Overpriced bidding puts little investors vulnerable to loss

Some rogue institutional investors are jeopardising the way prices are determined for stocks for his or her launch in the currency markets, detrimentally affecting general investors.

Their modus operandi: positioning inflated price bids in the book-building process.

This simple tampering disrupts the whole process made to determine cut-off prices of initial public offerings properly.

The book-building method involves play whenever a company wants to issue stocks at a price higher than the facial skin value.

The procedure involves an underwriter, usually an investment bank, inviting institutional investors such as for example fund managers to submit bids for the amount of shares they want together with the prices they are prepared to pay for it.

The book is "made" by listing and evaluating the demand, and the common price is taken as the ultimate price in the IPO.

In addition to the book building approach, gleam "fixed pricing" approach where in fact the price is place ahead of investor participation. In this article the face worth is considered as the issue price.

If the bids are inflated, it unnecessarily raises the stock rates, forcing general investors to pour in additional money than they might have otherwise to obtain the shares, discussed stock investor Arifur Rahman, who includes a decade's encounter of the market.

This mishandling is generally brought about by the firms issuing the stocks in connivance with some rogue institutional investors, he said.

In regards to what was driving this practice, he said the companies were getting higher amounts of profit the listing method and having a good "pricey" stock as the institutional investors could not care less.

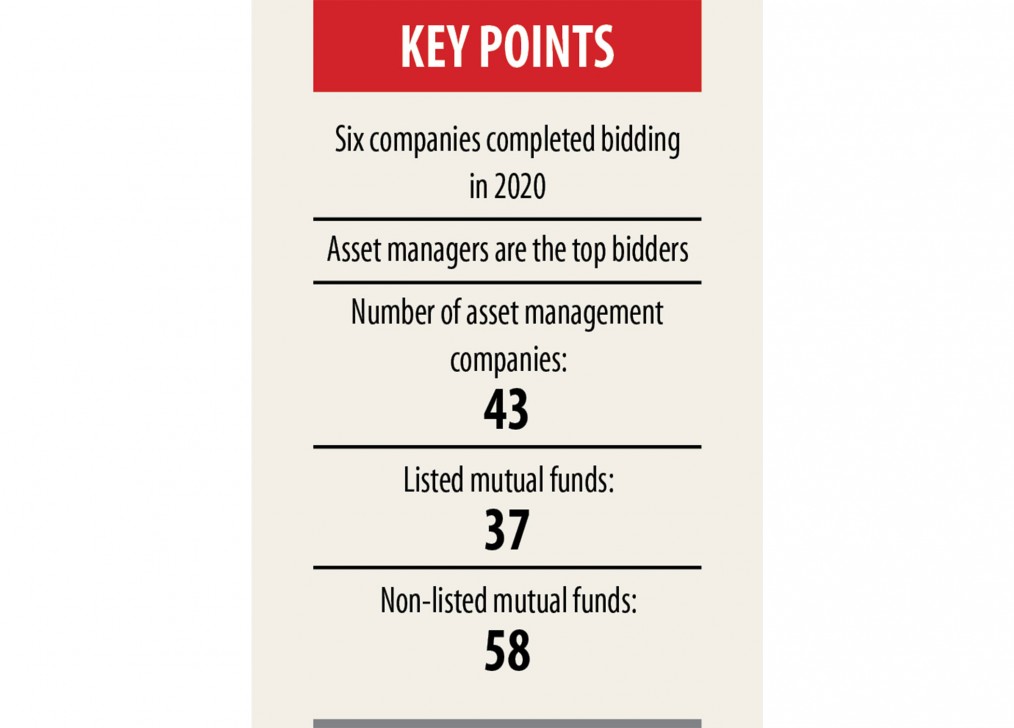

Asset management companies are actually paid a set annual fee for managing mutual funds, which pool cash from investors and channel those into securities such as for example stocks, bonds and additional assets.

The asset managers get yourself a management fee towards the end of the year, whether or not they were able to make a profit and distribute those among unitholders of the mutual funds.

The exorbitant investments from mutual cash ensuing from inflated prices are depriving unit holders, Rahman said.

Mutual funds cannot log higher profits, therefore the unitholders are also being deprived of great dividends, stated another merchant banker. Whoever locations inflated rates in bids ought to be investigated, he said.

"This is manipulation," said 1 stockbroker, pointing out general investors were mainly the kinds to finish up suffering because that they had to get the stocks at a higher price.

Come to think about it, asset managers aren't putting their own cash on the line; it really is that of investors, that there is no good sense of attachment to operate a vehicle a proper evaluation and valuation, stated one merchant banker.

They are availing illegitimate benefits through underhand dealings with unscrupulous issuer companies seeking inflated prices in the bids, he said, adding, "Their bidding practice proves it."

The Bangladesh Securities and Exchange Commission (BSEC), which is the currency markets regulator, should conduct investigations and punish errant market players, he said.

Otherwise, general inventory investors will continue steadily to incur losses and also have their confidence available in the market eroded, said the merchant banker.

The BSEC caused the book construction method in 2015 to retain in tune with international practices, but this has fallen victim to manipulation, he said.

Before its introduction, the BSEC used to itself determine the worthiness, but that gave grow to a lot of criticisms, he said.

One recent example of the blatant malpractice took place in the IPO value dedication of Index Agro.

The stock had a face value of Tk 10 and several renowned asset managers with good performance records bid with offers which range from Tk 15 to Tk 20.

On the other hand, 38 institutional investors bid a lot more than Tk 70. Of them, 21 had been of mutual funds. Some gone so far as Tk 100.

The BSEC recently formed a two-member investigation committee to recognize anomalies in the IPO bidding of Index Agro.

The regulator is definitely irritated by such manipulation, that it had issued a notification this past year stipulating that bidders could have to buy the stocks at the respective price that they had placed in the bid.

General investors on Bangladesh are allowed to buy stocks at prices 10 % less than the cut-off price.

Though the notification brought some institutional investors to their senses, right now there were others who by no means flinched, presumably because they were certainly not bidding with their own money.

The Daily Superstar talked to many asset managers, but none wanted to speak on the record. However, virtually all said the purchase price finding mechanism had been affected for the malpractices of a few.

So, rather than blaming all of the asset managers, the regulator should identify and punish the rogue kinds, they said.

Earlier, the currency markets regulator had as well asked to start to see the analysis based on which institutional investors bid high prices in book building processes for Walton Hi-tech Industries and Mir Akhter Hossain Business.

Institutional investors cannot come up with a bidding price out of nowhere. The procedure requires forming a committee within their institution to analyse days gone by effectiveness of the issuer firm alongside its prospects.

The investors need to conduct the analysis and also have a valuation committee who'll work on settling on a cost, according to a BSEC notification.

"We've already sought a conclusion from plenty of institutional investors for his or her high-priced bids," explained Mohammad Rezaul Karim, BSEC spokesperson and executive director (current charge).

"If we find they have certainly not followed the proper procedure, then we will take action," he said.

"Already, various investors have grown to be alert, and others will also come about if they notice we are strict upon this matter. Our industry intelligence department can be focusing on it," he added.