Regulator moves to rewrite IPO rules

Retail investors gets a higher allocation of shares during initial public offerings (IPOs) as the regulator has moved to help make the market an attractive investment destination for folks.

The Bangladesh Securities and Exchange Commission (BSEC) has proposed to improve the overall investors' portion in the IPO in the draft amendment of related rules.

The regulator has published the draft of the amended public issue rules on its website, seeking comments from the stakeholders by March 15.

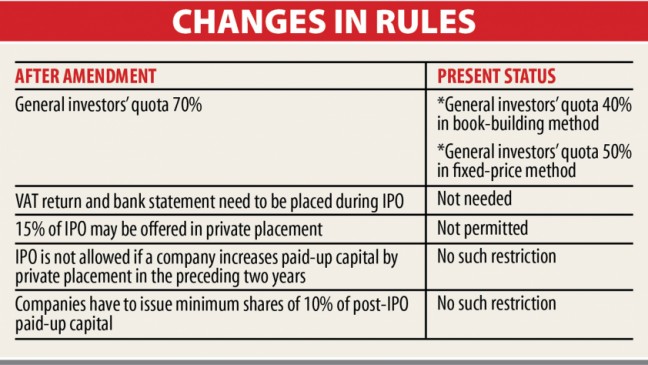

The commission plans to award 70 % shares of an IPO to general investors. Now, it stands at 50 % for the fixed-price method and 40 % for the book-building method.

Whenever a company enters the marketplace at face-value, it goes through the fixed-price method. A firm follows the book-building method if it wants a higher price over the face-value.

Of the 70 % share, 5 per cent has been proposed to reserve for non-resident Bangladeshis, from 10 % now.

The proposal came at the same time when the regulator is defined to implement a fresh provision for IPOs which will distribute shares proportionately among the applicants, bringing an end to the lottery system.

From April 1, every IPO applicant will get shares if indeed they have a minimum secondary market investment of Tk 20,000. They have to produce a subscription of at least Tk 10,000 in the IPOs.

Retail investors welcomed the proposal on the higher quota for folks. Institutional investors expressed concerns that their portion will be lower due to the amendment.

"Our stock market has been bearish for nearly all the time within the last decade. Many institutional investors didn't make a good profit from IPOs. Now, we must fight in the secondary market aswell to remain afloat," said an asset manager, preferring anonymity.

Other proposed amendments are best for the marketplace, said the asset manager.

According to 1 of the amendments, foreign investors and placement shareholders of an IPO-seeking company would face a lock-in period for just one year and 2 yrs, respectively.

In an initial, the regulator has set the very least share issuance. If how big is the post-IPO paid-up capital is up to Tk 75 crore, at least 30 % shares must be issued.

At least 20 per cent of shares need to be offloaded if the post-IPO paid-up capital ranges from Tk 75 crore to Tk 150 crore. It'll be at least 10 per cent when the post-IPO paid-up capital goes past Tk 150 crore.

"Almost all of the amendments proposed are positive," said Prof MA Baqui Khalily, a former chairman of the finance department at the University of Dhaka.

"Due to steps, the supply side of the currency markets has been strengthened. General investors will be happy because they are certain to get more shares."

One thing should be ensured in order that mutual funds do not get a lower number of shares for the reason that sector plays a essential role in the currency markets, he said.

"Though they are receiving benefits now, the mutual fund sector shouldn't be impacted."

IPO-seeking companies must submit the certified copies of VAT returns from the National Board of Revenue and the certified copies of bank statements, in line with the draft amendment.

The commission may verify the authenticity of the documents.

"Bank statements and VAT return certificates will add greater transparency to IPO-seeking companies' financials," said Prof Khalily.

The provision of setting aside a 15 per cent share of IPO for IPO-seeking companies had not been welcomed.

An issuer company may offer private placement for 15 % of the size of the IPO at par value beneath the fixed-price method or at a cut-off price beneath the book-building method. It'll be treated as a part of the IPO, the draft rule said.

A company will not get permission to go public if it has already established any private placement in the preceding two years before the IPO.

A merchant banker said the provision to allocate 15 % of the IPO shares as private placement wouldn't normally be a good one.

"Neither general investors nor institutional investors will reap the benefits of it. It could work for the betterment of a company's owners."