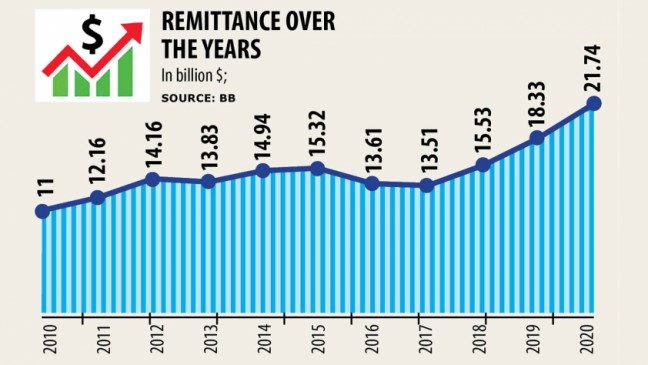

Remittance hits $21.7b, a great all-time high

Remittance hit an all-time most of $21.74 billion last year as migrant personnel continued to use formal channels sidestepping the hundi system to send residence massive levels of money.

This past year, the inflow posted a magnificent growth of 18.59 per cent compared to that in the last year, showed data from the central bank.

Migrant personnel remitted $2.05 billion in December, meaning that the inflow crossed the $2-billion tag for the fourth straight month.

The increasing trend has given a boost to government confidence in managing the macro-economy in times of crisis.

The country's forex reserve has already surpassed the $43 billion tag riding on the upward trend of remittance, a production that will help the government utilize the forex reserve on a rainy day time. The reserve stood at $32.38 billion in March last year when the coronavirus hit the united states.

Experts hope that the trend will be maintained until in least the finish of the pandemic given the global monetary situation and the initiatives taken by the federal government.

They, however, said that there was zero scope to pinpoint any cause of the increase in remittance as this is quite a unique phenomenon from the point of view of the global scenario.

Although the country's workforce export came to a halt in April last year as a result of the pandemic, remittance has kept the ball rolling.

Between January and March this past year, 181,218 Bangladeshi citizens went abroad, according to info from the Bureau of Manpower, Employment and Schooling (BMET).

No data is on the BMET web page for April onwards.

On an average, the country sends 7 to 8 lakh persons abroad as workforce each year.

Just as much as 700,159 workers visited different countries about job appointments in 2019.

The stagnation of hundi, an against the law cross-boundary financial transaction, has pushed the country's remittance up, said Zahid Hussain, a former lead economist at the World Bank's Dhaka office.

The act of sending employees to foreign nations has almost come to an end as a result of ongoing business slowdown, he said.

"The financial deal for the export procedure for workers is often settled through hundi," he said.

Furthermore, money laundering through imports has been practically taken to an end lately, he said.

A vested quarter generally dodges taxes by method of under-invoicing while settling imports, Hussain said.

Imports have nosedived lately as businesses experience adopted a go-slow insurance policy in establishing new industrial units or expanding existing ones.

Imports decreased 8.84 per cent year-on-year to $20.24 billion in the first four months of fiscal 2020-21.

Remittance may decrease somewhat when the pandemic concludes as being the global hundi cartel can witness a good revival, Hussain said.

He, however, said the pandemic would support a sizable number of migrant staff become accustomed to the formal channel for the transfer of their hard-earned money.

This will play a positive role in increasing remittance in the days to come, he said.

"But, the government must lay great focus on exporting manpower abroad in order to keep remittance inflow secure," Hussain said.

This is echoed by Ahsan H Mansur, executive director of the Insurance plan Exploration Institute of Bangladesh.

A great number of migrant workers won't get back to the hundi system following the pandemic as they nowadays feel secured and comfortable by method of using the formal channel, he said.

The platforms of mobile financial service (MFS) and agent banking are little by little turning out to be pivotal centres for transferring money from foreign nations, he said.

"Together with the migrant employees, some expatriate Bangladeshis, who go businesses abroad, may also have transferred cash to the country as part of their portfolio expense," he said.

A portfolio investment can be an ownership of a share, bond, or other monetary assets with the expectation that it'll earn a return or grow in benefit over time, or both.

It entails passive or perhaps hands-off ownership of possessions as opposed to direct expenditure, which would involve a dynamic management role.

"Many countries in North America and Europe have previously entered into the deadlock of a zero per cent interest. A country usually will need several years to get rid of such a predicament," Mansur said.

This has also created a deflation in the countries in both continents.

Given the encounters of countries that had earlier faced deflation, an economy requires at least three to four years for the moribund situation to fade away.

Therefore the Bangladeshi diasporas today send funds as the interest rate on deposit products offered by local lenders is a lot higher than those in the countries they are actually based in.

Mansur went on expressing trust that the upward trajectory of remittance might continue for in least four to five a few months.

But, remittances from the western nations may continue flowing set for the next three to four years offered the zero % interest prevailing there.

Restrictions on cross-boundary travels in addition has pushed remittance up, said Syed Mahbubur Rahman, managing director of Mutual Trust Lender.

The 2 2 % income incentive introduced by the government in 2019 in addition has encouraged the expatriate Bangladeshis to send out additional money through the formal channel, he said.