Recovery still a far cry for steel makers

A go back to normalcy for Bangladesh's steel manufacturing sector continues to be a long way off as factories have already been forced to limit their businesses because of declining demand amid the ongoing coronavirus pandemic, according industry insiders.

The majority of the steel makers are running below 50 % capacity and selling 60-grade mild steel (MS), commonly found in construction, at prices less than production cost so that you can stay afloat in this difficult time, they said.

Besides, manufacturers are facing a raw material shortage as the supply of steel scraps is inadequate despite a fall popular.

Up to 90 % of the recycleables used by the sector is imported from the united states, UK, Canada, Italy and Australia, all of whom are yet to totally resume their monetary activities since declaring nationwide shutdowns in March to support the coronavirus outbreak.

"Over the last six months, the sector's losses have amounted to around Tk 6,000 crore," said Manwar Hossain, president of the Bangladesh Steel Mill Owners Association (BSMOA).

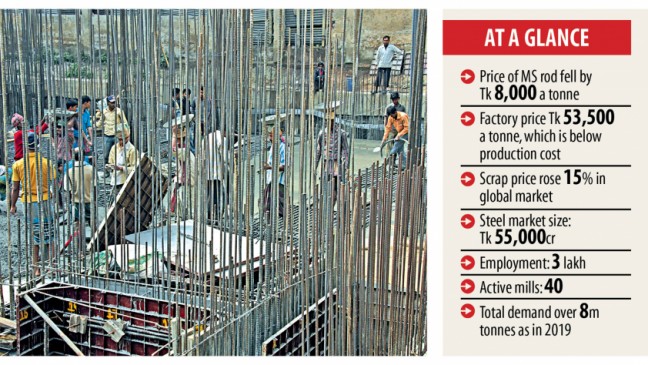

"We are facing losses because of low demand and a 15 per cent price hike for steel scraps in the global market," he added.

Hossain, also managing director of the Anwar Group of Industries, went on to say that unhealthy competition in the domestic market has emerged as everyone wants to make a quick buck off their finished products.

The purchase price for 60-grade MS rods has declined by about 15 % at the factory level, hitting Tk 53,500 per tonne although it was Tk 61,500 per tonne through the pre-pandemic era.

Manufacturers have already been compelled to sell at low prices in order to make up operational costs, the managing director said.

However, this is simply not the right model for the long run and may cause many businesses to collapse.

Besides, incessant rain for recent months has damaged previous stocks of finished products and there is absolutely no taker for rusted metal, he added.

Bangladesh Bank should play a far more supportive role now by increasing the repayment tenure for loans from the stimulus packages from the existing 5 years to 12 to be able to help the industry recoup its losses.

With regards to the stimulus packages, Hossain also said it's been rather ineffective as the country's lenders only provide 30 % of a company's existing working capital from the fund, which is insufficient to perform a factory.

"We are looking for additional working capital to run our business for a long period and recover our losses," he added.

The managing director went on to suggest that the federal government could bring in more foreign direct investment for infrastructure development beneath the public private partnership model to reduce the burden among tax payers to repay the debt.

By doing so, both construction and steel sectors will recover together.

The steel industry in Bangladesh is now worth Tk 55,000 crore, according to advertise players.

Tapan Sengupta, deputy managing director of BSRM, said the united states must improve its ease of doing business ranking to be able to help the economy recover rapidly.

The National Board of Revenue blocked over Tk 4,000 crore from the steel sector as advance tax over the past 10 years but nonetheless, it has not repaid the millers.

"Our capital has been blocked but we are repaying interest against the blocked capital," he said, adding that If the blocked capital is returned, the sector could utilise the amount of money to survive the pandemic.

"Neither the government nor the steel makers are benefitting from the blocked capital. Our liabilities are increasing continuously," said Sengupta said.

In light of the situation, Sengupta urged for a reduction in advance income tax at the import stage.

He said tax deductions at source should not be considered as the very least charge to ensure that the steel industry can get some breathing space.

Despite being truly a capital-intensive sector with very low profit percentage, the steel makers need to pay the very least tax of Tk 1,150 for each tonne of steel produced, which has made it impossible to create any profit now, he said.

He now fears that the steel industry could collapse after suffering continues losses as a result of pandemic.

Over the past few years, the united states has seen the establishment of a great number of new steel and re-rolling mills that use state-of-the-art technologies and churn out world-class products, Sengupta said.

Earlier, Md Shahidullah, secretary general of the Bangladesh Steel Manufacturers' Association, said Bangladesh has about 40 active factories, that have a combined capacity to produce nine million tonnes of steel annually.

Of these, Abul Khair Steel, GPH Steel, BSRM and KSRM meet over fifty percent of the gross annual domestic demand around eight million tonnes.

"We've been left in a pickle as the pandemic has broken the supply chain for all your countries from where we source our recycleables," said Shahidullah, also managing director of Metrocem Steel.

The government's infrastructure projects account for 35 to 40 % of the total steel consumption in Bangladesh, up from 15 % a decade ago.

If a steel factory can run at 60 to 70 % capacity, it ought to be able to maintain a break-even point, he said.

However, the country's steel makers remain struggling to take their production levels over 40 per cent at this time, the managing director added.