Recruiting agencies face higher AIT: Tax burden could be pushed onto migrant workers

Recruiting agencies will have to pay higher advance income tax (AIT) on service charges or costs they earn from migrant personnel going abroad, according to tax measures proposed by the National Board of Revenue (NBR) for the next fiscal year of 2021-22.

Recruiting agencies will be asked to pay 10 % advance tax for another fiscal year of 2021-22 instead of today's 7.5 % of the outgoing fiscal year.

They will also need to pay Tk 50,000 when availing or renewing licences from the Ministry of Expatriates' Welfare and Overseas Employment, according to Finance Bill 2021 located by Finance Minister AHM Mustafa Kamal in parliament on June 3.

The measure, once passed in parliament, should come into effect from next month with recruiting agencies and migration analysts saying that the agencies may pass on the burden of increased AIT to the shoulders of migrant employees going abroad for jobs.

And this will in turn will boost the cost of migration at a time when the outflow of personnel for jobs has slumped and migrants are experiencing to count higher costs for airfare and complying with health safety rules to guard against infections.

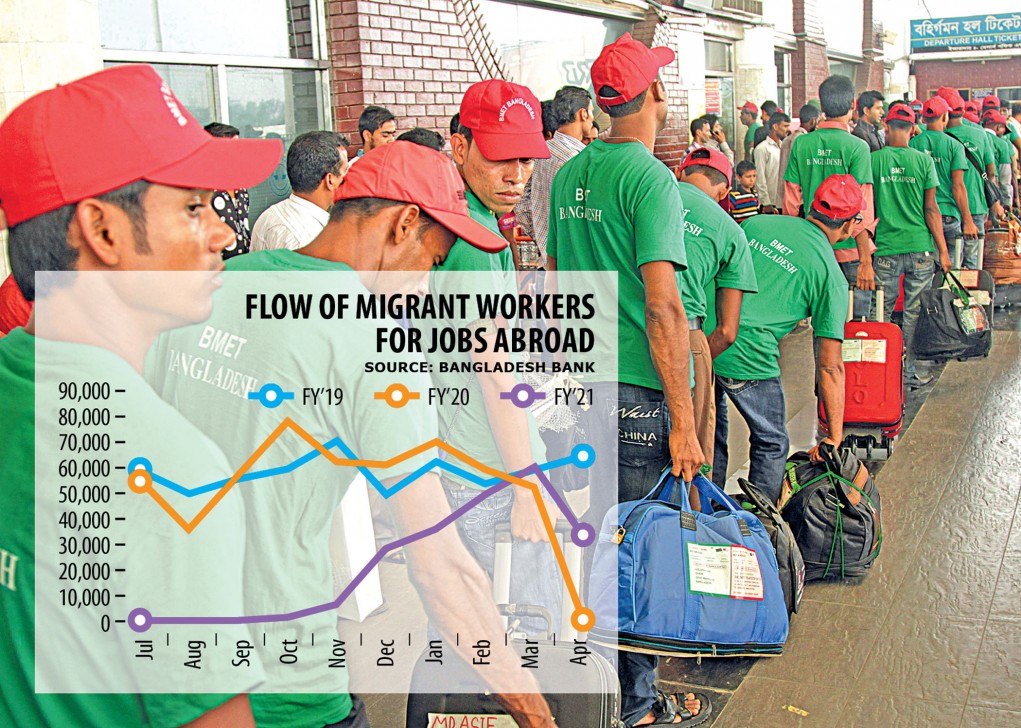

Workers going abroad need to pay anywhere between Tk 3 lakh and Tk 4 lakh for jobs and their combined numbers going abroad dipped 59 % year-on-year to 2.17 lakh in the July-April period of fiscal 2020-21, showed data from Bangladesh Bank.

At this time, the increased AIT will put a negative impact on the sector.

"We are simply the service providers. If any tax is increased, migrant employees will in the end suffer as the responsibility will be offered to them," said Shameem Ahmed Chowdhury Noman, former secretary general of the Bangladesh Association of International Recruiting Agencies (Baira).

Any tax that affects the sector should not be increased, he said.

A senior official of the NBR said the AIT to be paid by recruiting agencies could possibly be adjusted with their total payable taxes. Hence, the price to migrants shouldn't rise, he added.

Noman said recruiting agencies were hit hard over the last one . 5 years for the coronavirus crisis.

"We have to bear the expense of office rent, pay salaries for staff and bear other expenses regularly. Now I am bearing all of the expenses by taking financing. In this situation, we wish cooperation from the federal government on how we are able to all keep the sector alive," said Noman, proprietor of Sadia International.

Shariful Hasan, head of the migration programme at Brac, said recruiting agencies transfer all the costs onto the migrant workers.

"Which means increased tax burden will probably hit the pockets of overseas job hunters," he said.

"Workers have to bear additional expense for Covid-19 which is a bad time too for recruiting agencies. Which means this is not a great time for putting additional pressure on taxpayers," he said.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, however, said the marketplace of recruiting agencies was competitive and any single firm would not be able to shift the excess tax onto jobseekers for threat of losing business to others.