money on IPOs anymore,” said the disappointed retail investor, adding that he is now biding his time to sell off his 500 Ring Shine shares.